- United States

- /

- Chemicals

- /

- NYSE:PPG

Does Recent Share Slide Offer Opportunity in PPG Industries for 2025?

Reviewed by Bailey Pemberton

If you have been tracking PPG Industries and wondering whether now is the time to make your move, you are not alone. The stock has shown some interesting twists in its price recently, catching the attention of both long-term holders and would-be buyers. Over the past week, PPG inched up 0.6%, but zooming out to a month, it slipped by 4.6%. Year-to-date, the stock has seen a 9.4% decline, and if you look at the bigger picture—one, three, and even five years—the returns have stayed stubbornly in the red. This tells us there are bigger forces at play, from shifting demand in the coatings and materials sector to evolving investor risk perceptions, all against the backdrop of broader market uncertainty.

With this kind of price action, the big question for investors is: What is PPG Industries really worth, and are the current levels a smart entry point? Our valuation score for the company stands at 5 out of 6, which means PPG is undervalued by almost every metric we look at. This is a rare feat, and it could signal an opportunity if you know how to read the signs.

Let’s break down the different valuation approaches that underpin this score. At the end, I’ll share a perspective on valuation that can give you an even clearer edge before you decide what to do next with PPG Industries.

Why PPG Industries is lagging behind its peers

Approach 1: PPG Industries Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by forecasting a company’s future cash flows and then discounting those projections back to their value in today’s money. This approach provides a picture of what PPG Industries could be worth, based solely on the money it is expected to generate in the future.

For PPG Industries, the latest reported Free Cash Flow sits at $898 million. Looking ahead, analysts and model projections show Free Cash Flow steadily increasing, passing $1.4 billion by 2026 and reaching approximately $2.5 billion in 2035. These projections are based on a mix of analyst forecasts for the next five years, with longer-term estimates extrapolated by Simply Wall St to paint a trajectory of continued moderate growth.

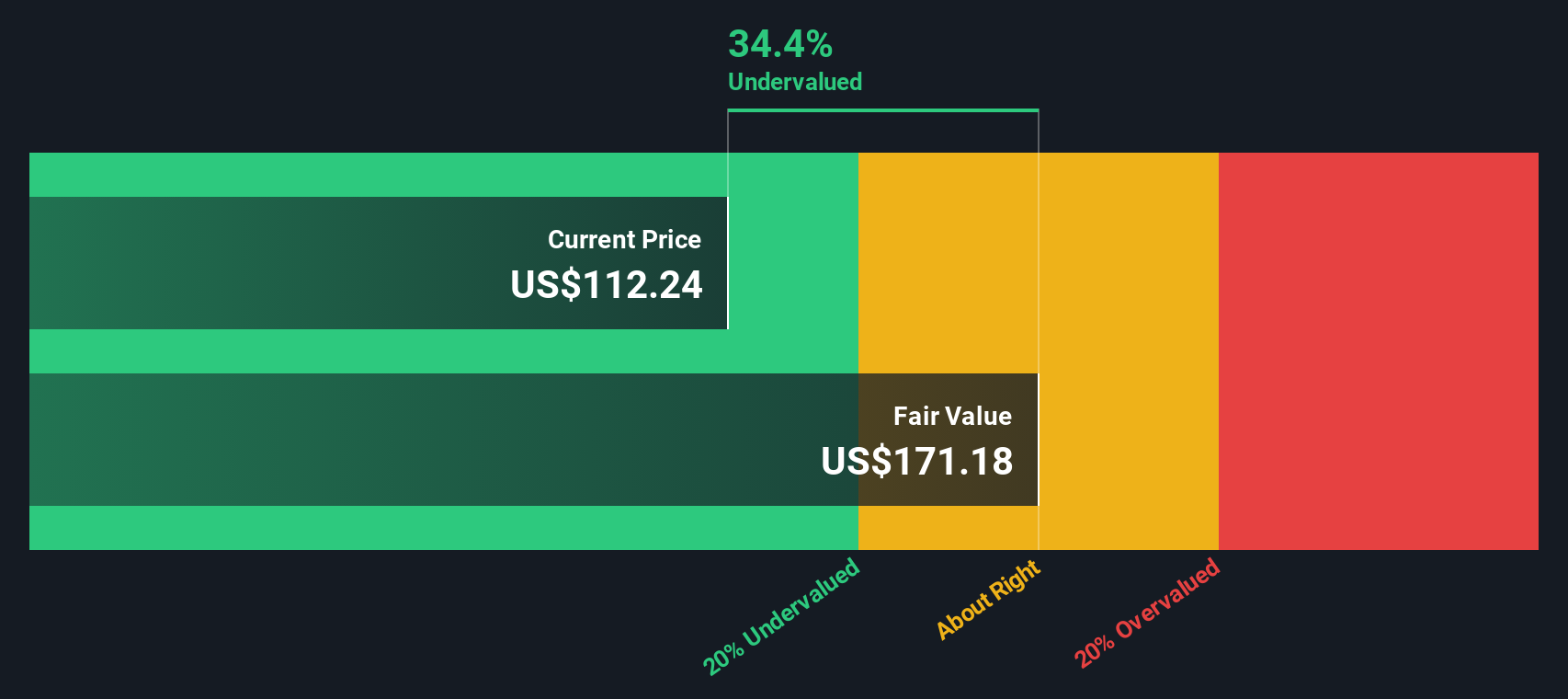

After crunching the numbers, the DCF model estimates a fair value for PPG Industries at $165.66 per share. Currently, the market price is about 36.9 percent below this intrinsic value, suggesting the stock is notably undervalued according to this methodology.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests PPG Industries is undervalued by 36.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: PPG Industries Price vs Earnings

The price-to-earnings (PE) ratio is a go-to metric for valuing steady, profitable companies like PPG Industries. It offers a quick snapshot of how much investors are willing to pay for each dollar of earnings and is especially useful when a business has consistent profits.

What is considered a “normal” or “fair” PE ratio depends on several factors. Companies expected to grow faster or carrying lower risks typically deserve a higher PE, while mature or riskier firms often command lower ratios. Market participants judge these factors routinely, so the PE ratio reflects market sentiment around growth and risk.

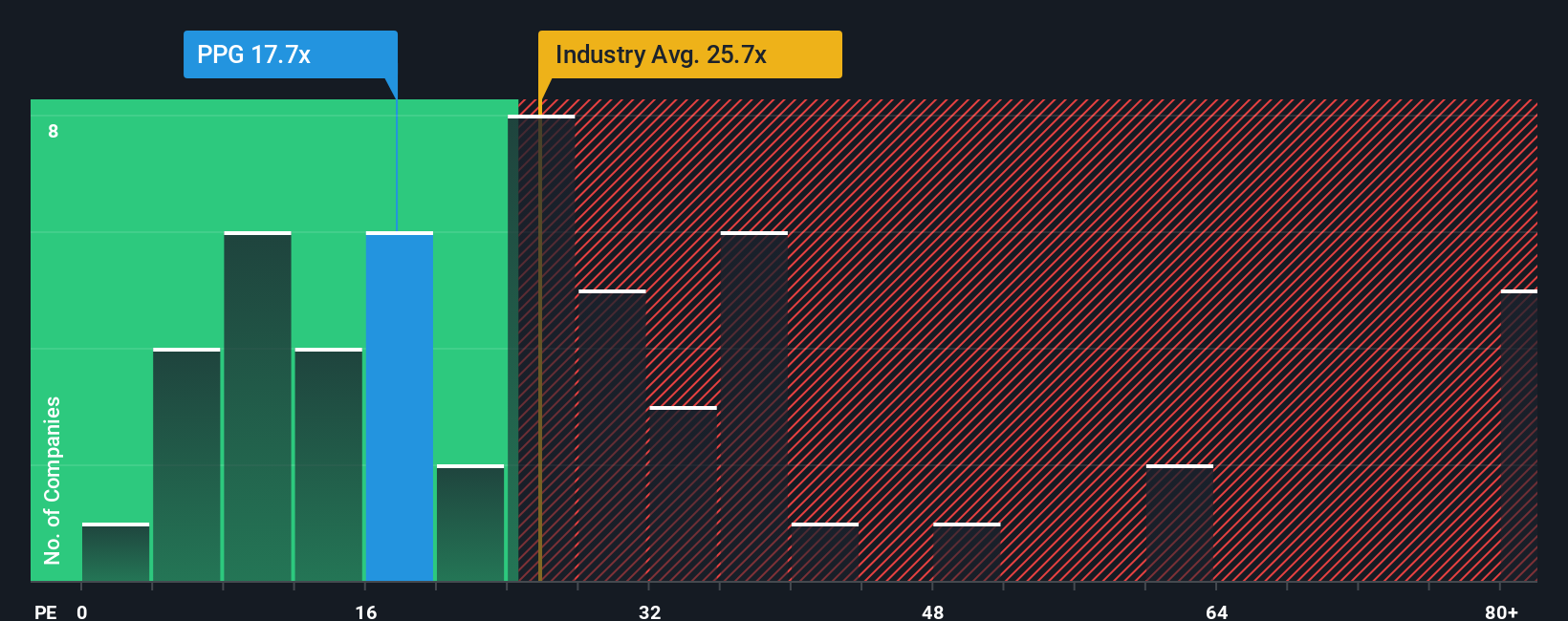

Currently, PPG Industries trades on a PE ratio of 18.6x. This is almost identical to the average among similar peers at 18.4x, but significantly below the broader chemicals industry average of 26.7x. At face value, the current multiple suggests PPG is trading at a discount to its wider industry, yet in line with more direct competitors.

Simply Wall St’s proprietary “Fair Ratio” for PPG comes in at 22.2x. This is not just any average, but a purpose-built benchmark that considers the company’s earnings growth, profit margins, risk profile, scale, and the context of the chemicals industry. Unlike peer or industry comparisons that can overlook key differences, the Fair Ratio aims to be a tailored target of what PPG’s multiple should be.

With PPG’s actual PE of 18.6x below the Fair Ratio of 22.2x, the numbers suggest the stock is undervalued based on this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your PPG Industries Narrative

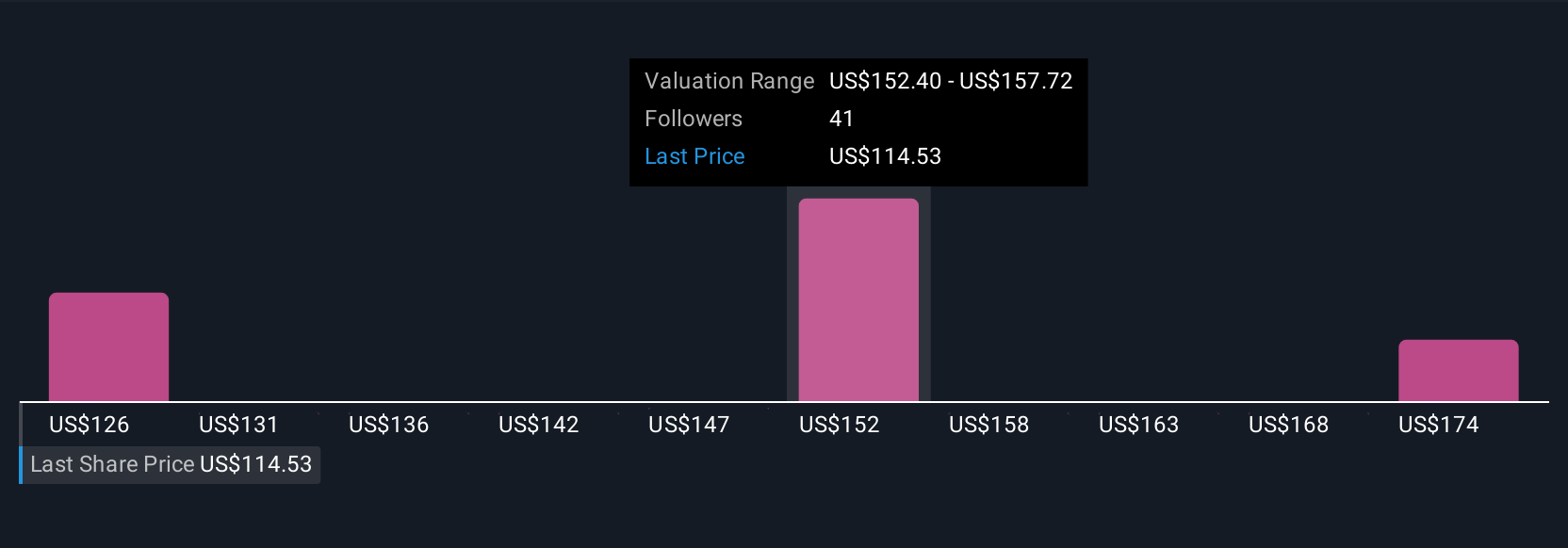

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story about a company: what you believe is driving its future performance, and how that shapes your expectations for its fair value, revenue, earnings, and profit margins. By connecting the company's story with a concrete financial forecast and resulting fair value, Narratives allow you to make sense of the numbers in a truly personalized way.

Narratives are accessible, dynamic tools available to millions of investors through Simply Wall St’s Community page. They help you decide when to buy or sell by letting you compare your Fair Value estimate, built from your assumptions about PPG Industries, to the current share price. Most importantly, Narratives update automatically as new information, like news or earnings, comes out, ensuring your perspective stays relevant.

To illustrate, some investors see PPG Industries accelerating with rapid 16% revenue growth and assign a fair value as high as $152.76. Others expect more modest gains and set a fair value closer to $127.35. Both perspectives reflect valid Narratives based on different beliefs about the company’s strategy and industry outlook. Now, you can craft yours and invest with greater conviction.

Do you think there's more to the story for PPG Industries? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PPG

PPG Industries

Manufactures and distributes paints, coatings, and specialty materials in the United States, Canada, the Asia Pacific, Latin America, Europe, the Middle East, and Africa.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives