- United States

- /

- Metals and Mining

- /

- NYSE:MTRN

Materion (MTRN): Assessing Valuation After a Strong Year of Share Price Gains

Reviewed by Simply Wall St

Materion (MTRN) has quietly delivered a strong year, with the stock up about 31% year to date and roughly 26% over the past year, outpacing many industrial and materials peers.

See our latest analysis for Materion.

The latest leg higher, including a roughly 9% 1 month share price return to about $124.90, has come as investors reward solid earnings growth. That strength builds on a three year total shareholder return of around 47% that points to durable momentum rather than just a short term trade.

If Materion's run has you thinking about where else disciplined growth might be hiding, now is a good time to explore fast growing stocks with high insider ownership for other under the radar ideas.

With earnings climbing faster than revenue and shares still trading below analyst targets, investors have to ask whether Materion remains undervalued on its long term fundamentals, or if the market has already priced in future growth.

Most Popular Narrative: 13.1% Undervalued

With Materion closing at $124.90 against a narrative fair value near $143.67, the story leans toward opportunity rather than exhaustion.

The company's ongoing investments in value added, engineered solutions (such as advanced alloys and precision coatings), combined with active R&D and customer co development initiatives, are enhancing pricing power and reducing reliance on commoditized products, supporting further margin expansion and long term earnings growth.

Curious how steady mid single digit revenue growth, surging earnings power, and a sharply lower future earnings multiple can still add up to upside potential? The narrative connects these moving parts into one aggressive long term valuation play.

Result: Fair Value of $143.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained weakness in Chinese semiconductor demand and lingering trade tensions could quickly erode margins and challenge the current undervaluation narrative.

Find out about the key risks to this Materion narrative.

Another View: Rich on Earnings Multiples

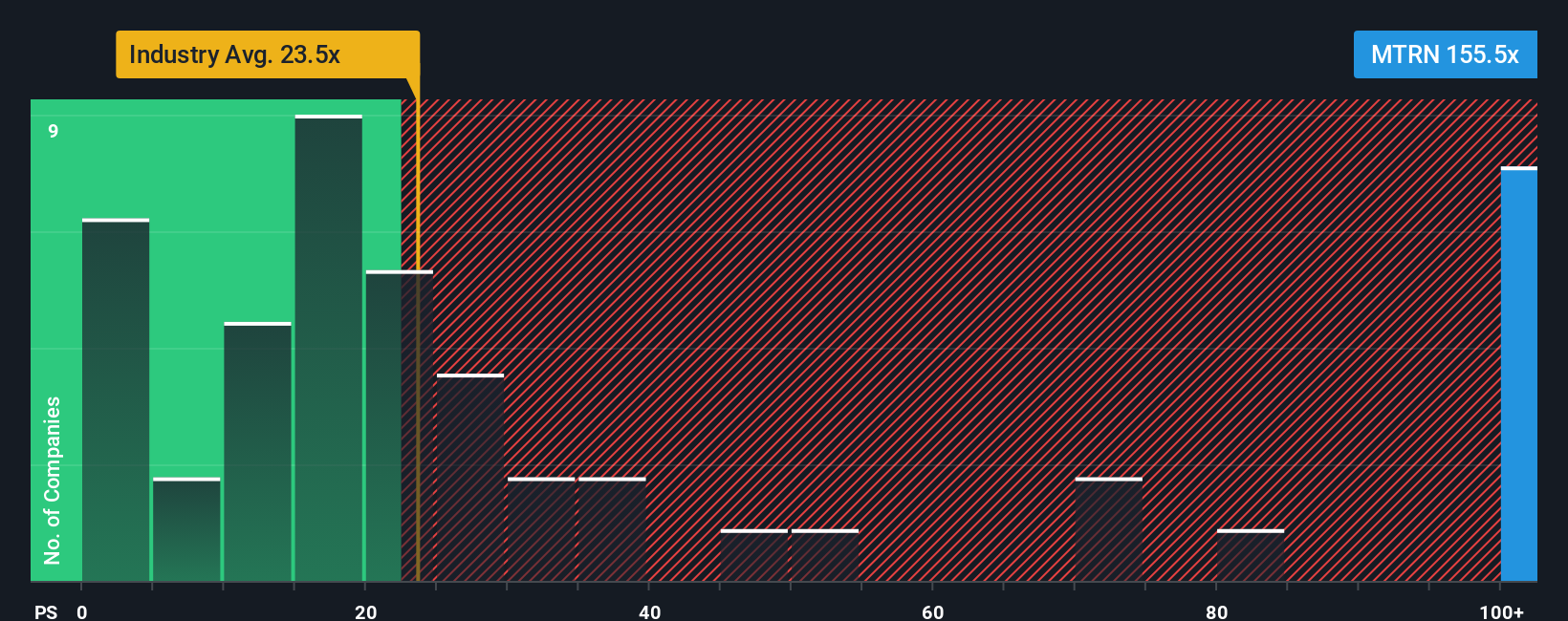

Look past the narrative fair value and the picture gets more complicated. On a simple price to earnings basis, Materion trades at about 133.5 times earnings, far above the US Metals and Mining industry at 24.5 times and our fair ratio of 34.8 times. This suggests valuation risk if growth falters.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Materion Narrative

If you are unconvinced by this view, or simply prefer to dig into the numbers yourself, you can build a custom take in minutes: Do it your way.

A great starting point for your Materion research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider your next move by using the Simply Wall St Screener to uncover fresh, data driven opportunities beyond Materion.

- Explore early stage opportunities by scanning these 3628 penny stocks with strong financials that already show stronger fundamentals than many smaller names.

- Access technology focused ideas by targeting these 24 AI penny stocks positioned at the intersection of innovation, automation and scalable software driven business models.

- Reinforce your portfolio's income component by focusing on these 13 dividend stocks with yields > 3% that aim to provide regular payments even when markets are volatile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTRN

Materion

Produces advanced engineered materials in the United States, Asia, Europe, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion