- United States

- /

- Chemicals

- /

- NYSE:SXT

Sensient Technologies (SXT): Profit Margin Expansion Reinforces Bullish Narratives on Earnings Quality

Reviewed by Simply Wall St

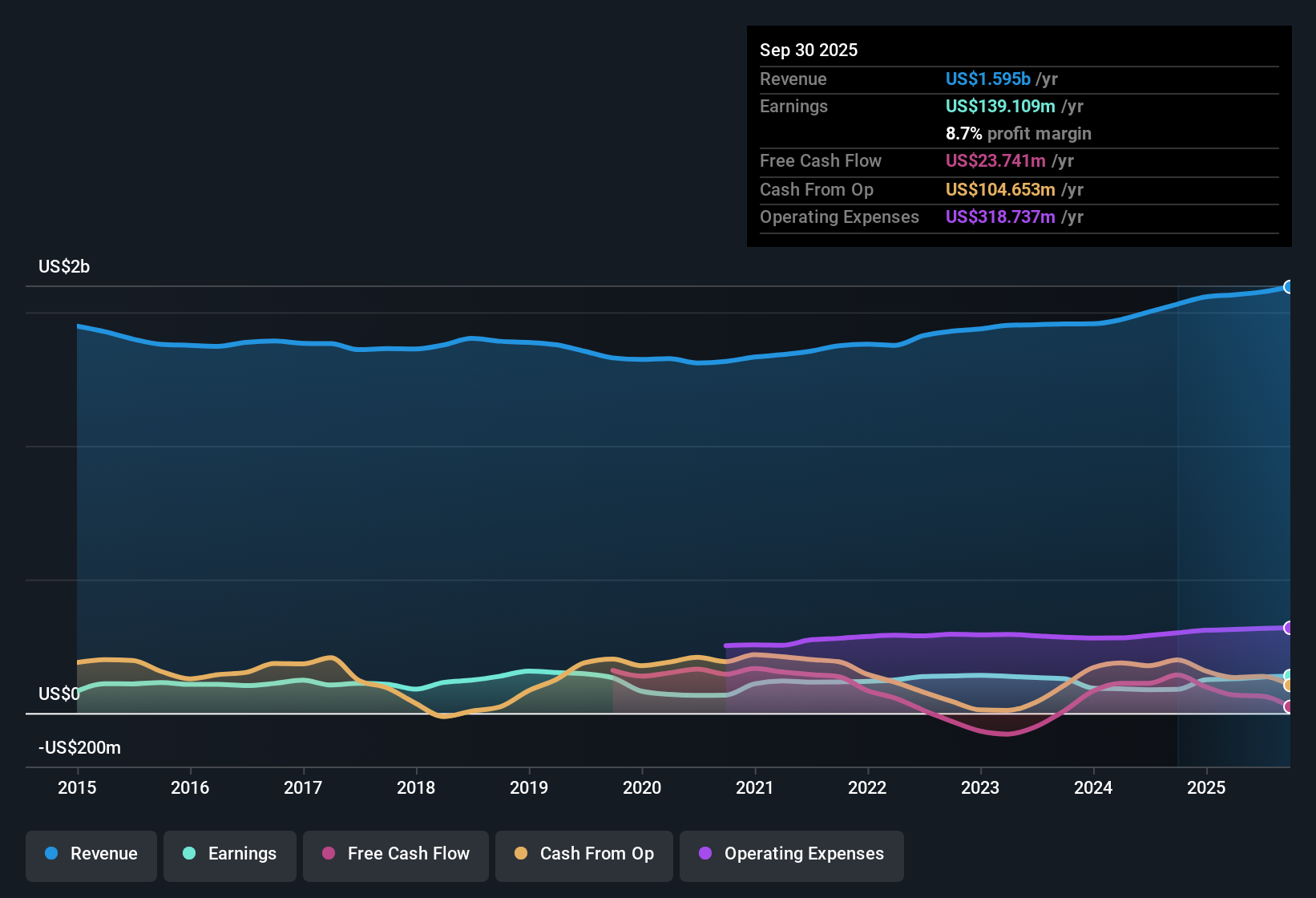

Sensient Technologies (SXT) delivered standout earnings growth of 54% over the past year, far surpassing its five-year average of 1.2% per year. Net profit margins expanded sharply to 8.6%, up from 5.8% a year ago. Forecasts point to ongoing earnings growth of 18.5% per year, outpacing the broader US market's 15.9% projection, even as revenue growth of 7.6% per year is expected to trail the US average. With profit quality flagged as high and recent momentum clear, investors are taking note. Valuation questions persist, however, as the stock trades at a premium to the chemicals industry average and direct peers.

See our full analysis for Sensient Technologies.Now, the key question is how these fresh results measure up to the dominant market narratives. Some storylines may get reaffirmed, while others could be put to the test.

See what the community is saying about Sensient Technologies

Natural Colors Drive Margin Expansion

- Profit margins are projected to rise from 8.6% today to 11.4% over the next three years, according to analyst estimates in the EDGAR summary.

- The analysts' consensus view describes Sensient's long-term investments in natural color R&D and vertical integration as crucial for sustainable growth.

- This supports higher operating leverage as global demand for clean-label ingredients increases, especially with a major regulatory shift to natural colors in the US expected by 2028.

- Margin improvements are already being realized in the Color Group segment, indicating strong upside if volumes continue to ramp alongside capacity expansions.

Capital Spending and Cash Flow Pressures

- Annual capital expenditures have exceeded $100 million, reflecting Sensient's focus on expanding natural color capacity and global manufacturing infrastructure.

- Consensus narrative highlights that while these investments are strategic, persistently high spending may strain free cash flow.

- If new plants and capacity do not deliver expected returns, the company’s ability to generate cash and maintain financial flexibility could be challenged.

- Elevated costs for agricultural inputs and expansion pose ongoing risks to margins unless matched by improved pricing or efficiency gains.

Premium Valuation Versus Peers

- Sensient trades at a Price-to-Earnings (PE) ratio of 35.1x, compared to 25.9x for the US Chemicals industry, with the current share price of $94.29 sitting below the consensus analyst price target of $122.00.

- Analysts' consensus narrative points out that the current price implies investors are willing to pay a premium for future growth.

- The stock would need to justify a forward PE multiple of 29.4x on projected 2028 earnings, which is still above the industry average, to fully meet analyst expectations.

- This premium reflects investor confidence in Sensient's strategy but leaves little room for error should growth or margins underwhelm over the next few years.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Sensient Technologies on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? Share your view and build your own narrative in just a few minutes with Do it your way.

A great starting point for your Sensient Technologies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Sensient’s ambitious expansion plans and elevated capital spending have put pressure on its free cash flow, which could strain financial flexibility if returns fall short.

Looking for companies with more robust financial cushions and reliability? Use solid balance sheet and fundamentals stocks screener (1984 results) to focus on businesses that prioritize financial health and can better withstand uncertain conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SXT

Sensient Technologies

Manufactures and markets colors, flavors, and other specialty ingredients worldwide.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives