- United States

- /

- Metals and Mining

- /

- NYSE:RS

A Look at Reliance (RS) Valuation Following Q3 Earnings, Dividend Declaration, and Share Buyback Update

Reviewed by Simply Wall St

Reliance (NYSE:RS) caught investor attention after announcing third quarter results, showing sales growth over last year, even as net income dipped. The board also reaffirmed its quarterly dividend and provided an update on recent share repurchases.

See our latest analysis for Reliance.

Despite a busy stretch with quarterly results, dividend affirmation, and an ongoing share buyback, Reliance’s share price return this year has been positive, though steady, up 5.9% year to date. However, the one-year total shareholder return is nearly flat at -0.7%, hinting that while the business has maintained stability, market momentum has yet to build in a meaningful way. Longer-term holders have been better rewarded with a 45% three-year total return.

If this mix of results and steady momentum has you curious about what else the market is offering, now’s a good time to broaden your search and see what’s happening among fast growing stocks with high insider ownership

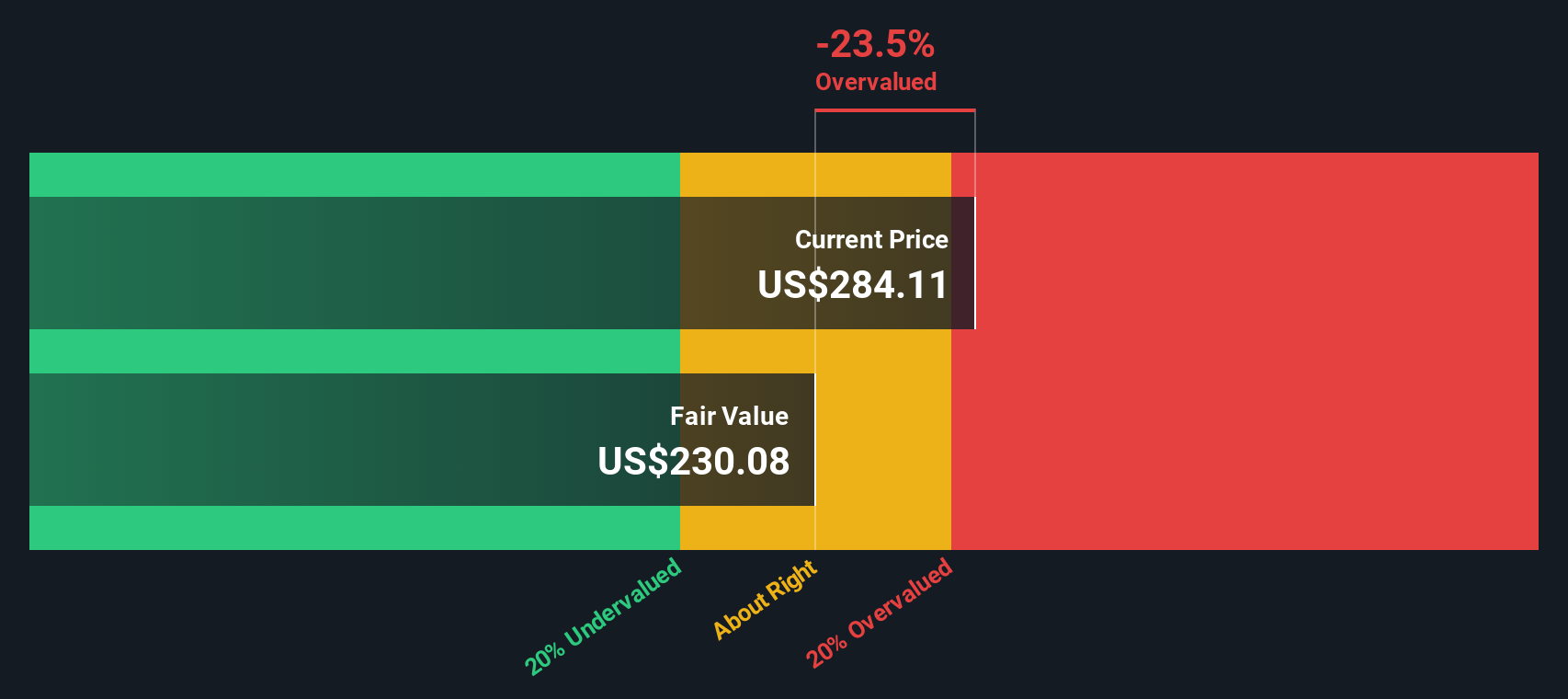

With these elements in play, the key question for investors is whether Reliance’s current share price reflects untapped value or if the market has already factored in expectations for future growth. Could this be the right time to buy, or is the opportunity priced in?

Most Popular Narrative: 12.6% Undervalued

With the most recent fair value calculation coming in at $323.25 versus a last close of $282.43, the most widely followed valuation narrative sees meaningful upside from here. This gap reflects expectations for improving fundamentals and management's ongoing capital returns.

Strategic investments in processing, logistics, and acquisitions enhance customer retention and gross margins. Robust cash flow also enables shareholder returns and earnings growth.

What are analysts betting on to justify this premium? There are pivotal growth levers, aggressive buybacks, and bold future margin targets reflected in the analysis. Want to uncover which factors are moving the price target needle? The answers might surprise you.

Result: Fair Value of $323.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing trade policy uncertainty and rising input costs could squeeze margins. This may challenge Reliance’s ability to deliver on optimistic growth forecasts.

Find out about the key risks to this Reliance narrative.

Another View: Rethinking Valuation Risk

While the popular narrative points to upside, our DCF model presents a different outlook. It estimates Reliance’s fair value at $203.29, which is well below the current price. This suggests the shares could be overvalued. Does this model capture risks that the market is overlooking?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Reliance for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 845 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Reliance Narrative

If you have a different perspective, or want hands-on insight, you can dive into the data and craft your personalized view of Reliance in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Reliance.

Looking for More Investment Ideas?

Why settle for the usual picks when some of the market’s most exciting opportunities are just a click away? Take the lead and make your portfolio work harder by tapping into investment ideas that others might be missing.

- Secure your future income by tapping into these 20 dividend stocks with yields > 3% offering attractive yields and the potential for steady returns.

- Catch the wave of technological innovation with these 27 AI penny stocks poised to disrupt industries and set new growth benchmarks.

- Position yourself ahead of the curve in digital finance with these 81 cryptocurrency and blockchain stocks transforming how businesses and investors think about value exchange.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RS

Reliance

Operates as a diversified metal solutions provider and metals service center company primarily in the United States and Canada.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives