- United States

- /

- Chemicals

- /

- NYSE:NGVT

Why Ingevity (NGVT) Is Up 5.2% After Securing Rights to CHASM’s Nanotube Battery Technology

Reviewed by Sasha Jovanovic

- On November 11, 2025, CHASM Advanced Materials announced that Ingevity signed a license agreement to manufacture CHASM’s patented carbon nanotube additives for battery applications in North America and select European markets.

- This agreement advances Ingevity’s position in supplying high-performance battery materials, directly supporting the domestic EV gigafactory ecosystem and regional supply chain security.

- We'll explore how securing manufacturing rights for low-cost carbon nanotube technology could influence Ingevity's future specialty chemicals growth outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Ingevity Investment Narrative Recap

For investors in Ingevity, the core belief centers on the company’s ability to shift its portfolio toward higher-margin specialty chemicals, capitalizing on trends in battery materials and local supply chain resilience. The new license agreement with CHASM Advanced Materials positions Ingevity as a North American supplier of advanced carbon nanotube additives, but the most immediate catalyst remains the ongoing divestiture of non-core businesses and the focus on margin recovery. Near-term risks, particularly from APT segment softness and tariff uncertainty, are not mitigated meaningfully by this agreement. A recent earnings update on November 5, 2025, offered revised full-year guidance, reflecting continued competitive pressures and demand challenges in the APT segment. This news, coupled with the CHASM agreement, demonstrates the company’s efforts to strengthen future growth drivers while addressing margin headwinds and cyclical volatility. However, while Ingevity is expanding into new specialty high-growth markets, continued weakness in global industrial demand and persistent tariff pressures are risks investors should be aware of, especially if…

Read the full narrative on Ingevity (it's free!)

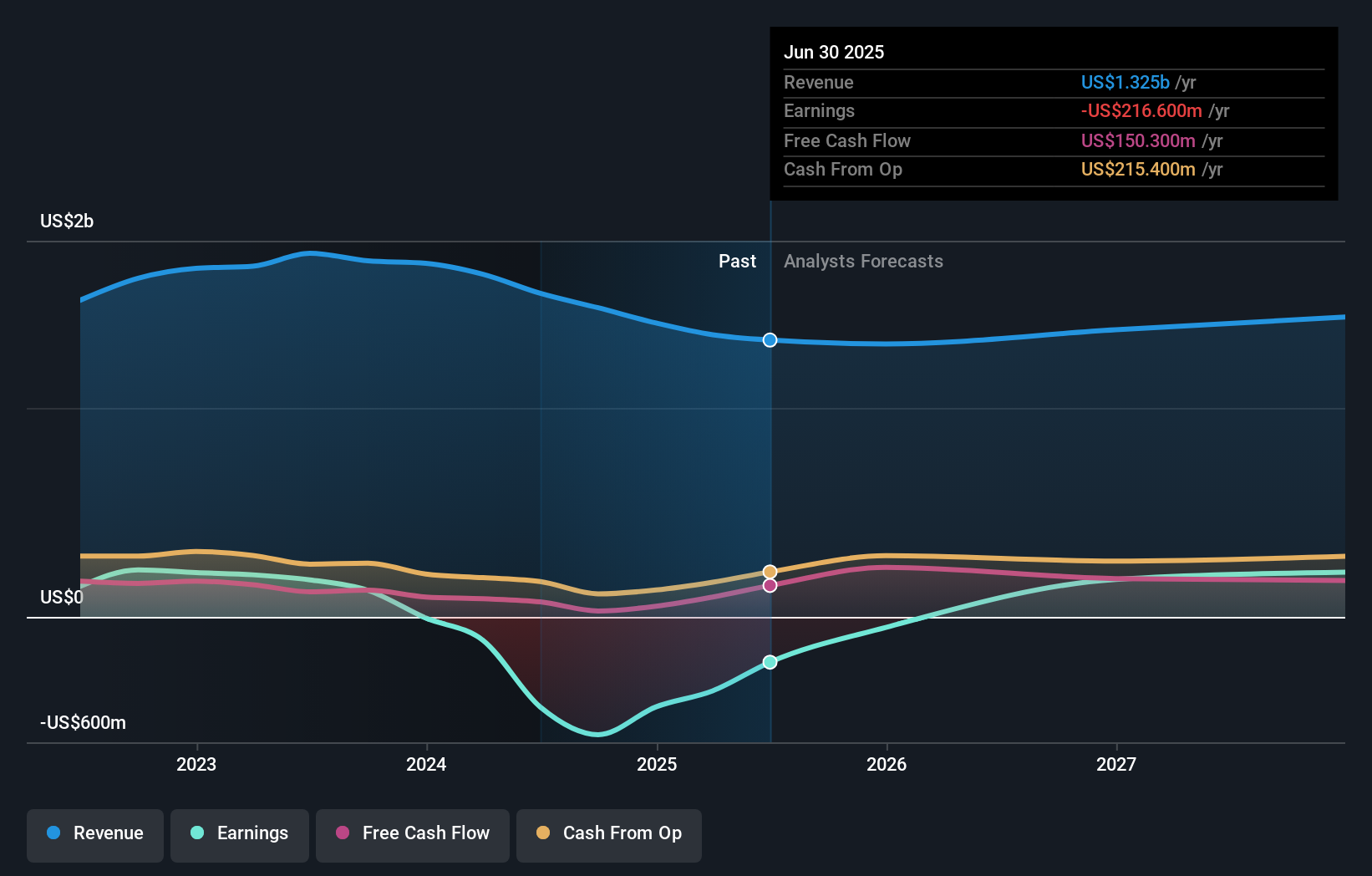

Ingevity's outlook expects $1.5 billion in revenue and $412.8 million in earnings by 2028. This scenario is based on a 3.1% annual revenue growth rate and a $629.4 million increase in earnings from the current level of -$216.6 million.

Uncover how Ingevity's forecasts yield a $65.25 fair value, a 32% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community’s single fair value estimate for Ingevity stands at US$65.25, showing less diversity but signaling a view of undervaluation versus company guidance. Amid these differing opinions, remember that the company’s ability to reposition its portfolio and drive margin improvement will shape future returns.

Explore another fair value estimate on Ingevity - why the stock might be worth just $65.25!

Build Your Own Ingevity Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ingevity research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ingevity research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ingevity's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NGVT

Ingevity

Manufactures and sells activated carbon products, derivative specialty chemicals, and engineered polymers in North America, the Asia Pacific, Europe, the Middle East, Africa, and South America.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives