Want to participate in a short research study? Help shape the future of investing tools and receive a $20 prize!

While it may not be enough for some shareholders, we think it is good to see the Owens-Illinois, Inc. (NYSE:OI) share price up 14% in a single quarter. But if you look at the last five years the returns have not been good. You would have done a lot better buying an index fund, since the stock has dropped 40% in that half decade.

View our latest analysis for Owens-Illinois

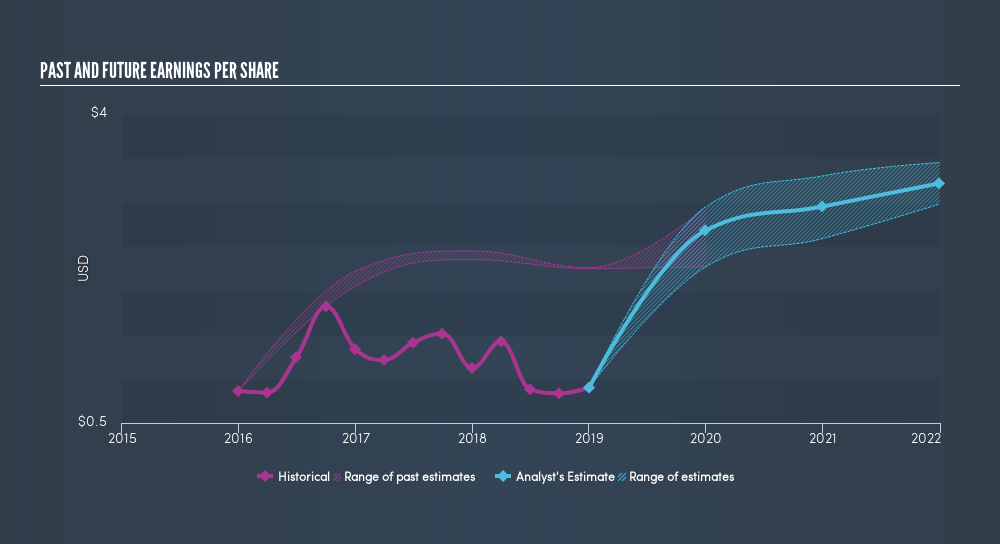

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Looking back five years, both Owens-Illinois's share price and EPS declined; the latter at a rate of 15% per year. The share price decline of 9.9% per year isn't as bad as the EPS decline. So investors might expect EPS to bounce back -- or they may have previously foreseen the EPS decline.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

This free interactive report on Owens-Illinois's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market gained around 3.1% in the last year, Owens-Illinois shareholders lost 7.1% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 9.8% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. If you would like to research Owens-Illinois in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

Of course Owens-Illinois may not be the best stock to buy. So you may wish to see this freecollection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:OI

O-I Glass

Through its subsidiaries, engages in the manufacture and sale of glass containers to food and beverage manufacturers primarily in the Americas, Europe, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives