- United States

- /

- Chemicals

- /

- NYSE:SHW

Assessing Sherwin-Williams After Industry Consolidation and a 12.5% Slide in Share Price

Reviewed by Bailey Pemberton

- Thinking about whether Sherwin-Williams stock is a bargain right now? You are not alone. Many investors want to know if the recent share price reflects the company's true long-term value.

- Over the past year, Sherwin-Williams shares have slipped by 12.5%, and the stock is down 2.8% year-to-date. There have been short-term moves of -6.2% in the last week and -2.1% over the last month.

- These moves come as investors react to shifting market sentiment and macroeconomic headlines impacting the broader materials sector. Most recently, news around ongoing industry consolidation and raw material pricing has been front and center for Sherwin-Williams, sparking fresh conversations about competitive positioning and cost pressures.

- If you are focusing on valuation, it is worth noting that Sherwin-Williams currently scores 0 out of 6 on undervaluation checks. This means the usual metrics are suggesting the stock is not a classic bargain. However, there are a few angles to valuation that are easy to overlook at first glance, and we will explore those as well as a more insightful method later in the article.

Sherwin-Williams scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Sherwin-Williams Dividend Discount Model (DDM) Analysis

The Dividend Discount Model (DDM) estimates the fair value of a company’s stock by projecting future dividend payments and discounting them back to today’s value. This model is particularly useful for businesses like Sherwin-Williams, which have a steady track record of paying dividends.

For Sherwin-Williams, the latest annual dividend per share is $3.45, with a payout ratio of roughly 27.3%. The company’s return on equity is an impressive 70.2%, suggesting a strong ability to generate profits relative to shareholder equity. Based on the DDM, future dividend growth is capped at 3.26%, providing a conservative outlook compared to past growth rates.

Using this methodology, the estimated intrinsic value for Sherwin-Williams is $75.45 per share. With the current share price significantly higher, the model implies the stock is about 329.2% overvalued relative to this fair value benchmark. This suggests that, according to the DDM and assuming dividends and growth persist at these levels, Sherwin-Williams does not offer a value opportunity at this time.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests Sherwin-Williams may be overvalued by 329.2%. Discover 906 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Sherwin-Williams Price vs Earnings

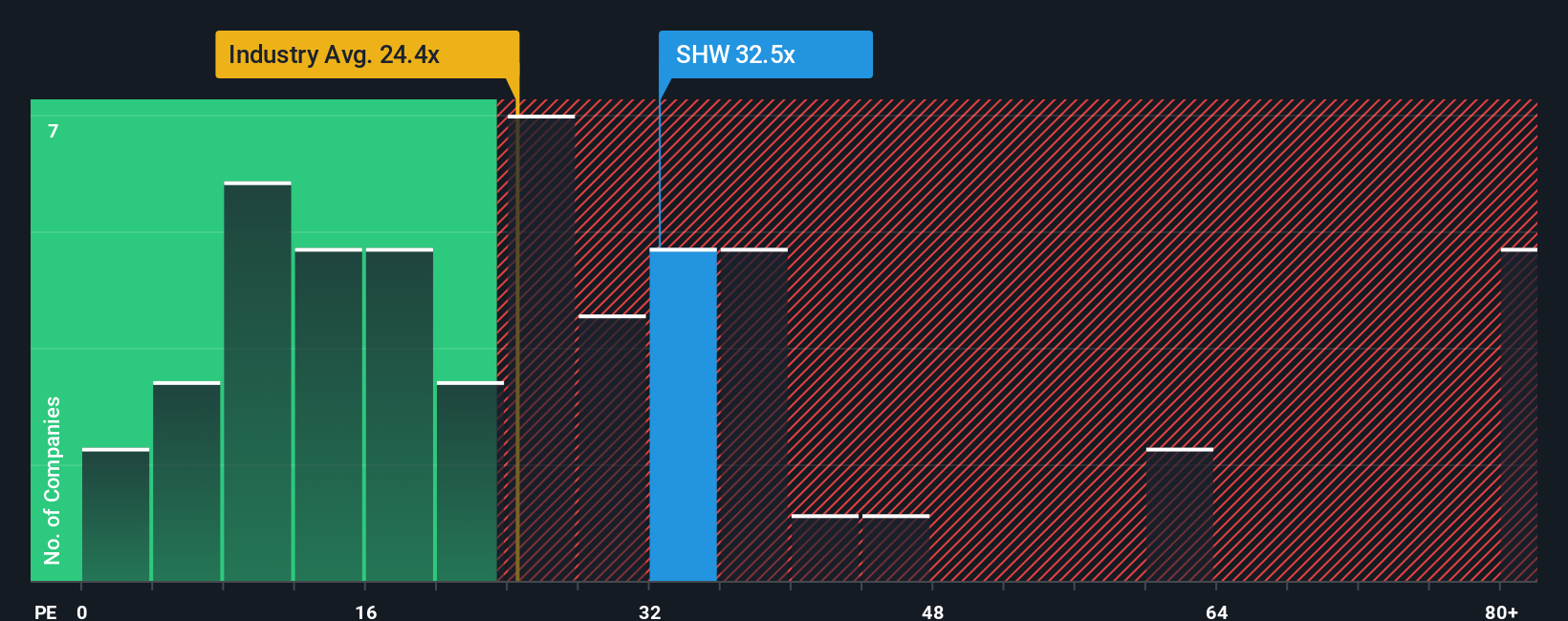

The price-to-earnings (PE) ratio is a widely used valuation metric, especially for profitable companies like Sherwin-Williams. It helps investors understand how much they are paying for each dollar of the company’s earnings. Generally, a higher PE is justified by stronger earnings growth prospects or lower perceived risk. A lower PE can indicate more muted expectations or greater business uncertainties.

Sherwin-Williams currently trades at a PE ratio of 31x. This is notably above both the Chemicals industry average of 22.3x and the peer group average of 23.7x. At first glance, this premium might suggest the stock is expensive relative to its sector and competitors. However, comparing only to industry or peers can overlook unique factors that might justify a higher or lower rating, such as company-specific growth rates, profit margins, risk profile, and size.

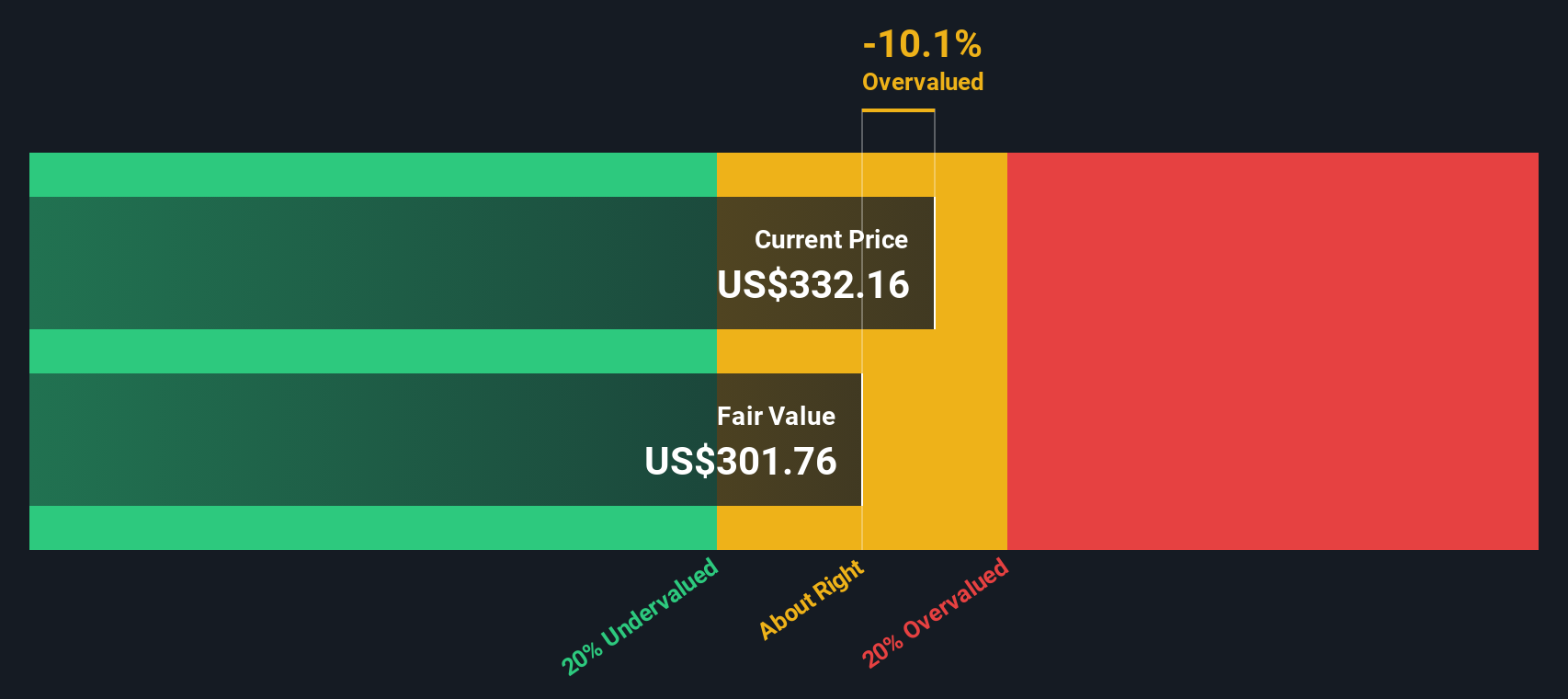

To address these nuances, Simply Wall St calculates a proprietary “Fair Ratio,” which adjusts the expected PE multiple by considering Sherwin-Williams’ earnings outlook, underlying risk, profitability, industry, and market capitalization. For Sherwin-Williams, this Fair Ratio is 24.1x. This tailored approach provides a more comprehensive valuation benchmark than standard peer or industry comparisons.

Comparing the current PE of 31x to the Fair Ratio of 24.1x, Sherwin-Williams appears to be trading well above what would be considered fair based on its specific fundamentals and outlook.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1421 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Sherwin-Williams Narrative

Earlier, we mentioned there's an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story behind the numbers, a way to connect your expectations and big-picture beliefs about Sherwin-Williams to actual forecasts of future revenue, earnings, and profit margins, and ultimately a fair value for the stock.

Narratives make investing more powerful and personal by tying together a company’s business story with financial forecasts and valuation. This allows you to see how your outlook would influence your decision to buy, hold, or sell at current prices. On Simply Wall St’s Community page, millions of investors are already using Narratives, comparing their own fair value estimates with market prices in just a few clicks.

Narratives update automatically as new information comes in, such as earnings results or important news. This ensures you always have a dynamically refreshed view that reflects the latest developments. For example, one Sherwin-Williams Narrative uses a fair value of $420.00 based on a bullish outlook for growth, while another takes a much more cautious view and lands at $258.00. Your Narrative can help clarify whether this stock (at its current price) is a buy for you, based on your own expectations for the future.

Do you think there's more to the story for Sherwin-Williams? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SHW

Sherwin-Williams

Engages in the development, manufacture, distribution, and sale of paint, coatings, and related products to professional, industrial, commercial and retail customers.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.