- United States

- /

- Chemicals

- /

- NYSE:PRM

Perimeter Solutions' (NYSE:PRM) Earnings Offer More Than Meets The Eye

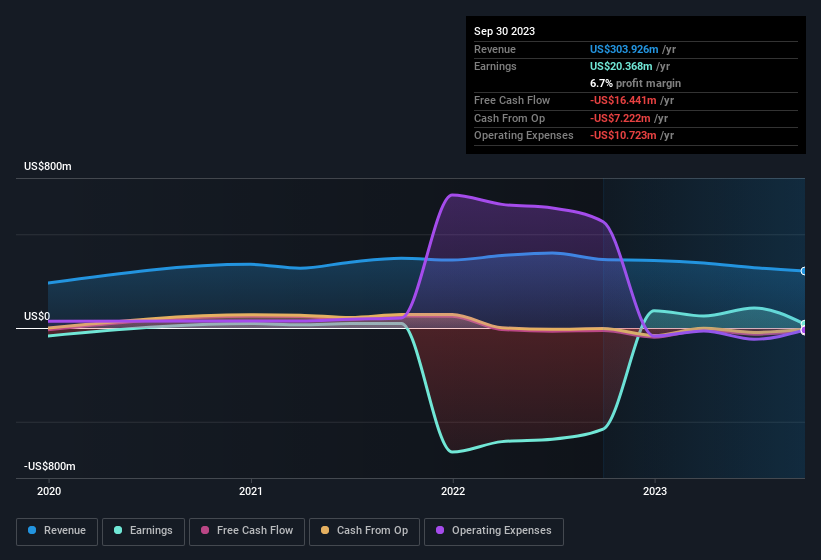

Shareholders appeared to be happy with Perimeter Solutions, SA's (NYSE:PRM) solid earnings report last week. This reaction by the market reaction is understandable when looking at headline profits and we have found some further encouraging factors.

See our latest analysis for Perimeter Solutions

How Do Unusual Items Influence Profit?

To properly understand Perimeter Solutions' profit results, we need to consider the US$32m expense attributed to unusual items. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. Assuming those unusual expenses don't come up again, we'd therefore expect Perimeter Solutions to produce a higher profit next year, all else being equal.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

An Unusual Tax Situation

Just as we noted the unusual items, we must inform you that Perimeter Solutions received a tax benefit which contributed US$6.6m to the bottom line. It's always a bit noteworthy when a company is paid by the tax man, rather than paying the tax man. Of course, prima facie it's great to receive a tax benefit. And since it previously lost money, it may well simply indicate the realisation of past tax losses. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth. While we think it's good that the company has booked a tax benefit, it does mean that there's every chance the statutory profit will come in a lot higher than it would be if the income was adjusted for one-off factors.

Our Take On Perimeter Solutions' Profit Performance

In its last report Perimeter Solutions received a tax benefit which might make its profit look better than it really is on a underlying level. Having said that, it also had a unusual item reducing its profit. Considering all the aforementioned, we'd venture that Perimeter Solutions' profit result is a pretty good guide to its true profitability, albeit a bit on the conservative side. If you want to do dive deeper into Perimeter Solutions, you'd also look into what risks it is currently facing. For instance, we've identified 2 warning signs for Perimeter Solutions (1 is a bit unpleasant) you should be familiar with.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:PRM

Perimeter Solutions

Manufactures and supplies firefighting products and lubricant additives in the United States, Germany, and internationally.

Adequate balance sheet with acceptable track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026