- United States

- /

- Paper and Forestry Products

- /

- NYSE:SLVM

Sylvamo (SLVM): Evaluating Valuation After Launching New $150 Million Share Buyback and Dividend

Reviewed by Kshitija Bhandaru

If you are tracking Sylvamo (SLVM), there is a lot to unpack this week. The company just wrapped up a sizable buyback program, repurchasing over 13% of its shares. Now the board is rolling out a brand new $150 million share repurchase plan with no expiration. Alongside that, Sylvamo declared a fresh quarterly dividend. These moves make it clear management is prioritizing giving back to shareholders.

These capital return announcements are getting attention against a tough backdrop. Sylvamo's shares have slid 48% in the past year, with weakness persisting even over the past three months. Net income growth has held up, but revenues are flatlining, which may have dented investor confidence. Even so, introducing ongoing buybacks and consistent dividends now could signal to the market that management sees long-term value others are missing.

With shares under pressure, is Wall Street overlooking Sylvamo’s true worth or is the market accurately pricing in muted growth? Let’s dig into the numbers to find out.

Most Popular Narrative: 18.5% Undervalued

Based on the prevailing narrative, Sylvamo is considered undervalued, with analysts estimating the fair value of the stock is significantly higher than its current market price.

Ongoing strategic investments in operational efficiency and capacity expansion at the Eastover mill are set to add more than $50 million annually to adjusted EBITDA. These initiatives are expected to directly improve the cost structure and support stronger earnings and cash flow in 2026 and beyond.

Want to understand why analysts believe Sylvamo is poised for a rebound? The narrative’s valuation is driven by bold growth projections and profit margin assumptions that contrast with the company’s recent performance. Curious about the specific factors driving this double-digit price target gap? The underlying math may surprise you.

Result: Fair Value of $53.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent weak demand, especially in Europe, or intensifying global competition could undermine these optimistic forecasts and challenge Sylvamo’s recovery narrative.

Find out about the key risks to this Sylvamo narrative.Another View: The SWS DCF Model

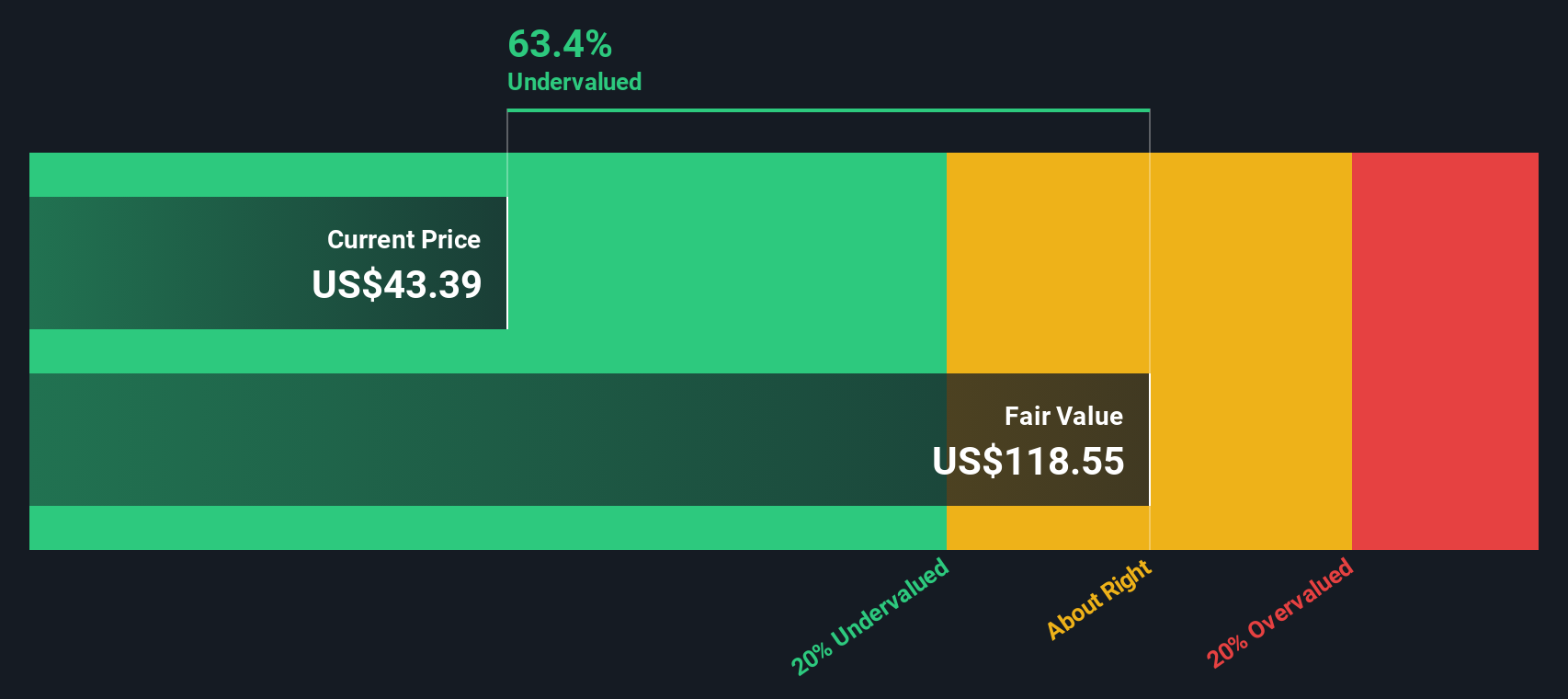

Taking a step back from analyst targets, our DCF model also points to Sylvamo being undervalued. This method weighs future cash flows instead of multiples. Could the disconnect with the market be an opportunity, or a warning?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Sylvamo Narrative

If these takes are not your own, or if you value forming your own view, you can dig into the numbers and shape your own narrative in just a few minutes. Do it your way

A great starting point for your Sylvamo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't limit yourself to just one opportunity. Give your portfolio an edge by tapping into hand-picked themes and trends that are shaping tomorrow's winners.

- Unlock hidden gems with strong financials by scanning through penny stocks with strong financials. These companies are often overlooked by mainstream investors but are delivering real results.

- Catch the next wave in cutting-edge healthcare by checking out healthcare AI stocks. Here, artificial intelligence merges with medical breakthroughs to drive growth.

- Boost your income potential instantly by finding reliable payers via dividend stocks with yields > 3% to access stocks offering attractive dividend yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SLVM

Sylvamo

Produces and markets uncoated freesheet for cutsize, offset paper, and pulp in Europe, Latin America, and North America.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives