- United States

- /

- Packaging

- /

- NYSE:SEE

Is Sealed Air's (SEE) Dividend Hike and Analyst Optimism Shaping Its Long-Term Value Story?

Reviewed by Sasha Jovanovic

- Sealed Air Corporation announced that its Board of Directors declared a quarterly cash dividend of US$0.20 per common share, payable on December 19, 2025, to shareholders of record as of December 5, 2025.

- Following a wave of analyst upgrades, including stronger ratings from Raymond James and RBC Capital, market sentiment around Sealed Air's future growth potential has become increasingly optimistic.

- We'll now explore how these analyst upgrades and renewed confidence could impact Sealed Air's long-term investment prospects.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

Sealed Air Investment Narrative Recap

To be a shareholder in Sealed Air Corporation, you need confidence in its ability to deliver stable cash flow and earnings resilience, especially as it adapts packaging solutions to regulatory and consumer sustainability trends. The recent analyst upgrades and dividend affirmation are supportive signals, though these don't directly address the biggest near-term risk: a prolonged downturn in North American beef, which continues to weigh on the Food segment and restricts momentum in overall volumes.

Among recent announcements, the continued rollout of substrate-agnostic, fiber-based packaging, highlighted by the AUTOBAG® 850HB Hybrid Bagging Machine launch, is especially relevant. This move advances Sealed Air’s positioning for future volume growth in sustainable packaging, a catalyst that could help counter cyclical and margin pressures if industry demand materializes as expected.

However, in contrast to upbeat sentiment around recent analyst upgrades, investors should be aware of heightened risks tied to continued weakness in the beef market segment and what this could mean for...

Read the full narrative on Sealed Air (it's free!)

Sealed Air's narrative projects $5.7 billion in revenue and $534.4 million in earnings by 2028. This requires 2.4% yearly revenue growth and a $235 million increase in earnings from $299.4 million today.

Uncover how Sealed Air's forecasts yield a $41.93 fair value, a 20% upside to its current price.

Exploring Other Perspectives

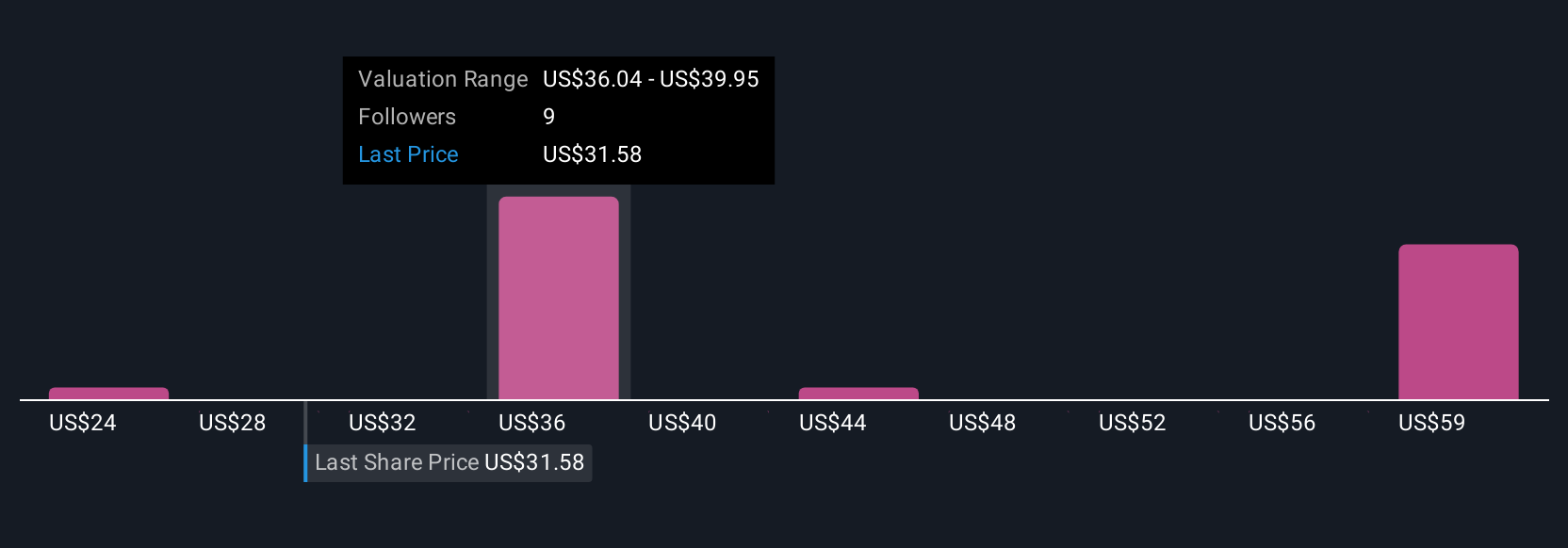

The Simply Wall St Community produced four fair value targets for Sealed Air, ranging widely from US$24.33 to US$69.81 per share. Opinions vary sharply here, and as margin risk remains a key concern in light of ongoing industry challenges, you can explore a broader set of perspectives in our community analysis.

Explore 4 other fair value estimates on Sealed Air - why the stock might be worth as much as 100% more than the current price!

Build Your Own Sealed Air Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sealed Air research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sealed Air research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sealed Air's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SEE

Sealed Air

Provides packaging solutions in the United States and internationally, Europe, the Middle East, Africa, and Asia Pacific.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives