- United States

- /

- Metals and Mining

- /

- NYSE:MTRN

Is Materion’s (MTRN) Fusion Energy Supply Deal Shifting Its Long-Term Growth Trajectory?

Reviewed by Sasha Jovanovic

- Commonwealth Fusion Systems announced an agreement with Materion Corporation to supply beryllium fluoride for use in their fusion power plants, with shipments from Materion's Elmore, Ohio facility beginning this year.

- This partnership ties Materion to the development of grid-scale fusion technology, positioning the company within the growing clean energy supply chain.

- We'll explore how Materion's entry into the fusion energy sector positions the company for long-term growth in advanced materials.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Materion Investment Narrative Recap

To invest in Materion, you have to believe in the company’s ability to deliver consistent growth across advanced materials while managing volatility from highly concentrated end markets like semiconductors and aerospace. The recent supply agreement with Commonwealth Fusion Systems is a meaningful step into fusion energy, potentially supporting long-term exposure to next-generation energy markets, but it does not materially change the most immediate catalysts (semiconductor upcycles and defense orders) or near-term risks around customer concentration and input costs.

Alongside headline partnerships, Materion recently declared a fourth-quarter 2025 dividend of US$0.14 per share, signaling ongoing confidence in cash generation. The combination of steady dividends and new market entries reflects management's measured approach to balancing growth opportunities with shareholder returns, but does not alter the importance of monitoring ongoing volatility in Materion’s core operating segments.

However, against that optimism, investors should be aware of potential raw material shortages or price swings for specialty metals like beryllium that could suddenly...

Read the full narrative on Materion (it's free!)

Materion's narrative projects $2.1 billion revenue and $355.2 million earnings by 2028. This requires 7.2% yearly revenue growth and a $338.9 million increase in earnings from $16.3 million today.

Uncover how Materion's forecasts yield a $132.00 fair value, in line with its current price.

Exploring Other Perspectives

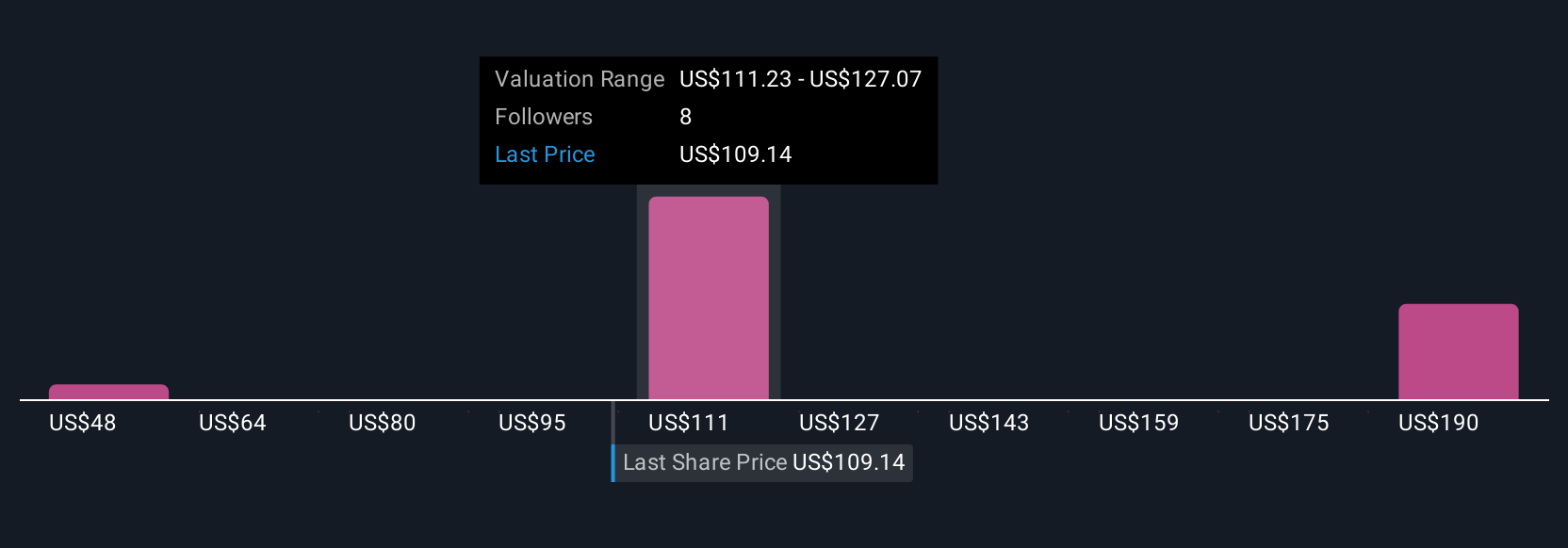

Four Simply Wall St Community members set fair value for Materion between US$47.87 and US$197.60, reflecting a wide spectrum of outlooks. While future demand from sectors like energy may support long-term revenue, reliance on a few key end markets still presents risks.

Explore 4 other fair value estimates on Materion - why the stock might be worth less than half the current price!

Build Your Own Materion Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Materion research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Materion research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Materion's overall financial health at a glance.

No Opportunity In Materion?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTRN

Materion

Produces advanced engineered materials in the United States, Asia, Europe, and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives