- United States

- /

- Packaging

- /

- NYSE:SEE

Sealed Air (SEE): Assessing Valuation Following Launch of Sustainable AUTOBAG 850HB Hybrid Bagging Machine

Reviewed by Kshitija Bhandaru

Sealed Air (SEE) just raised the stakes in the packaging industry by announcing its latest innovation: the AUTOBAG 850HB Hybrid Bagging Machine. If you have been watching the company for cues on how it's navigating the fast-changing fulfillment landscape, this new machine is a clear signal. Designed to help businesses handle more orders with fewer resources while supporting both curbside recyclable paper and poly mailers, the product directly responds to demand for efficiency and sustainability in e-commerce and logistics. The launch cements Sealed Air’s strategy to position itself as the go-to provider for fulfillment operations and may shift how investors view the company’s long-term growth prospects.

This announcement comes after a period of mixed momentum for Sealed Air stock. While shares are up roughly 10% over the past three months, they're still down about 4% for the year, showing the market’s cautious optimism. Even as revenue and net income have grown, long-term returns remain subdued. Still, these recent gains suggest the company’s moves, such as rolling out curbside recyclable packaging and deepening its automation lineup, are getting investor attention.

Now the question is whether this recent innovation signals a buying opportunity for Sealed Air, or if investors have already priced in the company’s future growth.

Most Popular Narrative: 12.4% Undervalued

According to the most widely followed narrative, Sealed Air’s stock is currently deemed undervalued based on a blend of future earnings growth, margin improvements, and discounted cash flow analysis. The narrative suggests that the company’s ongoing modernization and global expansion efforts could yield significant long-term benefits for shareholders.

"Sealed Air is accelerating the rollout of substrate-agnostic and fiber-based packaging (e.g., Jiffy/Boss Paper Mailer, hybrid Autobag), positioning it to benefit from expanding regulatory and consumer demand for sustainable and recyclable packaging. This development may support longer-term volume growth and help defend or expand market share, which could positively impact future revenue and margins."

Craving the inside story on why analysts are bullish? The secret lies in ambitious growth projections and profit margin targets that signal a potential rerating ahead. There is a bold quantitative call behind this fair value. Find out what future milestones must be hit to unlock the upside implied by that discounted price.

Result: Fair Value of $39.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent supply chain volatility and a prolonged protein market downturn could undermine earnings growth and put the bullish outlook at risk.

Find out about the key risks to this Sealed Air narrative.Another View: What Does the Market Say?

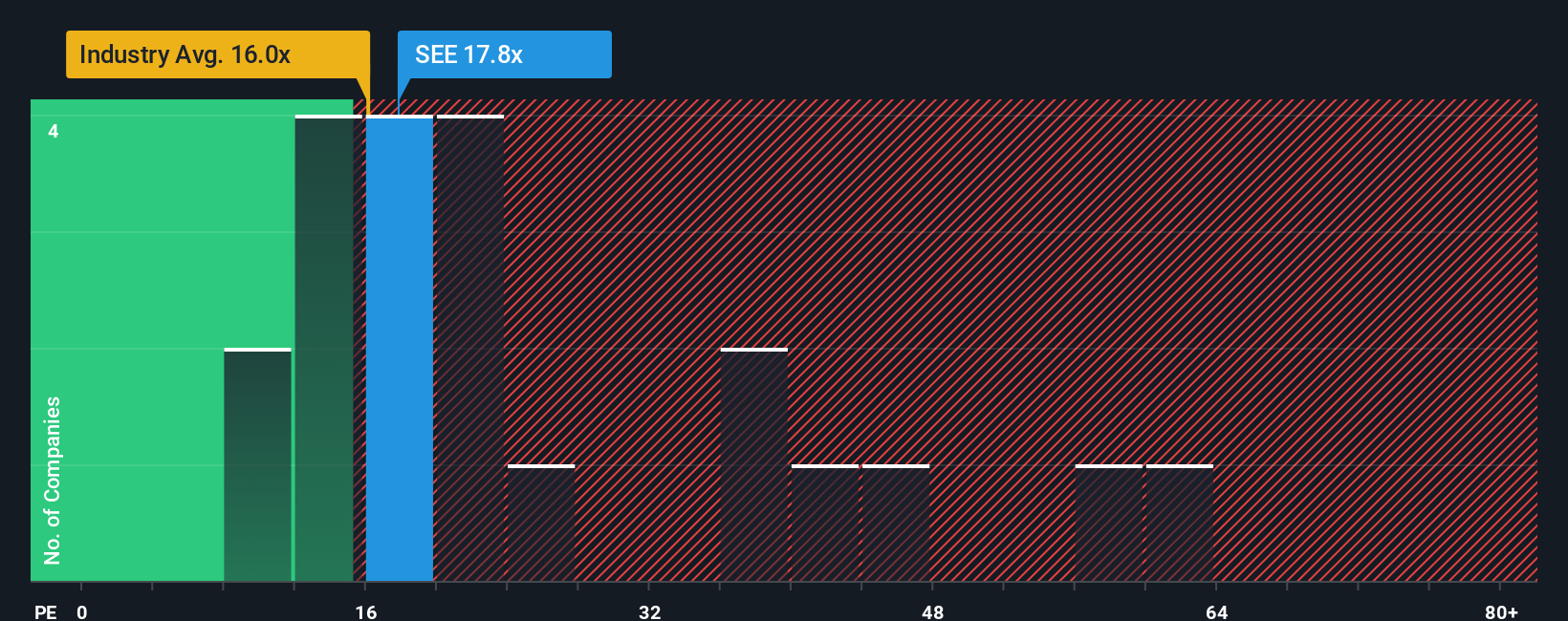

While the popular view leans on discounted cash flow to argue Sealed Air is undervalued, looking at the going price compared to the industry paints a different picture. The stock trades higher than the average. Which story will play out?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Sealed Air to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Sealed Air Narrative

If these perspectives leave you wanting a different take, consider diving deeper and shaping your own viewpoint using our platform in just a few minutes, then Do it your way.

A great starting point for your Sealed Air research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Don’t let your next winning idea slip through the cracks. Use the Simply Wall Street Screener to target investments with real momentum, fresh potential, or reliable income.

- Spot tomorrow’s tech trendsetters by searching for companies shaking up artificial intelligence markets. Find them all in one place with AI penny stocks.

- Grow your passive income by tapping into portfolios built around companies boasting yields over 3 percent, using dividend stocks with yields > 3%.

- Seize bargain opportunities before the crowd by seeking out stocks trading below their true worth with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SEE

Sealed Air

Provides packaging solutions in the United States and internationally, Europe, the Middle East, Africa, and Asia Pacific.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives