- United States

- /

- Metals and Mining

- /

- NYSE:MUX

Can McEwen's (MUX) Cost Discipline Offset Its Lower Production Outlook?

Reviewed by Sasha Jovanovic

- Earlier this month, McEwen Inc. reported a consolidated third-quarter production of 29,662 gold equivalent ounces, down from last year, and issued revised 2025 production guidance of 112,000–123,000 GEOs, narrowing its prior range.

- Despite operational headwinds and lower production figures, McEwen's net loss significantly narrowed for both the quarter and nine-month periods, reflecting tighter cost controls and improved financial resilience.

- We'll now explore how McEwen's reduced production outlook and improvement in losses may impact its investment narrative going forward.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

McEwen Investment Narrative Recap

To be a shareholder in McEwen means believing in the company’s ability to drive value through resource development and operational improvement, despite production setbacks and operational risks. The recent downward revision in 2025 production guidance may moderate short term expectations, but the company’s progress on reducing net losses suggests resilience remains a key part of the investment case. For now, the biggest risk continues to be ongoing operational underperformance at core producing assets, especially given the lower production results just reported.

Among recent announcements, the Q3 2025 earnings report is especially relevant, as it highlights McEwen’s sharply reduced net loss versus the previous year, thanks to tighter cost controls. While this signals some progress on financial discipline, the underlying challenge of hitting ambitious production targets continues to frame both the pressure and potential for upcoming catalysts, particularly any newsflow related to exploration success or efficiency gains at existing operations.

Yet, while the improved loss figures may attract attention, investors should not overlook production risks that could offset financial progress if operational issues persist...

Read the full narrative on McEwen (it's free!)

McEwen's outlook anticipates $446.1 million in revenue and $201.4 million in earnings by 2028. This scenario is based on a 38.4% annual revenue growth rate and a $214.9 million increase in earnings from the current $-13.5 million.

Uncover how McEwen's forecasts yield a $24.00 fair value, a 39% upside to its current price.

Exploring Other Perspectives

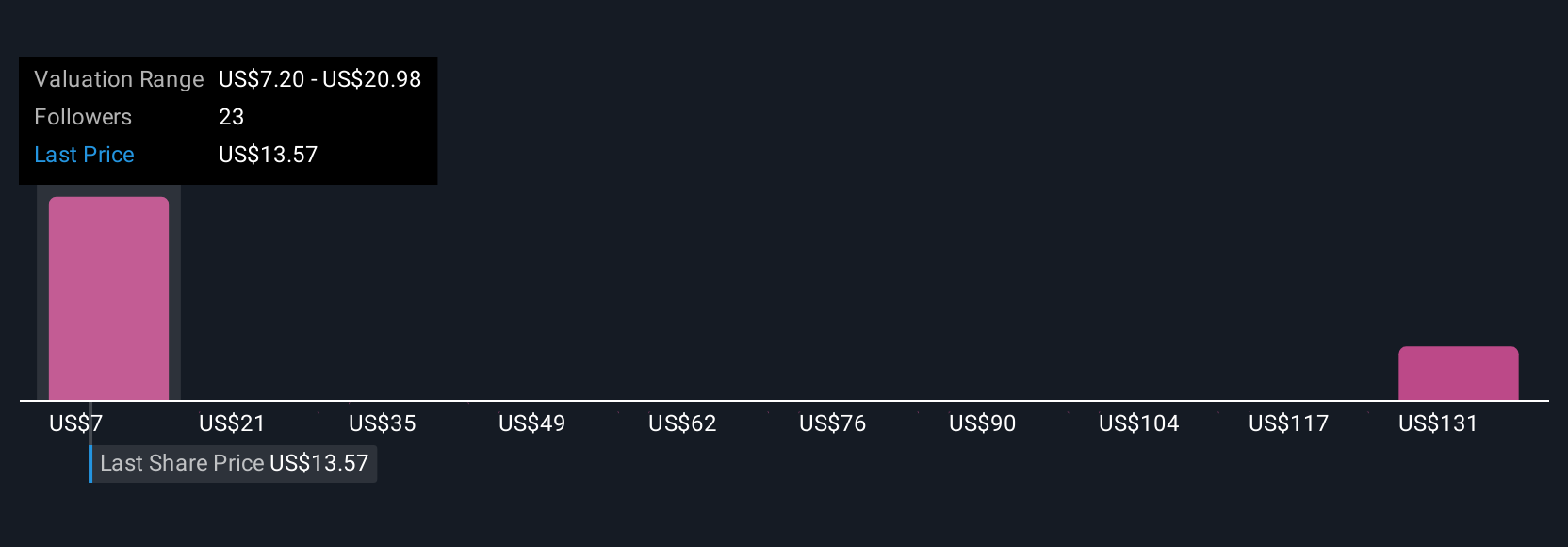

Seven independent fair value estimates from the Simply Wall St Community place McEwen between US$8.69 and US$255.27 per share. With operational execution still a key risk, broad differences in outlook signal why it is worth reviewing a variety of perspectives on McEwen’s potential.

Explore 7 other fair value estimates on McEwen - why the stock might be worth 50% less than the current price!

Build Your Own McEwen Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your McEwen research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free McEwen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate McEwen's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MUX

McEwen

Engages in the exploration, development, production, and sale of gold and silver deposits in the United States, Canada, Mexico, and Argentina.

High growth potential and good value.

Market Insights

Community Narratives