- United States

- /

- Metals and Mining

- /

- NYSE:NEM

Newmont (NEM) Announces US$2 Billion Debt Tender Offer Amid Financial Strategies

Reviewed by Simply Wall St

Newmont (NEM) recently announced debt tender offers to purchase up to $2 billion in notes. This development, alongside a second-quarter earnings report showing a substantial increase in net income and sales, might have positively influenced Newmont’s 20% price increase over the last quarter, aligning with the general upward market trend. The company's robust financial performance, supported by a new $3 billion share repurchase program and ongoing dividend payments, contributes further to investor confidence. Despite some operational adjustments and executive changes, these financial maneuvers appear to have added momentum to Newmont's positive price movement.

Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

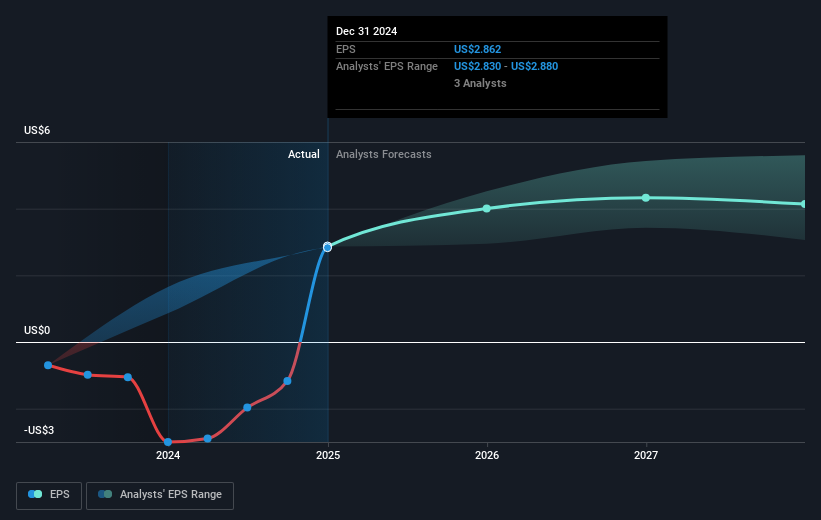

The recent debt tender offers and share repurchase announcement by Newmont are pivotal developments, expected to bolster both revenue and earnings forecasts. These strategic financial maneuvers, alongside an earnings report showcasing significant boosts in net income and sales, have the potential to sustain investor confidence, potentially enhancing Newmont's ability to finance ongoing projects and divestiture proceeds efficiently. These actions are likely to refine the company's focus on high-margin, Tier 1 assets, aiding in the expected 2.7% annual revenue growth projected over the next three years.

Over a three-year period, Newmont has achieved a total shareholder return of 56.54%, delivering substantial value to shareholders. This long-term figure provides context to more short-term returns, where the company outperformed both the US Metals and Mining industry, which returned 13.8%, and the broader US market's 17.7% return over the past year. Despite the projected 2.2% annual decline in earnings over the next three years, the company's operational and financial strategies may provide stability in the face of industry challenges.

With a current share price of $63.66 contrasted against the price target of $69.06, Newmont's stock demonstrates a potential appreciation opportunity for investors, indicating an 8.48% discount to the target. This divergence suggests that the market may be pricing in near-term uncertainties, such as regulatory challenges and rising production costs, which could impact future margin expansion and revenue stability. However, the steps taken to enhance operational efficiency and maintain a robust balance sheet position Newmont favorably against these risks, reinforcing its long-term potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Newmont might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NEM

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives