- United States

- /

- Metals and Mining

- /

- NYSE:SXC

Brokers Are Upgrading Their Views On SunCoke Energy, Inc. (NYSE:SXC) With These New Forecasts

SunCoke Energy, Inc. (NYSE:SXC) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's statutory forecasts. Consensus estimates suggest investors could expect greatly increased statutory revenues and earnings per share, with the analysts modelling a real improvement in business performance.

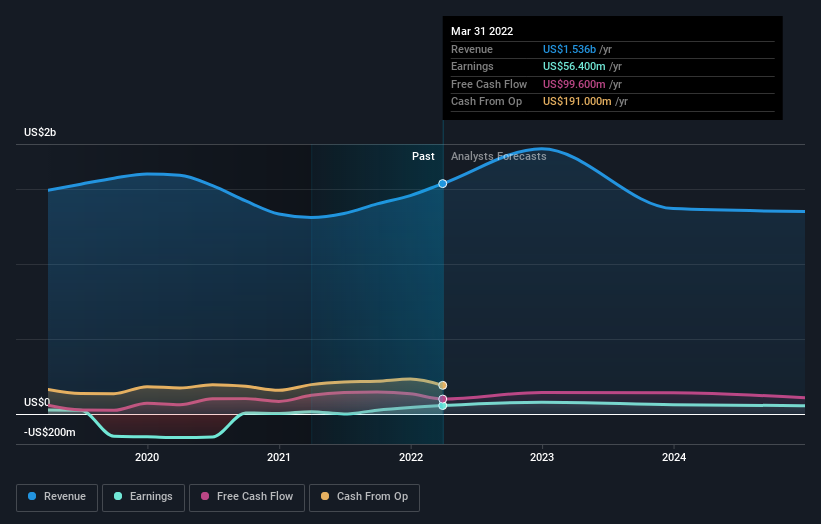

Following the upgrade, the most recent consensus for SunCoke Energy from its dual analysts is for revenues of US$1.8b in 2022 which, if met, would be a decent 15% increase on its sales over the past 12 months. Statutory earnings per share are presumed to jump 39% to US$0.94. Before this latest update, the analysts had been forecasting revenues of US$1.5b and earnings per share (EPS) of US$0.68 in 2022. There has definitely been an improvement in perception recently, with the analysts substantially increasing both their earnings and revenue estimates.

View our latest analysis for SunCoke Energy

Despite these upgrades, the analysts have not made any major changes to their price target of US$10.50, suggesting that the higher estimates are not likely to have a long term impact on what the stock is worth. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. The most optimistic SunCoke Energy analyst has a price target of US$11.00 per share, while the most pessimistic values it at US$10.00. This is a very narrow spread of estimates, implying either that SunCoke Energy is an easy company to value, or - more likely - the analysts are relying heavily on some key assumptions.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. It's clear from the latest estimates that SunCoke Energy's rate of growth is expected to accelerate meaningfully, with the forecast 21% annualised revenue growth to the end of 2022 noticeably faster than its historical growth of 2.0% p.a. over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue shrink 2.3% per year. It seems obvious that as part of the brighter growth outlook, SunCoke Energy is expected to grow faster than the wider industry.

The Bottom Line

The biggest takeaway for us from these new estimates is that analysts upgraded their earnings per share estimates, with improved earnings power expected for this year. On the plus side, they also lifted their revenue estimates, and the company is expected to perform better than the wider market. The lack of change in the price target is puzzling, but with a serious upgrade to this year's earnings expectations, it might be time to take another look at SunCoke Energy.

Analysts are definitely bullish on SunCoke Energy, but no company is perfect. Indeed, you should know that there are several potential concerns to be aware of, including a weak balance sheet. You can learn more, and discover the 3 other flags we've identified, for free on our platform here.

We also provide an overview of the SunCoke Energy Board and CEO remuneration and length of tenure at the company, and whether insiders have been buying the stock, here.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SXC

SunCoke Energy

Operates as an independent producer of coke in the Americas and Brazil.

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion