- United States

- /

- Chemicals

- /

- NYSE:SHW

Sherwin-Williams (NYSE:SHW) Reports Q1 Earnings, Reaffirms 2025 Guidance, Completes Share Buyback

Reviewed by Simply Wall St

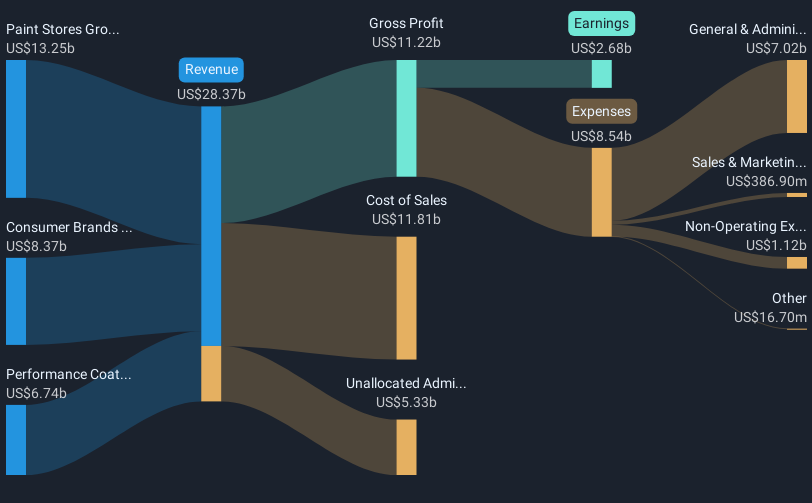

Sherwin-Williams (NYSE:SHW) announced its earnings and updated its guidance, reporting stable basic EPS growth amidst slightly declining sales. The company also continued its share buyback program, acquiring significant shares in Q1. The market, however, remained turbulent due to economic data indicating an economic contraction, with major indices experiencing fluctuations. Despite the market managing a 5% rise over the last week, Sherwin-Williams's 5% price change was aligned with general market trends, underlining its resilience. The earnings and buyback efforts reinforced investor confidence, contributing positively amidst broader market volatility from mixed corporate results.

We've identified 2 risks for Sherwin-Williams that you should be aware of.

Find companies with promising cash flow potential yet trading below their fair value.

Sherwin-Williams' recent announcement and updated guidance highlight its stable basic EPS growth despite a slight sales decline, largely influenced by ongoing share buybacks. This move potentially signals continued investor confidence, possibly buoying both revenue and earnings forecasts. This confidence could be crucial as the company anticipates revenue growth driven by residential repaint demand and strategic price adjustments, amidst broader economic turbulence. The company’s plan to expand through new store openings and innovation investments could further fortify its financial outlook against potential headwinds such as rising costs and competitive pricing.

Over a longer five-year period, Sherwin-Williams delivered a total shareholders return, including dividends, of 104.89%, indicating its strong past performance. In comparison, over the past year, the company's performance outpaced the US market return of 7.7% and exceeded the US Chemicals industry return of 9.8%. These factors underscore Sherwin-Williams' resilient position in a fluctuating market landscape.

Considering the current share price of US$331.96, the analysts' target price of US$371.11 suggests a modest potential upside. This slight discount could reflect investor caution amidst mixed market conditions, despite the company's robust fundamentals and growth initiatives. Future earnings and revenue forecasts will need to account for both market challenges and the company's strategic adaptations to prevail.

Gain insights into Sherwin-Williams' historical outcomes by reviewing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Sherwin-Williams, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SHW

Sherwin-Williams

Engages in the development, manufacture, distribution, and sale of paint, coatings, and related products to professional, industrial, commercial and retail customers.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives