- United States

- /

- Chemicals

- /

- NYSE:PPG

PPG Industries (PPG): Assessing Valuation After Mixed Earnings and Segment Weakness

Reviewed by Simply Wall St

If you follow PPG Industries (PPG), the latest round of executive changes may have caught your eye. However, it is the recent earnings results that are creating a buzz among investors. Despite beating revenue expectations, the company’s profit fell and sales declined in its core Global Architectural Coatings and Industrial Coatings segments. This mix of positive and negative results can shift how markets value PPG, raising questions for those holding or considering the stock right now.

While shares edged up 2% over the past week, they lost steam when quarterly earnings showed shrinking bottom-line numbers. PPG Industries is not alone in feeling pressure in materials, but the pullback over the past year has been sharper for this stock, with a 7% drop, alongside a soft 1% year-to-date return. Momentum that once lifted the stock has faded, and investors are weighing whether the revenue surprise is enough to reverse the trend, especially after segment-level weakness.

After this uneven stretch, is the market underestimating PPG's future growth, or is the current price a fair reflection of its earnings risks? Let’s dig into the valuation picture.

Most Popular Narrative: 25% Undervalued

According to the narrative by Dman, PPG Industries is trading significantly below its estimated fair value, with market pessimism potentially overlooking catalysts for future growth. This undervaluation is tied to shifting sector dynamics, portfolio restructuring, and evolving technologies within the coatings industry.

"PPG Industries presents a compelling risk-reward profile for patient investors. Near-term challenges, including cyclical demand softness and restructuring costs, are counterbalanced by strategic investments in high-growth technologies and shareholder-friendly capital allocation. The stock’s 12.7% discount to average price targets and 3.2% dividend yield offer downside protection. Smart windows and digital coatings provide optionality on decarbonization trends."

Why is Wall Street missing the mark on PPG’s true value? The secret sauce driving this valuation comes from a bold mix of future-facing products, ongoing portfolio shifts, and a profit trajectory that defies today’s muted numbers. Ready to uncover which assumptions set up this eye-catching upside? Dive into the full narrative to see what could make PPG the comeback story of the sector.

Result: Fair Value of $152.76 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent input cost pressures and execution risks in portfolio restructuring could quickly challenge the optimistic outlook currently favored by analysts and investors.

Find out about the key risks to this PPG Industries narrative.Another View: Discounted Cash Flow Indicates Undervaluation Too

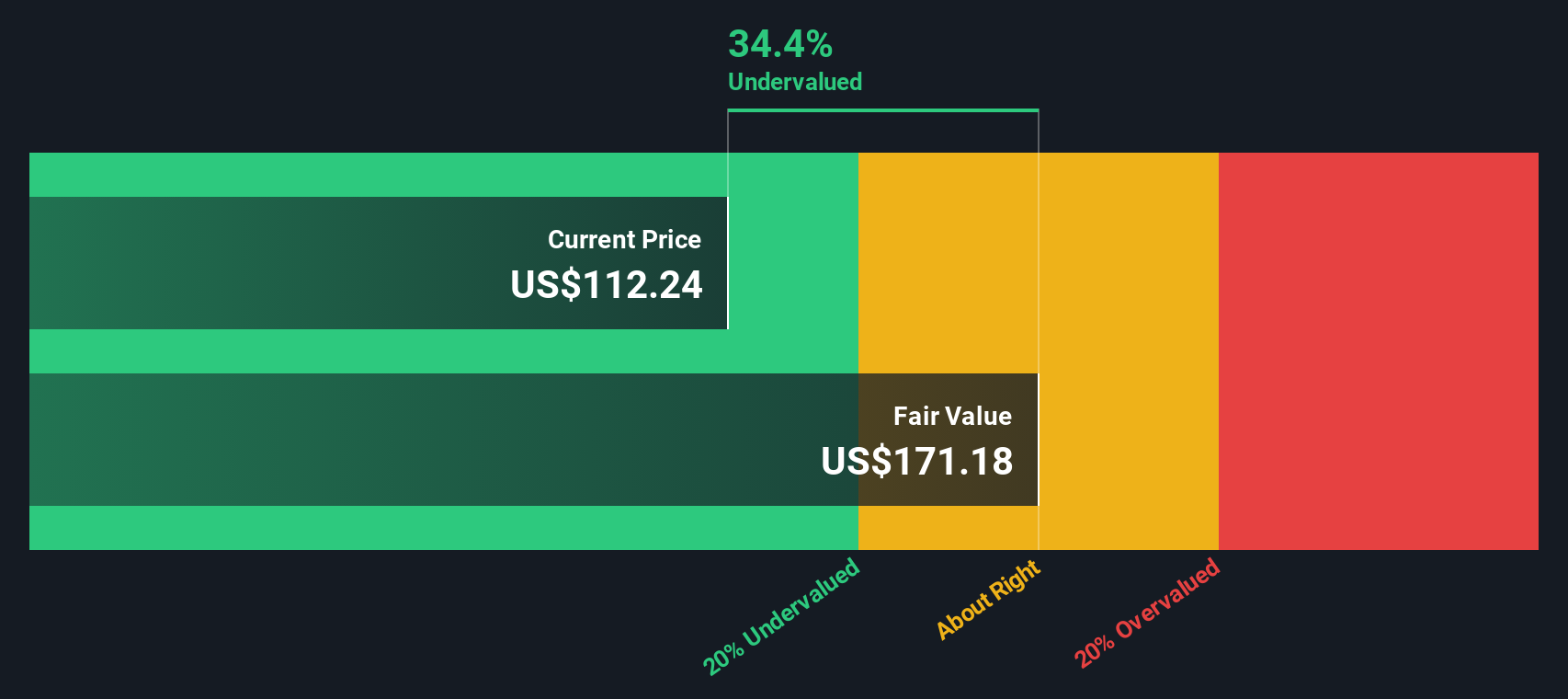

Taking a different angle, the SWS DCF model also suggests the stock is priced below its estimated fair value. Both methods indicate a potential opportunity. However, a key question remains: can these calculations hold up if market sentiment shifts?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own PPG Industries Narrative

If you have a different perspective or want to build your own investment story, you can easily craft your own narrative in just a few minutes. So why not do it your way?

A great starting point for your PPG Industries research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Winning Investment Ideas?

Opportunities do not wait. Now is the time to broaden your search and get ahead of the market curve. Make the most of Simply Wall Street’s powerful stock screeners to set yourself up for smarter investing. Here are three hand-picked routes to help you spot your next great portfolio contender:

- Kickstart your search for stable income by uncovering companies offering strong yields and consistent payments with dividend stocks with yields > 3%.

- Seize the chance to ride the wave of innovation in life sciences by spotting future leaders among AI-powered healthcare stocks using healthcare AI stocks.

- Position yourself early in the digital revolution by tapping into companies advancing new currencies and secure transactions, all found with cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PPG

PPG Industries

Manufactures and distributes paints, coatings, and specialty materials in the United States, Canada, the Asia Pacific, Latin America, Europe, the Middle East, and Africa.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives