- United States

- /

- Chemicals

- /

- NYSE:NEU

The Bull Case For NewMarket (NEU) Could Change Following Major Expansion in Defense Supply Chain Capacity

Reviewed by Sasha Jovanovic

- In June 2025, NewMarket Corporation announced a US$100 million investment to expand American Pacific Corporation’s ammonium perchlorate production capacity, with completion targeted for 2026.

- This move highlights NewMarket’s commitment to strengthening its role in the defense and space sectors by supporting mission-critical supply chains.

- We’ll explore how NewMarket’s boost to defense-related production capacity adds weight to its long-term investment case.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is NewMarket's Investment Narrative?

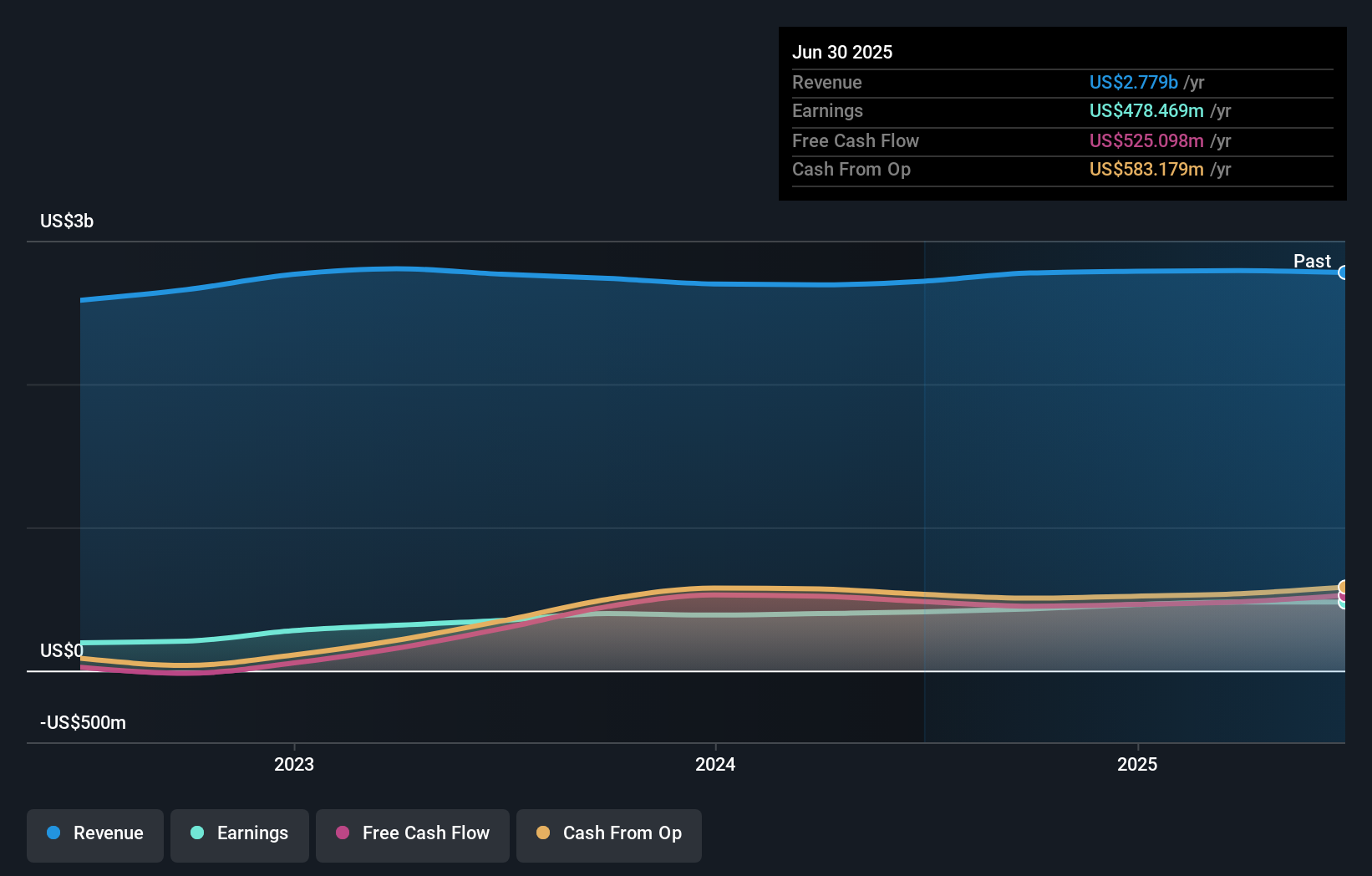

To be a NewMarket shareholder today, you need to believe in the company’s ability to steer value from its specialized chemicals portfolio and keep rewarding investors through strong earnings, healthy dividends, and buybacks. The recent US$100 million investment in expanding ammonium perchlorate production at AMPAC is a fresh catalyst, deepening NewMarket’s positioning in critical defense and space supply chains. This expansion directly addresses a key short-term catalyst: fulfilling rising demand from aerospace and defense sectors. However, it could also change the risk equation, as it increases exposure to government contract cycles, spending priorities, and potential regulatory hurdles tied to ammonium perchlorate, which is a tightly controlled chemical. Our prior analysis focused on balance sheet strength and steady profit growth, but the latest move brings new operational and supply chain dependencies to the forefront for investors watching the Q3 2025 results and beyond.

But what happens if defense spending priorities shift unexpectedly? Despite retreating, NewMarket's shares might still be trading 49% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 2 other fair value estimates on NewMarket - why the stock might be worth just $739.86!

Build Your Own NewMarket Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NewMarket research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NewMarket research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NewMarket's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NewMarket might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NEU

NewMarket

Through its subsidiaries, primarily engages in the manufacture and sale of petroleum additives.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives