- United States

- /

- Chemicals

- /

- NYSE:SHW

Sherwin-Williams (SHW): Evaluating Valuation After Recent Decline in Shareholder Returns

Reviewed by Simply Wall St

See our latest analysis for Sherwin-Williams.

After climbing steadily for much of the past few years, Sherwin-Williams has faced a cooling in momentum, with a recent 30-day share price return of -4.49% and a one-year total shareholder return of -7.57%. However, its three- and five-year total shareholder returns remain strong, suggesting long-term holders have seen considerable gains even as short-term volatility persists.

If today’s moves have you wondering what else is out there, now could be a smart time to broaden your search and discover fast growing stocks with high insider ownership

With Sherwin-Williams trading below analyst targets and recent returns turning negative, the question for investors is clear: Is the stock offering value for those willing to buy now, or is the market already factoring in its future potential?

Most Popular Narrative: 12.7% Undervalued

Sherwin-Williams is trading at $331.24 while the most-followed narrative places its fair value significantly higher. The narrative focuses on long-term growth levers and positions the company as a beneficiary if catalysts materialize.

Heightened investment in targeted customer-facing growth initiatives during a period of competitor retrenchment, layoffs, and price disruptions in the industry is likely to accelerate share gains with professional contractors and commercial projects. This would support long-term topline growth substantially above industry averages.

What’s driving this bullish outlook? The narrative relies on aggressive expansion, margin breakthroughs, and dominant market gains as important factors for a higher valuation. Want the actual projections and how analysts arrive at that premium number? The details behind this optimism might just surprise you.

Result: Fair Value of $379.52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing weakness in housing demand and continued supply chain challenges could put pressure on Sherwin-Williams’s recovery if these conditions persist.

Find out about the key risks to this Sherwin-Williams narrative.

Another View: Multiples Tell a Cautious Story

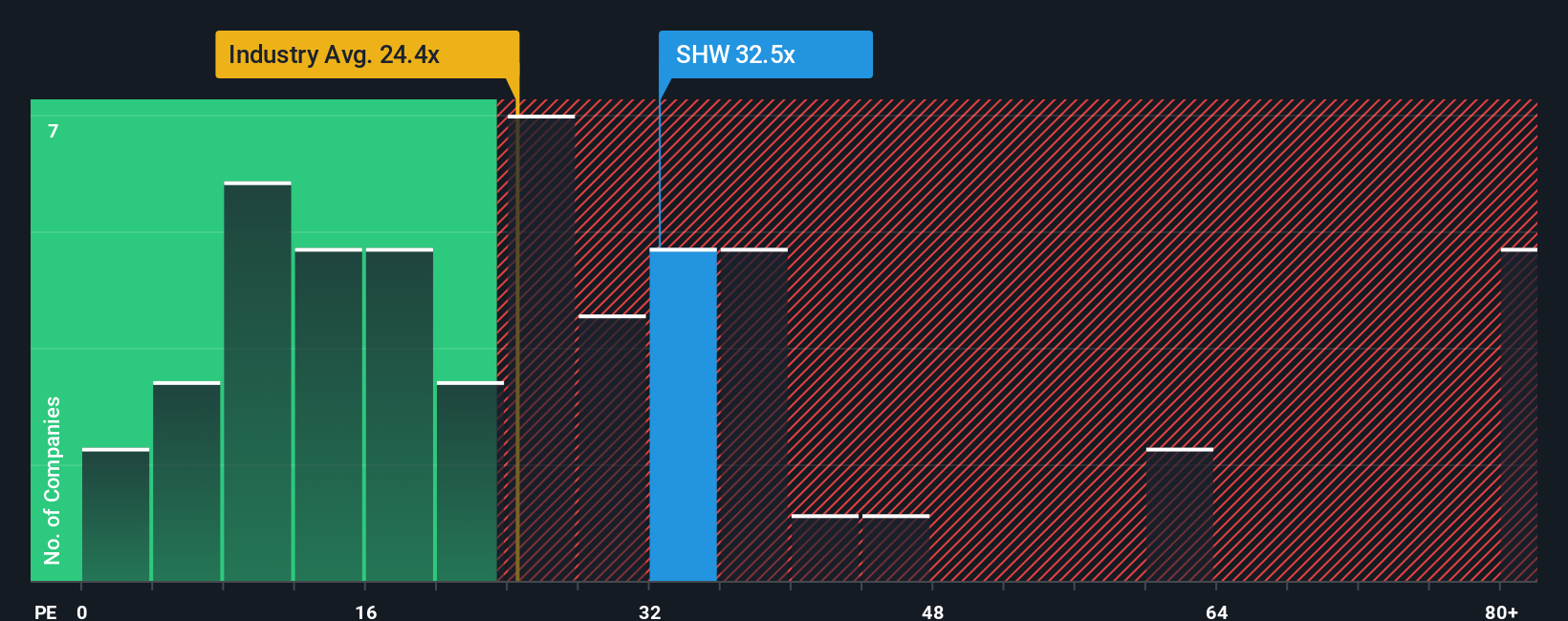

While some see Sherwin-Williams as undervalued based on future earnings projections, the company’s current price-to-earnings ratio stands at 32.4x. This figure is much higher than both the Chemicals industry average of 25.9x and its peer average of 22.8x. The fair ratio is even lower at 24.1x, suggesting the market is demanding a significant premium for SHW shares.

Does this premium reflect real future opportunity, or is it a sign of valuation risk that could limit upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sherwin-Williams Narrative

If you’d rather dig into the numbers yourself or challenge these viewpoints, you can craft your own analysis and perspective in just a few minutes. Do it your way

A great starting point for your Sherwin-Williams research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let your next big opportunity pass by unnoticed. Smart investors look beyond the obvious to find real potential with the right tools at their fingertips.

- Accelerate your search for high-yield opportunities and access attractive payouts by unlocking these 17 dividend stocks with yields > 3% now.

- Spot tomorrow’s leaders in advanced computing and stay ahead of the curve when you check out these 26 quantum computing stocks poised for explosive growth.

- Enhance your portfolio with substantial bargains backed by cash flows and secure your edge through these 875 undervalued stocks based on cash flows before the broader market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SHW

Sherwin-Williams

Engages in the development, manufacture, distribution, and sale of paint, coatings, and related products to professional, industrial, commercial and retail customers.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives