- United States

- /

- Chemicals

- /

- NYSE:MTX

Minerals Technologies (MTX) Is Up 14.8% After Q2 Profit Surge and Buyback Has The Bull Case Changed?

Reviewed by Simply Wall St

- Minerals Technologies Inc. reported second quarter 2025 results showing sales of US$528.9 million and a significant rise in net income to US$45.4 million, compared to the previous year, despite a slight sales decline; the company also completed a share buyback and affirmed its quarterly dividend.

- This financial performance, marked by improved quarterly profitability and ongoing capital returns, highlights management's focus on shareholder value and operational efficiency.

- We'll examine how the company's sharp turnaround in quarterly net income could reshape its investment narrative and future outlook.

Minerals Technologies Investment Narrative Recap

To be a Minerals Technologies shareholder, you need to believe in the company’s ability to drive sustained earnings growth, manage operational challenges, and handle large non-recurring legal or regulatory costs that could affect cash flow. The latest quarter’s strong net income turnaround could help restore confidence in its profitability, but the overhang from talc-related claims and the reserve for potential liabilities remains the main short-term risk. For now, these results deliver welcome improvement without materially reducing headline risks.

Among the company’s recent announcements, the completed share buyback of 624,731 shares for US$39.06 million stands out, especially following a quarter with sharply higher net income. While repurchases can signal capital discipline and improve per-share metrics, investors are still closely watching demand trends and legal proceedings to assess whether this performance can be sustained.

However, before overlooking the potential financial impact tied to ongoing talc-related litigation, investors should be aware that...

Read the full narrative on Minerals Technologies (it's free!)

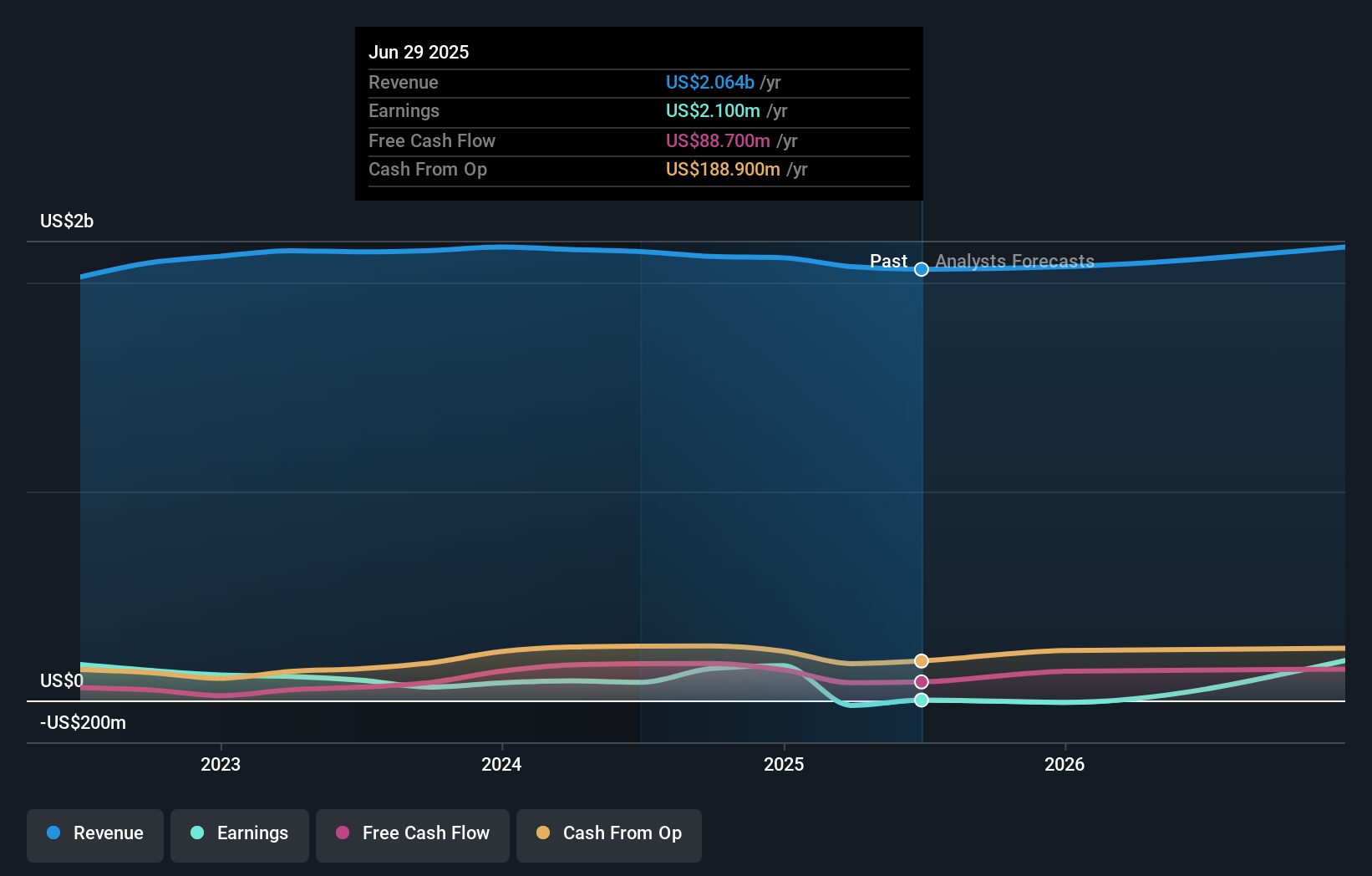

Minerals Technologies is projected to reach $2.3 billion in revenue and $320.8 million in earnings by 2028. This forecasts annual revenue growth of 2.9% and an increase in earnings of $344.4 million from current earnings of -$23.6 million.

Exploring Other Perspectives

Two fair value assessments from the Simply Wall St Community range from US$81.33 to US$95.67. With ongoing legal uncertainties still on the table, your own outlook may differ widely from others here.

Build Your Own Minerals Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Minerals Technologies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Minerals Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Minerals Technologies' overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTX

Minerals Technologies

Develops, produces, and markets various mineral, mineral-based, and related systems and services.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives