- United States

- /

- Metals and Mining

- /

- NYSE:MUX

McEwen (NYSE:MUX) Valuation in Focus After Positive Los Azules Feasibility Study and Government Backing

Reviewed by Kshitija Bhandaru

McEwen (NYSE:MUX) just unveiled results from a positive independent Feasibility Study for its Los Azules copper project in Argentina. The project is drawing attention because of government approvals and support from the International Finance Corporation.

See our latest analysis for McEwen.

McEwen’s Los Azules milestone appears to have revitalized sentiment, with the share price up 38% over the past month and an eye-catching 129% year-to-date. Momentum has clearly increased, and a three-year total shareholder return of nearly 494% places its long-term performance firmly on the radar for growth-focused investors.

If you’re watching McEwen’s momentum build, it could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares gaining rapidly on the back of Los Azules news and future growth prospects, investors now face a pressing question: Is McEwen’s recent rally a buying opportunity, or is the market already pricing in the next stage?

Most Popular Narrative: 15.2% Overvalued

With the most recent analyst narrative putting McEwen's fair value at $16.44, investors have driven the share price well above that mark to $18.94. The current sentiment reflects enthusiasm, but the consensus narrative warns that expectations for future growth now face a higher valuation bar.

The Future Price/Earnings ratio has risen from 5.36x to 26.05x, indicating a higher valuation multiple based on projected earnings. The Net Profit Margin estimate declined from 45.15% to 18.39%, suggesting lower anticipated profitability relative to earlier forecasts.

Curious how this narrative accounts for sky-high future profit multiples and shrinking margin assumptions? The secret mix behind this bold fair value goes well beyond the usual growth targets. Want to see the key financial projections and what drives their higher earnings expectations? Uncover the details shaping this controversial new analyst fair value.

Result: Fair Value of $16.44 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent operational setbacks or unexpected permitting delays could quickly undermine the optimism surrounding McEwen’s growth story and its ambitious forecasts.

Find out about the key risks to this McEwen narrative.

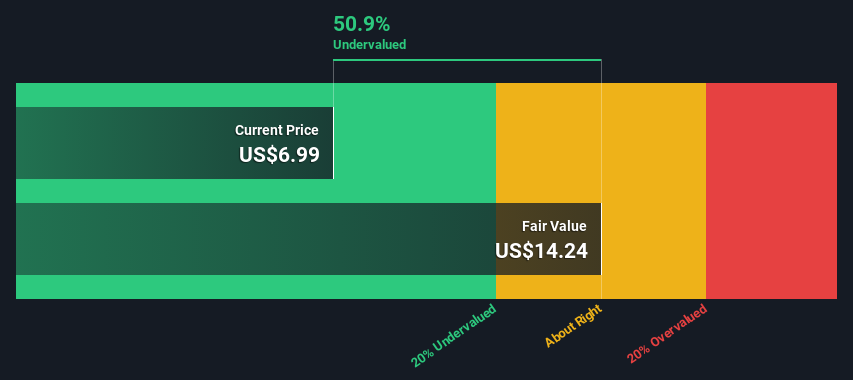

Another View: Discounted Cash Flow Signals Deep Value

While analyst price targets suggest McEwen is overvalued at current levels, our DCF model paints a dramatically different picture. It values the stock at $143.76, which is around 86% higher than the market price. This sharp gap highlights how divergent valuation methods can be. Which approach do you find most convincing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out McEwen for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own McEwen Narrative

Prefer a hands-on approach or have your own views on McEwen? You can analyze the numbers and build a personal story in just minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding McEwen.

Looking for More Smart Investment Opportunities?

Don’t stop at one stock. Maximize your investing game with unique ideas waiting in the Simply Wall Street Screener. If you miss these, you could be passing up tomorrow’s winners.

- Boost your growth portfolio by scanning these 24 AI penny stocks, which are at the forefront of artificial intelligence innovation and automation breakthroughs.

- Secure steady earnings by browsing these 19 dividend stocks with yields > 3%, featuring proven track records for delivering yield above 3%.

- Tap into future tech before the crowd and review these 26 quantum computing stocks, which is pushing boundaries in quantum computing and next-level processing power.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MUX

McEwen

Engages in the exploration, development, production, and sale of gold and silver deposits in the United States, Canada, Mexico, and Argentina.

High growth potential and good value.

Market Insights

Community Narratives