- United States

- /

- Packaging

- /

- NYSE:PACK

There's Reason For Concern Over Ranpak Holdings Corp.'s (NYSE:PACK) Massive 25% Price Jump

Ranpak Holdings Corp. (NYSE:PACK) shares have had a really impressive month, gaining 25% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 42%.

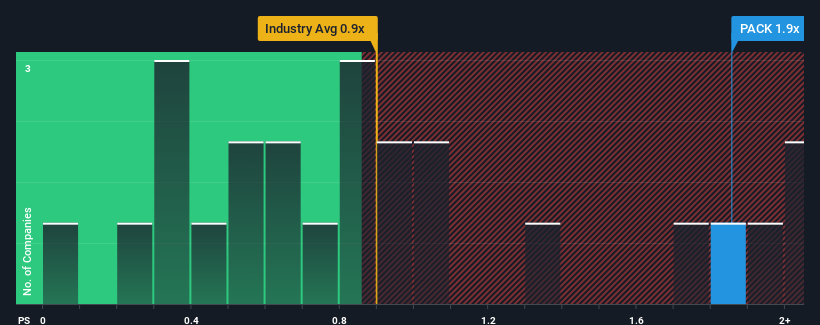

Following the firm bounce in price, given close to half the companies operating in the United States' Packaging industry have price-to-sales ratios (or "P/S") below 0.9x, you may consider Ranpak Holdings as a stock to potentially avoid with its 1.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Ranpak Holdings

How Has Ranpak Holdings Performed Recently?

With its revenue growth in positive territory compared to the declining revenue of most other companies, Ranpak Holdings has been doing quite well of late. Perhaps the market is expecting the company's future revenue growth to buck the trend of the industry, contributing to a higher P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ranpak Holdings.Is There Enough Revenue Growth Forecasted For Ranpak Holdings?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Ranpak Holdings' to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 7.7%. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 12% over the next year. With the industry predicted to deliver 19% growth, the company is positioned for a weaker revenue result.

With this information, we find it concerning that Ranpak Holdings is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On Ranpak Holdings' P/S

Ranpak Holdings shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Ranpak Holdings, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Plus, you should also learn about these 3 warning signs we've spotted with Ranpak Holdings.

If these risks are making you reconsider your opinion on Ranpak Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PACK

Ranpak Holdings

Provides product protection solutions and end-of-line automation solutions for e-commerce and industrial supply chains in North America, Europe, and Asia.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives