- United States

- /

- Chemicals

- /

- NYSE:MTX

A Look at Minerals Technologies (MTX) Valuation as Major Pet Care Plant Investments Signal Strategic Expansion

Reviewed by Kshitija Bhandaru

Minerals Technologies (NYSE:MTX) is moving ahead with major upgrades across three of its plants. The company aims to strengthen its SIVO pet care business with these investments, focusing on boosting capacity, flexibility, and worldwide supply of cat litter products.

See our latest analysis for Minerals Technologies.

Alongside these plant upgrades, Minerals Technologies has mixed short-term performance with modest longer-term gains. While recent share price returns have been subdued, the stock’s 3-year total shareholder return of 26% indicates steady value creation for those who have stayed invested. Ongoing investments could help renew momentum if operational improvements translate to higher earnings and market confidence.

If this strategic shift in a pet care leader has you curious about broader opportunities, now is a perfect moment to discover fast growing stocks with high insider ownership

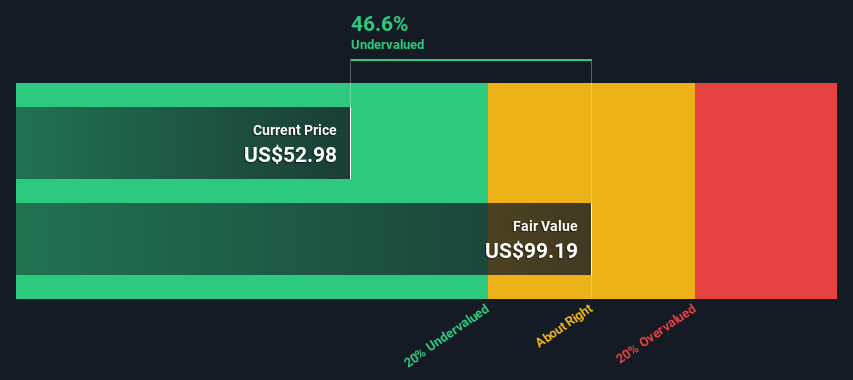

Yet with shares still trading at a notable discount to analyst targets, investors may be left wondering if this is the moment to buy into future growth or if the market has already priced in what lies ahead.

Most Popular Narrative: 25.3% Undervalued

With the narrative’s fair value estimate at $84 per share compared to the last close at $62.73, attention is squarely on the company’s future upside and the bold assumptions supporting it. This sets the stage for expectations of meaningful earnings expansion and global momentum.

Strong momentum in innovative, higher-margin specialty applications (especially natural oil purification, animal health, and advanced fabric care) aligns with global trends toward cleaner fuels, pollution control, and sustainable consumer products. This is expected to lift overall company net margins as these products outpace legacy mineral segments.

Curious about the actual numbers analysts believe justify this jump? There is a surprising path built on margin leaps and a profit explosion that few would expect from a traditional minerals business. Want to know exactly what new products and bold forecasts are behind the ambitious price target? The details await in the full narrative.

Result: Fair Value of $84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent legal uncertainties and intense competition in the pet care segment could quickly undermine even the most optimistic growth projections for Minerals Technologies.

Find out about the key risks to this Minerals Technologies narrative.

Another View: Discounted Cash Flow Suggests Even More Upside

Switching to a different approach, our DCF model estimates Minerals Technologies’ fair value at $82.08 per share. This is notably above both the current price and analyst targets. This method weighs future cash flows using today’s assumptions. Could this mean the market is missing an even greater opportunity?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Minerals Technologies Narrative

If you have your own perspective or want to dig deeper into the numbers, creating your own narrative is straightforward and can be done in minutes. Do it your way

A great starting point for your Minerals Technologies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Moves?

Set yourself up for success by acting on the latest trends and unique opportunities available right now. These ideas could give your portfolio an edge before the crowd catches on.

- Tap into real innovation by checking out these 24 AI penny stocks that are transforming the future of industries with breakthrough artificial intelligence.

- Unlock reliable cash flow and earnings potential by assessing these 19 dividend stocks with yields > 3% offering strong yields exceeding 3%.

- Seize the next wave in digital finance through these 78 cryptocurrency and blockchain stocks leading advances in blockchain technology and cryptocurrencies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTX

Minerals Technologies

Develops, produces, and markets various mineral, mineral-based, and related systems and services.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion