- United States

- /

- Paper and Forestry Products

- /

- NYSE:RFP

This Insider Has Just Sold Shares In Resolute Forest Products Inc. (NYSE:RFP)

We note that the Resolute Forest Products Inc. (NYSE:RFP) Senior Vice President of Pulp & Paper Operations, Richard Tremblay, recently sold US$77k worth of stock for US$5.07 per share. It wasn't a huge sale, but it did reduce their holding by 11%. This does not instill confidence.

See our latest analysis for Resolute Forest Products

The Last 12 Months Of Insider Transactions At Resolute Forest Products

Over the last year, we can see that the biggest insider sale was by the Senior VP of Corporate Affairs, Jacques Vachon, for US$208k worth of shares, at about US$3.16 per share. So it's clear an insider wanted to take some cash off the table, even below the current price of US$5.23. We generally consider it a negative if insiders have been selling, especially if they did so below the current price, because it implies that they considered a lower price to be reasonable. However, while insider selling is sometimes discouraging, it's only a weak signal. This single sale was just 39% of Jacques Vachon's stake.

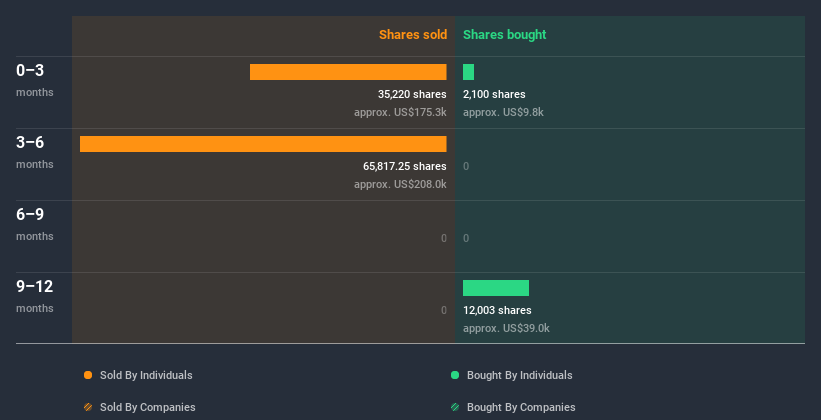

In the last twelve months insiders purchased 14.10k shares for US$49k. On the other hand they divested 101.04k shares, for US$383k. All up, insiders sold more shares in Resolute Forest Products than they bought, over the last year. They sold for an average price of about US$3.79. It's not particularly great to see insiders were selling shares at below recent prices. Of course, the sales could be motivated for a multitude of reasons, so we shouldn't jump to conclusions. The chart below shows insider transactions (by companies and individuals) over the last year. By clicking on the graph below, you can see the precise details of each insider transaction!

If you like to buy stocks that insiders are buying, rather than selling, then you might just love this free list of companies. (Hint: insiders have been buying them).

Insider Ownership of Resolute Forest Products

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. A high insider ownership often makes company leadership more mindful of shareholder interests. Resolute Forest Products insiders own about US$11m worth of shares. That equates to 2.5% of the company. We've certainly seen higher levels of insider ownership elsewhere, but these holdings are enough to suggest alignment between insiders and the other shareholders.

What Might The Insider Transactions At Resolute Forest Products Tell Us?

The stark truth for Resolute Forest Products is that there has been more insider selling than insider buying in the last three months. Despite some insider buying, the longer term picture doesn't make us feel much more positive. While insiders do own shares, they don't own a heap, and they have been selling. So we'd only buy after careful consideration. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. For example - Resolute Forest Products has 2 warning signs we think you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you decide to trade Resolute Forest Products, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NYSE:RFP

Resolute Forest Products

Resolute Forest Products Inc., together with its subsidiaries, operates in the forest products industry in the United States, Canada, Mexico, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives