- United States

- /

- Paper and Forestry Products

- /

- NYSE:RFP

Insider Buying: The Resolute Forest Products Inc. (NYSE:RFP) Director Just Bought US$76k Worth Of Shares

Whilst it may not be a huge deal, we thought it was good to see that the Resolute Forest Products Inc. (NYSE:RFP) Director, Randall Benson, recently bought US$76k worth of stock, for US$5.06 per share. While that isn't the hugest buy, it actually boosted their shareholding by 153.1%, which is good to see.

View our latest analysis for Resolute Forest Products

Resolute Forest Products Insider Transactions Over The Last Year

The Senior VP of Corporate Affairs, Jacques Vachon, made the biggest insider sale in the last 12 months. That single transaction was for US$357k worth of shares at a price of US$8.52 each. While we don't usually like to see insider selling, it's more concerning if the sales take place at a lower price. It's of some comfort that this sale was conducted at a price well above the current share price, which is US$4.65. So it may not shed much light on insider confidence at current levels.

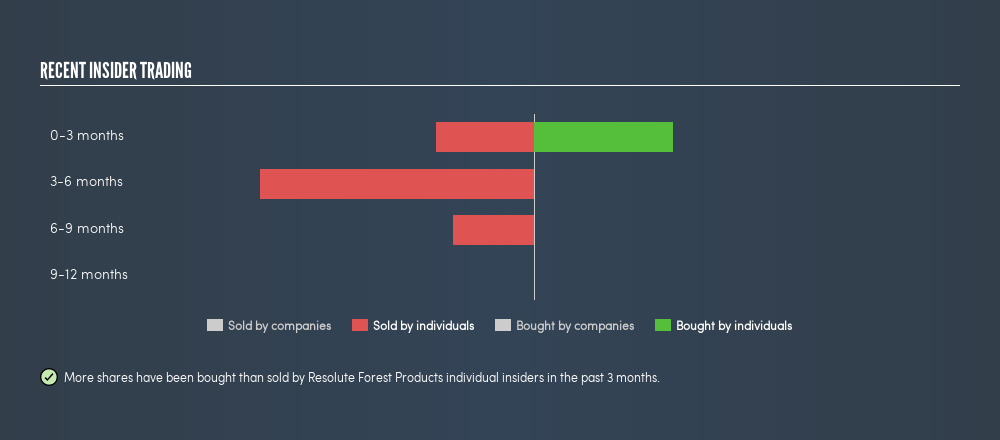

In the last twelve months insiders purchased 21422 shares for US$114k. On the other hand they divested 69720 shares, for US$574k. In total, Resolute Forest Products insiders sold more than they bought over the last year. You can see a visual depiction of insider transactions (by individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

Insider Ownership

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. I reckon it's a good sign if insiders own a significant number of shares in the company. Based on our data, Resolute Forest Products insiders have about 0.7% of the stock, worth approximately US$2.9m. I generally like to see higher levels of ownership.

So What Does This Data Suggest About Resolute Forest Products Insiders?

We note a that there has been a bit of insider buying recently (but no selling). Overall the buying isn't worth writing home about. Recent insider selling makes us a little nervous, in light of the broader picture of Resolute Forest Products insider transactions. And we're not picking up on high enough insider ownership to give us any comfort. If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:RFP

Resolute Forest Products

Resolute Forest Products Inc., together with its subsidiaries, operates in the forest products industry in the United States, Canada, Mexico, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives