- United States

- /

- Chemicals

- /

- NYSE:SQM

What Recent Lithium Demand Shifts Mean for SQM’s Current Share Price in 2025

Reviewed by Bailey Pemberton

If you’re debating what to do with Sociedad Química y Minera de Chile (SQM) shares, you’re hardly alone. The past year has been a bit of a roller coaster for SQM, with the stock closing most recently at $45.55. Short-term traders might have noticed the impressive 4.3% jump in the last week and a steady 4.2% climb over the past month, numbers that get your attention. Year-to-date, the stock has powered up by 26.4%, which might surprise those who only recall its painful 48.5% three-year drop. Looking at the bigger picture, the five-year gain of 41.3% suggests there is a broader story unfolding.

What is behind these latest moves? Industry chatter remains focused on global demand for lithium, a market in which SQM is a key player. Recent developments in the electric vehicle sector and shifting expectations around supply chains have stoked some optimism, helping buoy the company’s outlook. However, some investors still see lingering risks, keeping the valuation conversation very much in play.

Currently, SQM’s valuation score stands at just 1 out of 6, signaling that the company is currently undervalued by only one major metric. That alone does not decide the story, though, especially when you consider both the long-term gains and recent volatility. Here is a breakdown of the common valuation yardsticks to see where SQM stands today. Readers may want to stay tuned for a discussion of an even more comprehensive approach to weighing SQM’s true value at the end of the article.

Sociedad Química y Minera de Chile scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Sociedad Química y Minera de Chile Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future free cash flows and then discounting them back to today’s dollars. This approach aims to provide investors with a sense of what the company is truly worth based on its potential to generate cash over time.

For Sociedad Química y Minera de Chile, analysts estimate the latest twelve months of free cash flow at $269.5 Million. Over the next decade, this figure is projected to fluctuate before recovering, with 2026 expected to see a negative free cash flow, followed by a rebound to $459.5 Million by 2027. Projections from 2028 to 2035, which are based on Simply Wall St's extrapolations, point to a gradual increase and reach approximately $618.2 Million by 2035.

- Current Free Cash Flow: $269.5 Million

- 2026 projection: -$269.3 Million

- 2027 projection: $459.5 Million

- 2035 projection: $618.2 Million

Based on this methodology, the estimated intrinsic value of SQM is $25.82 per share. With the current share price at $45.55, this DCF model suggests the stock is 76.4% overvalued.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Sociedad Química y Minera de Chile may be overvalued by 76.4%. Find undervalued stocks or create your own screener to find better value opportunities.

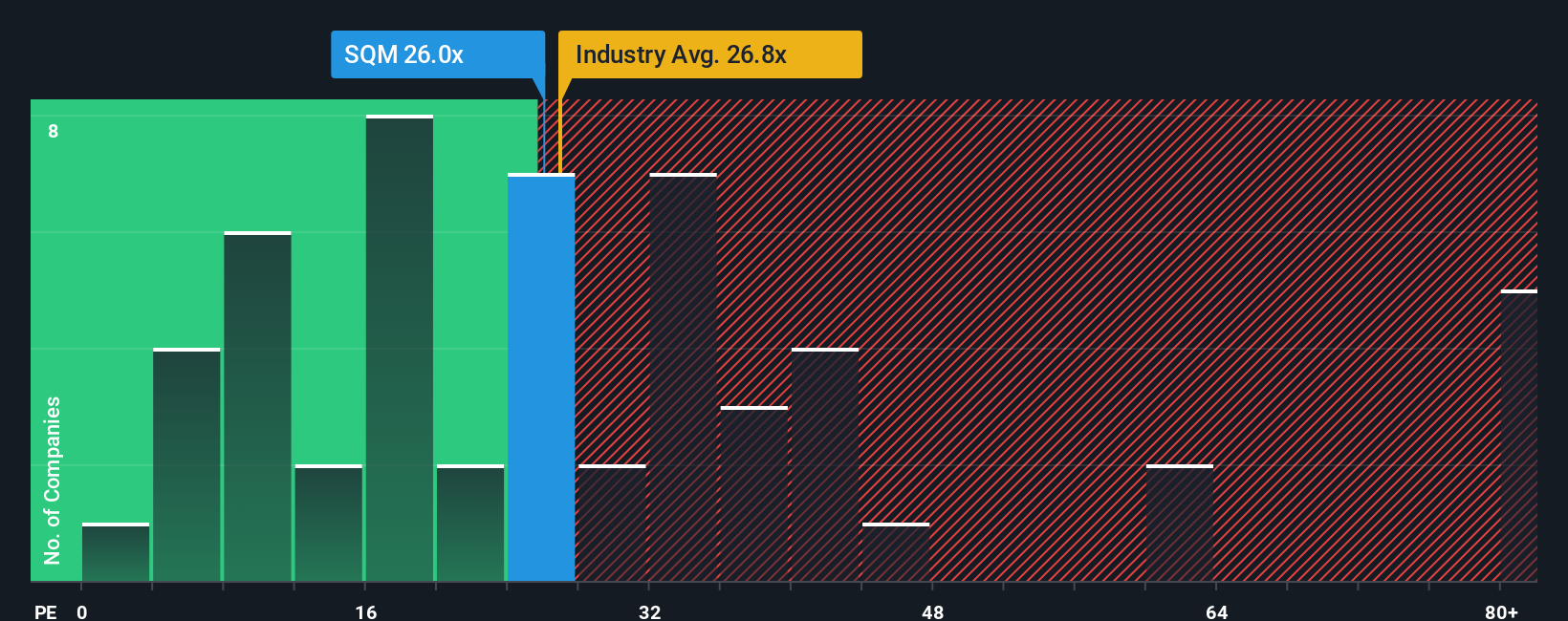

Approach 2: Sociedad Química y Minera de Chile Price vs Earnings

The price-to-earnings (PE) ratio is often the preferred valuation metric for profitable companies like Sociedad Química y Minera de Chile. Since the PE ratio links the share price to the company’s earnings, it provides investors with a quick way to gauge whether the stock is priced fairly relative to its bottom-line performance.

What counts as a “normal” or “fair” PE ratio depends not just on current profits but also on expectations for future growth and risk. Companies with higher growth prospects typically command higher PE multiples. In contrast, increased risks or market uncertainty can weigh that ratio down. That is why it is crucial to consider more than just the basic number in isolation.

For SQM, the current PE ratio stands at 27.25x. This is slightly above both the average for its industry peers at 15.66x and the broader Chemicals industry average of 25.72x. Taken at face value, this could hint that the stock is trading at a premium.

However, Simply Wall St’s proprietary “Fair Ratio” offers a deeper perspective. The Fair Ratio for SQM is calculated at 33.03x, factoring in the company’s earnings growth, profit margins, industry characteristics, and inherent risks. This measure aims to capture a more holistic view of what investors should pay, rather than relying solely on industry or peer averages.

Comparing SQM’s actual PE ratio of 27.25x to the Fair Ratio of 33.03x, the share price looks a bit under where it should be according to this comprehensive analysis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Sociedad Química y Minera de Chile Narrative

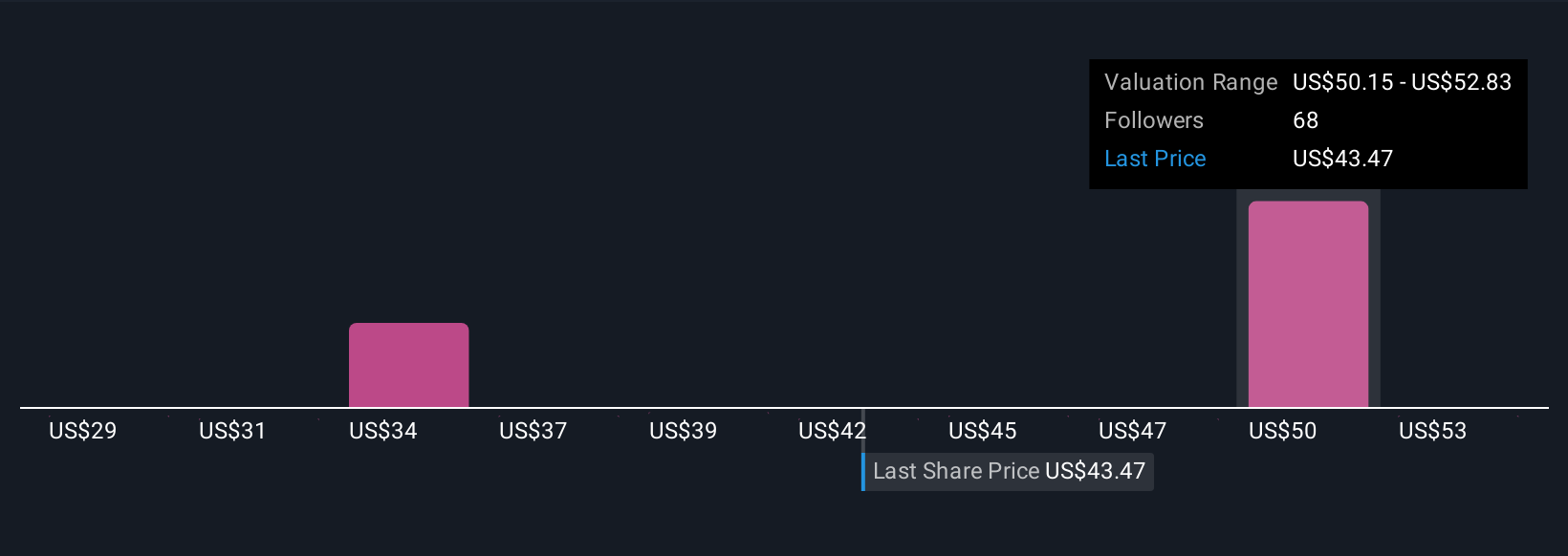

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. In simple terms, a Narrative is your personal investment story for a company, translating your own assumptions about its future growth, earnings, and margins into a financial forecast and, ultimately, a fair value estimate.

Narratives connect the "story" you believe about Sociedad Química y Minera de Chile’s future, such as strong global EV demand driving higher lithium prices or emerging risks from regulation, to the numbers behind the business. This lets you see exactly what your view implies for where the share price should be.

This approach is powerful because Narratives are easy to use, available right now to millions of investors on Simply Wall St’s Community page, and instantly update your fair value as new data and news emerge. By creating or browsing Narratives, you can quickly compare whether your assumptions predict a higher, lower, or similar fair value versus the current share price, helping you decide whether SQM is a buy, hold, or sell. For example, some investors’ Narratives for Sociedad Química y Minera de Chile see a fair value as high as $78.00, convinced that expansion and strong market demand will drive superior growth. Others take a bearish view with a fair value down at $37.00, focusing instead on regulatory risks and uncertain lithium prices.

Do you think there's more to the story for Sociedad Química y Minera de Chile? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SQM

Sociedad Química y Minera de Chile

Operates as a mining company worldwide.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives