- United States

- /

- Chemicals

- /

- NYSE:NGVT

Does Ingevity’s 37.7% 2025 Rally Signal More Room to Run After Partnership News?

Reviewed by Bailey Pemberton

- Ever wondered if Ingevity could be a hidden value gem, or if its recent gains signal that you might already be late to the party?

- The stock is up an impressive 37.7% year-to-date, but has cooled slightly in the last month, shedding 1.0% after a strong start.

- Recent news has spotlighted Ingevity’s strategic initiatives and industry partnerships, stirring investor optimism. Stories around potential M&A activity and new sustainability projects have grabbed headlines, fueling recent price moves and fresh interest among analysts.

- Currently, Ingevity scores 3 out of 6 on our undervaluation checks. This is a solid foundation as we compare valuation methods next, so stick around for an even more insightful approach coming at the end of this article.

Approach 1: Ingevity Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's value, reflecting the time value of money. This method helps investors assess what a business is truly worth, regardless of current market sentiment.

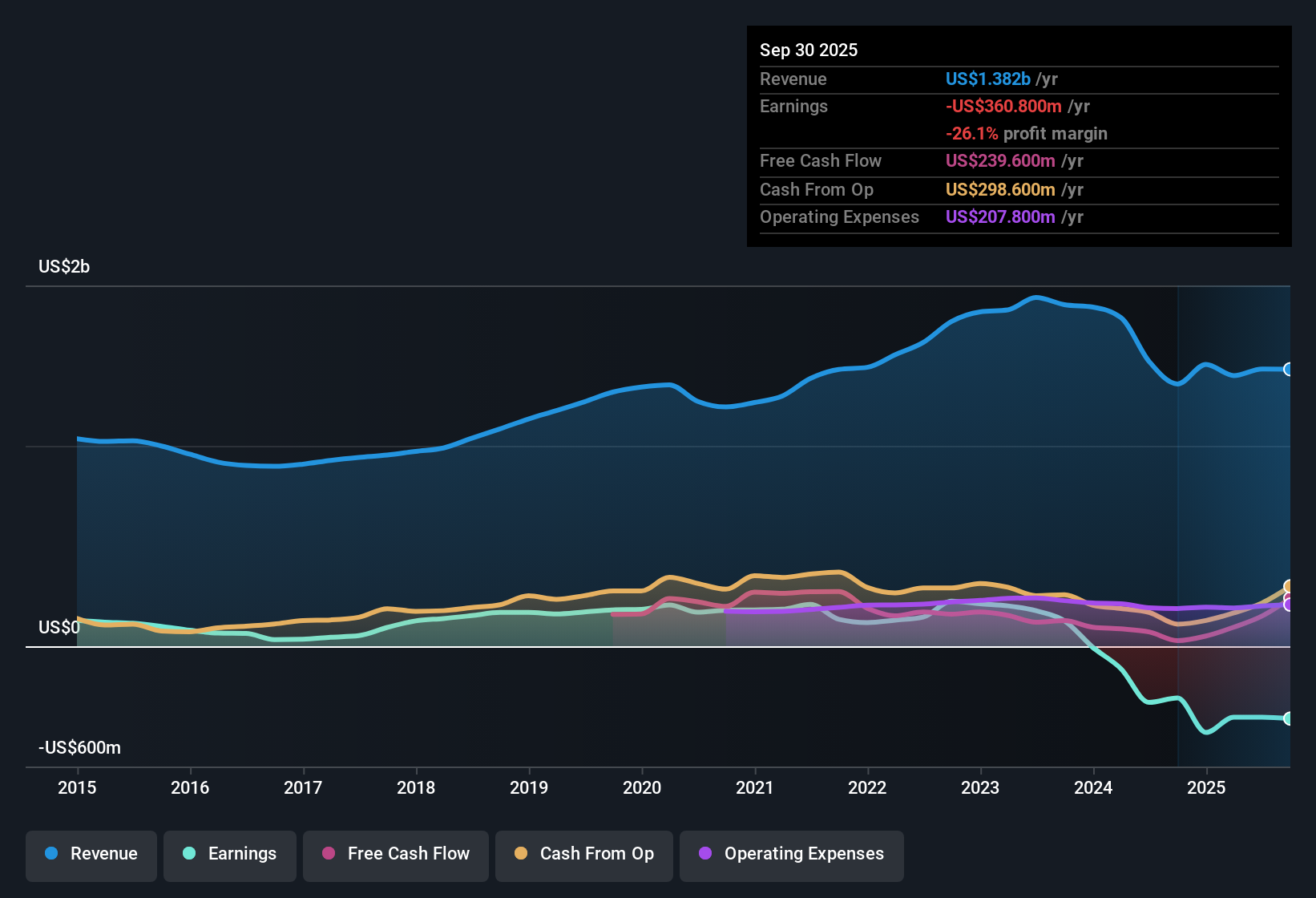

For Ingevity, the current Free Cash Flow stands at $130.7 million. According to analysts, Free Cash Flow is expected to grow steadily over the next several years and reach $175.9 million by 2027. Looking further ahead, Simply Wall St extrapolates these projections over the next decade, with the estimated Free Cash Flow approaching $184.6 million by 2035.

With these forecasts and using the 2 Stage Free Cash Flow to Equity approach, the DCF model calculates an intrinsic value of $73.32 per share. When compared to the current market price, this indicates that Ingevity shares are trading at a 25.7% discount to their estimated fair value.

If the DCF projections hold, Ingevity appears meaningfully undervalued by the market at this time, with a compelling margin of safety for long-term investors.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Ingevity is undervalued by 25.7%. Track this in your watchlist or portfolio, or discover 849 more undervalued stocks based on cash flows.

Approach 2: Ingevity Price vs Sales

The Price-to-Sales (P/S) ratio is the preferred valuation metric for Ingevity because it offers a straightforward way to value companies where earnings can be volatile or temporarily negative, but sales remain relatively stable. This makes it especially useful for evaluating cyclical or transitioning businesses, where profit margins may be compressed or in recovery.

Growth expectations and company-specific risks play a major role in determining what counts as a “normal” P/S ratio. Companies with higher growth prospects or more stable revenues typically command higher multiples, while those facing more uncertainty or risks are often valued at a discount to their peers.

Currently, Ingevity trades at a P/S ratio of 1.50x. This is above both the Chemicals industry average of 1.23x and the peer average of 1.09x, suggesting the market is already pricing in some premium for the company’s prospects.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio for Ingevity is 1.33x, which takes into account not just industry trends and peer companies, but also factors unique to Ingevity, such as its growth forecasts, profit margins, market capitalization, and specific risks. By blending these datapoints, the Fair Ratio provides a more tailored benchmark than simple industry or peer comparisons.

With Ingevity’s actual P/S ratio only slightly above its Fair Ratio, the stock appears to be valued about right based on this approach.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1407 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ingevity Narrative

Earlier we mentioned that there's an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is simply your story, your perspective about Ingevity’s future, where you set your own assumptions about things like revenue, margins, risk, and fair value, then link those beliefs directly to a financial forecast and a fair price for the company.

Unlike static models, Narratives bring the numbers to life by connecting your big-picture outlook to the valuation, making the reasoning behind every investment decision transparent and actionable. On Simply Wall St’s Community page, Narratives are simple to build and are used by millions of investors to easily see how fair value compares to the current share price. This helps guide decisions on whether to buy, hold, or sell at any time.

What makes Narratives stand out is that they're updated live whenever major news, earnings, or company events occur, so your view of Ingevity stays aligned with the most current information without extra effort.

For example, one investor might create a bullish Narrative for Ingevity, forecasting strong margin recovery and global growth to justify a fair value near $70 per share. Another may be more cautious about competitive pressures and set their fair value closer to $52, highlighting how different outlooks lead to different price targets and investment actions.

Do you think there's more to the story for Ingevity? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NGVT

Ingevity

Manufactures and sells activated carbon products, derivative specialty chemicals, and engineered polymers in North America, the Asia Pacific, Europe, the Middle East, Africa, and South America.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives