- United States

- /

- Chemicals

- /

- NYSE:TROX

Tronox Holdings plc's (NYSE:TROX) Shares Not Telling The Full Story

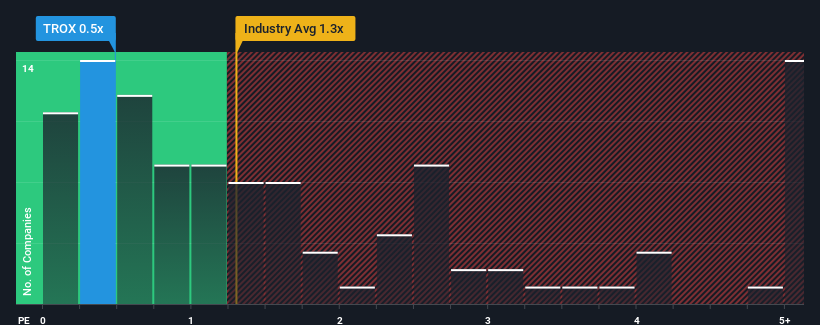

When you see that almost half of the companies in the Chemicals industry in the United States have price-to-sales ratios (or "P/S") above 1.3x, Tronox Holdings plc (NYSE:TROX) looks to be giving off some buy signals with its 0.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Tronox Holdings

What Does Tronox Holdings' P/S Mean For Shareholders?

Tronox Holdings certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. Perhaps the market is expecting future revenue performance to follow the rest of the industry downwards, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Tronox Holdings will help you uncover what's on the horizon.How Is Tronox Holdings' Revenue Growth Trending?

Tronox Holdings' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 9.6% last year. Still, lamentably revenue has fallen 11% in aggregate from three years ago, which is disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 2.8% over the next year. That's shaping up to be similar to the 2.5% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Tronox Holdings' P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've seen that Tronox Holdings currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

It is also worth noting that we have found 2 warning signs for Tronox Holdings that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Tronox Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:TROX

Tronox Holdings

Operates as a vertically integrated manufacturer of TiO2 pigment in North America, South and Central America, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.