- United States

- /

- Metals and Mining

- /

- NYSE:MTRN

A Closer Look at Materion (MTRN) Valuation After Recent Share Price Momentum

Reviewed by Simply Wall St

See our latest analysis for Materion.

Materion’s momentum has really picked up this year, with its share price up an impressive 41.3% year-to-date and a 30.1% total return for shareholders over the past 12 months. Recent gains reflect growing optimism about the company’s future prospects and management’s ability to deliver long-term value.

If this surge has you interested in discovering more companies with breakout potential, why not explore fast growing stocks with high insider ownership next?

The big question now is whether Materion’s stellar run still leaves room for upside, or if the recent price action means that all the good news is already reflected in the stock. Is there a buying opportunity, or has the market already priced in future growth?

Most Popular Narrative: 1.8% Overvalued

Materion’s widely followed narrative assigns a fair value of $132 per share, just below the most recent closing price of $134.39. Investors are weighing whether ambitious growth assumptions justify this slight gap as the company navigates evolving industry tailwinds.

The company's ongoing investments in value-added, engineered solutions (such as advanced alloys and precision coatings), combined with active R&D and customer co-development initiatives, are enhancing pricing power and reducing reliance on commoditized products. This supports further margin expansion and long-term earnings growth.

Want the full picture behind this pricing? The real surprise is how forecasts for key financial metrics, especially profit margins and future earnings, are woven into Materion’s fair value. Unlock the calculation that could change your view.

Result: Fair Value of $132 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, exposure to volatile raw material costs and customer concentration in cyclical sectors could quickly undermine these upbeat growth assumptions if conditions change.

Find out about the key risks to this Materion narrative.

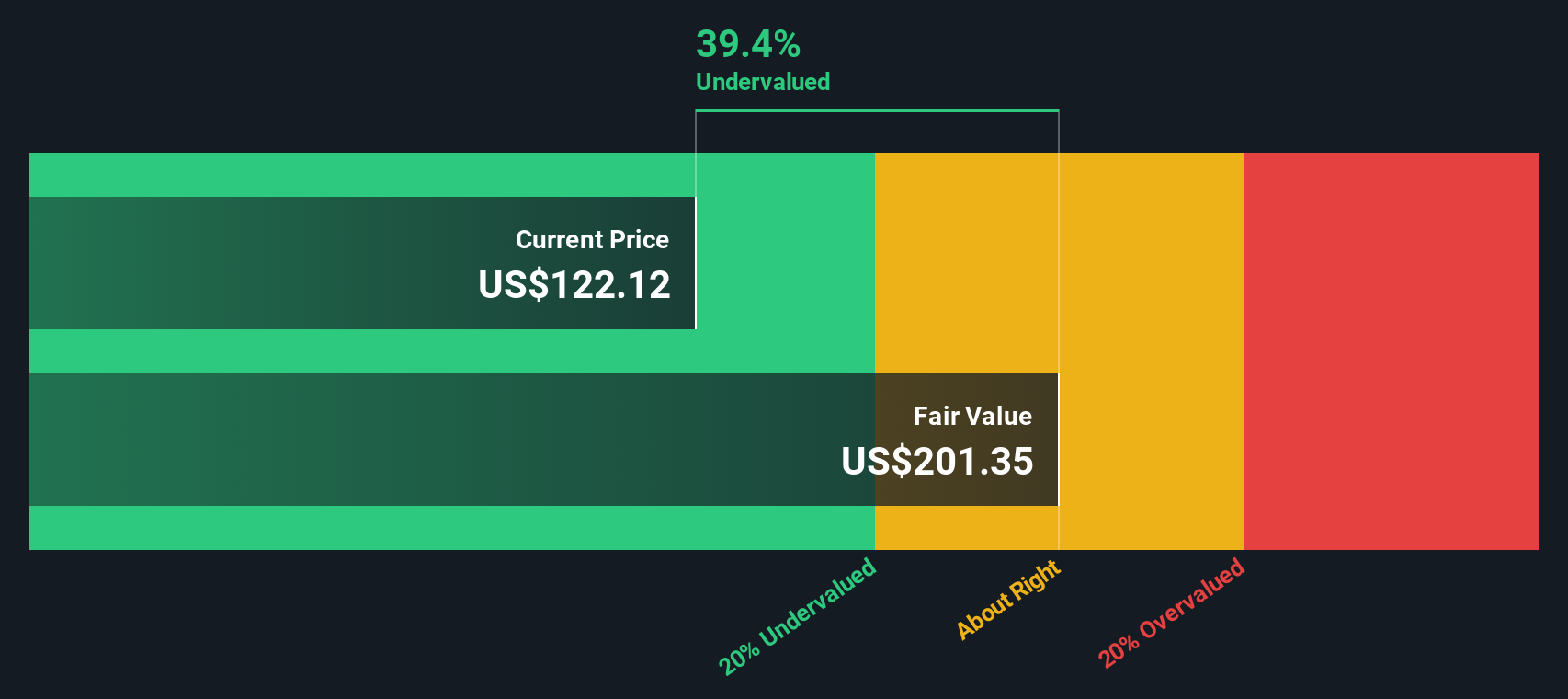

Another View: Discounted Cash Flow Tells a Different Story

Switching gears, our DCF model paints a much more optimistic picture by estimating Materion's fair value at $198, nearly 32% above the current share price. This suggests the market may be missing underlying value. Is the real opportunity flying under the radar?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Materion for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Materion Narrative

If you see things differently or want to dive into the numbers yourself, you can build your own perspective in just a few minutes with Do it your way.

A great starting point for your Materion research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Unlock more smart investing opportunities. Don’t limit yourself to just one stock when other market leaders and hidden gems are just a click away.

- Spot high-yield potential and strengthen your income strategy with these 17 dividend stocks with yields > 3% that offer robust returns above 3%.

- Catalyze your portfolio’s growth by checking out these 27 AI penny stocks paving the way in artificial intelligence and next-level innovation.

- Capitalize on mispriced assets now by tapping into these 877 undervalued stocks based on cash flows before the broader market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTRN

Materion

Produces advanced engineered materials in the United States, Asia, Europe, and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives