- United States

- /

- Chemicals

- /

- NYSE:SHW

Assessing Sherwin-Williams (SHW) Valuation After Its Recent Share Price Pullback

Reviewed by Simply Wall St

Sherwin-Williams (SHW) shares have drifted lower over the past month and past 3 months, even though earnings and revenue are still growing. That disconnect is exactly what has value-focused investors paying closer attention.

See our latest analysis for Sherwin-Williams.

Zooming out, Sherwin-Williams’ recent pullback, including an 8.5% 90 day share price return decline and a 1.8% year to date share price return dip to about $327, contrasts with a still solid 3 and 5 year total shareholder return. This suggests momentum has cooled even as the long term story remains intact.

If this shift in sentiment has you rethinking where growth might come from next, it could be a good time to explore fast growing stocks with high insider ownership.

With earnings still climbing, a decade-plus growth record, and shares now trading nearly 18 percent below analyst targets, is Sherwin-Williams quietly slipping into undervalued territory, or is the market already discounting its next leg of growth?

Most Popular Narrative Narrative: 15.4% Undervalued

Compared to Sherwin-Williams last close around $327, the most followed narrative argues for a meaningfully higher fair value anchored in steady compounding.

Ongoing construction of a new R&D center and increased R&D investment is expected to accelerate the rollout of premium, environmentally friendly, and specialty coatings that command higher price points, supporting future gross margin expansion and increasing competitive differentiation as sustainability and performance requirements intensify.

Want to see how a mature coatings leader gets priced like a growth story, without relying on wild forecasts or one off windfalls? Dig into the full narrative for the precise revenue, margin, and earnings path that supports this higher value.

Result: Fair Value of $386.52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if weak end market demand drags on or North America slows further, the revenue growth and margin expansion assumptions behind this narrative could quickly unravel.

Find out about the key risks to this Sherwin-Williams narrative.

Another View: Market Ratios Flash a Different Signal

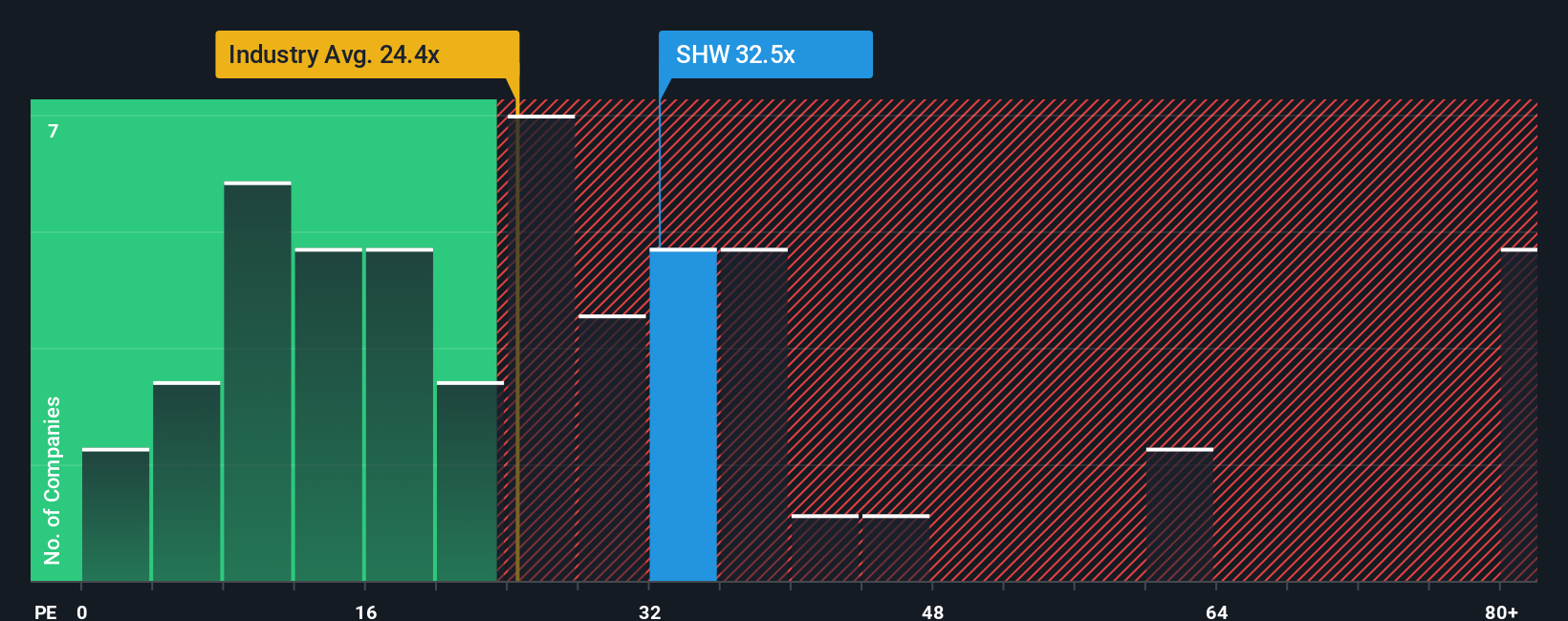

While the narrative driven fair value suggests upside, Sherwin-Williams current valuation multiples tell a more cautious story. At 31.4 times earnings versus a fair ratio of 24.4 times, and well above both the US Chemicals industry at 23.4 times and peer average at 24.3 times, the stock looks expensive on today’s numbers.

That kind of premium can evaporate quickly if growth or margins disappoint, leaving less room for error than the narrative might imply. Is this a quality name merely commanding a justifiable premium, or are investors paying too much for a still uncertain recovery?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sherwin-Williams Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a custom Sherwin-Williams view in just minutes: Do it your way.

A great starting point for your Sherwin-Williams research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before the market’s next shift, give yourself an edge by scanning fresh opportunities on Simply Wall St’s powerful screener instead of waiting for headlines to react.

- Capture potential bargains by targeting quality companies trading below their estimated value through these 909 undervalued stocks based on cash flows before other investors catch on.

- Position your portfolio for innovation-led growth by zeroing in on breakthrough businesses using these 27 AI penny stocks at the heart of the AI transformation.

- Strengthen your income stream by focusing on reliable payers through these 15 dividend stocks with yields > 3% that offer attractive yields with fundamental support.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SHW

Sherwin-Williams

Engages in the development, manufacture, distribution, and sale of paint, coatings, and related products to professional, industrial, commercial and retail customers.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026