- United States

- /

- Metals and Mining

- /

- NYSE:NEXA

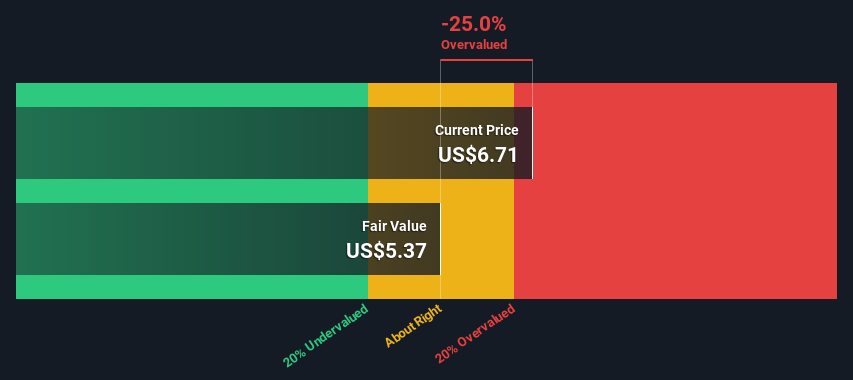

Nexa Resources S.A. (NYSE:NEXA) Shares Could Be 25% Above Their Intrinsic Value Estimate

Key Insights

- Nexa Resources' estimated fair value is US$5.4 based on 2 Stage Free Cash Flow to Equity

- Current share price of US$6.7 suggests Nexa Resources is 25% overvalued

- Analyst price target for NEXA is US$7.31 which is 36% above our fair value estimate

Today we'll do a simple run through of a valuation method used to estimate the attractiveness of Nexa Resources S.A. (NYSE:NEXA) as an investment opportunity by taking the forecast future cash flows of the company and discounting them back to today's value. We will use the Discounted Cash Flow (DCF) model on this occasion. It may sound complicated, but actually it is quite simple!

Remember though, that there are many ways to estimate a company's value, and a DCF is just one method. Anyone interested in learning a bit more about intrinsic value should have a read of the Simply Wall St analysis model.

Check out our latest analysis for Nexa Resources

The Model

We use what is known as a 2-stage model, which simply means we have two different periods of growth rates for the company's cash flows. Generally the first stage is higher growth, and the second stage is a lower growth phase. To begin with, we have to get estimates of the next ten years of cash flows. Where possible we use analyst estimates, but when these aren't available we extrapolate the previous free cash flow (FCF) from the last estimate or reported value. We assume companies with shrinking free cash flow will slow their rate of shrinkage, and that companies with growing free cash flow will see their growth rate slow, over this period. We do this to reflect that growth tends to slow more in the early years than it does in later years.

A DCF is all about the idea that a dollar in the future is less valuable than a dollar today, so we discount the value of these future cash flows to their estimated value in today's dollars:

10-year free cash flow (FCF) estimate

| 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | |

| Levered FCF ($, Millions) | US$111.3m | US$106.8m | -US$144.3m | US$133.0m | US$119.8m | US$112.2m | US$107.9m | US$105.6m | US$104.7m | US$104.7m |

| Growth Rate Estimate Source | Analyst x3 | Analyst x3 | Analyst x2 | Analyst x1 | Est @ -9.92% | Est @ -6.35% | Est @ -3.85% | Est @ -2.10% | Est @ -0.88% | Est @ -0.02% |

| Present Value ($, Millions) Discounted @ 13% | US$98.4 | US$83.5 | -US$99.7 | US$81.2 | US$64.7 | US$53.5 | US$45.5 | US$39.4 | US$34.5 | US$30.5 |

("Est" = FCF growth rate estimated by Simply Wall St)

Present Value of 10-year Cash Flow (PVCF) = US$431m

We now need to calculate the Terminal Value, which accounts for all the future cash flows after this ten year period. The Gordon Growth formula is used to calculate Terminal Value at a future annual growth rate equal to the 5-year average of the 10-year government bond yield of 2.0%. We discount the terminal cash flows to today's value at a cost of equity of 13%.

Terminal Value (TV)= FCF2032 × (1 + g) ÷ (r – g) = US$105m× (1 + 2.0%) ÷ (13%– 2.0%) = US$958m

Present Value of Terminal Value (PVTV)= TV / (1 + r)10= US$958m÷ ( 1 + 13%)10= US$279m

The total value is the sum of cash flows for the next ten years plus the discounted terminal value, which results in the Total Equity Value, which in this case is US$711m. To get the intrinsic value per share, we divide this by the total number of shares outstanding. Compared to the current share price of US$6.7, the company appears slightly overvalued at the time of writing. The assumptions in any calculation have a big impact on the valuation, so it is better to view this as a rough estimate, not precise down to the last cent.

The Assumptions

Now the most important inputs to a discounted cash flow are the discount rate, and of course, the actual cash flows. Part of investing is coming up with your own evaluation of a company's future performance, so try the calculation yourself and check your own assumptions. The DCF also does not consider the possible cyclicality of an industry, or a company's future capital requirements, so it does not give a full picture of a company's potential performance. Given that we are looking at Nexa Resources as potential shareholders, the cost of equity is used as the discount rate, rather than the cost of capital (or weighted average cost of capital, WACC) which accounts for debt. In this calculation we've used 13%, which is based on a levered beta of 2.000. Beta is a measure of a stock's volatility, compared to the market as a whole. We get our beta from the industry average beta of globally comparable companies, with an imposed limit between 0.8 and 2.0, which is a reasonable range for a stable business.

SWOT Analysis for Nexa Resources

- Debt is well covered by earnings.

- Dividend is in the top 25% of dividend payers in the market.

- Earnings declined over the past year.

- Annual earnings are forecast to grow faster than the American market.

- Good value based on P/E ratio compared to estimated Fair P/E ratio.

- Debt is not well covered by operating cash flow.

- Paying a dividend but company has no free cash flows.

- Annual revenue is expected to decline over the next 3 years.

Next Steps:

Although the valuation of a company is important, it ideally won't be the sole piece of analysis you scrutinize for a company. It's not possible to obtain a foolproof valuation with a DCF model. Preferably you'd apply different cases and assumptions and see how they would impact the company's valuation. For example, changes in the company's cost of equity or the risk free rate can significantly impact the valuation. Can we work out why the company is trading at a premium to intrinsic value? For Nexa Resources, we've compiled three relevant factors you should consider:

- Risks: Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Nexa Resources (at least 1 which is potentially serious) , and understanding these should be part of your investment process.

- Future Earnings: How does NEXA's growth rate compare to its peers and the wider market? Dig deeper into the analyst consensus number for the upcoming years by interacting with our free analyst growth expectation chart.

- Other Solid Businesses: Low debt, high returns on equity and good past performance are fundamental to a strong business. Why not explore our interactive list of stocks with solid business fundamentals to see if there are other companies you may not have considered!

PS. The Simply Wall St app conducts a discounted cash flow valuation for every stock on the NYSE every day. If you want to find the calculation for other stocks just search here.

Valuation is complex, but we're here to simplify it.

Discover if Nexa Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:NEXA

Nexa Resources

Engages in the zinc mining and smelting business worldwide.

Undervalued with moderate growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success