- United States

- /

- Metals and Mining

- /

- NYSE:MP

The Bull Case For MP Materials (MP) Could Change Following Major US Funding and Apple Supply Deal

Reviewed by Simply Wall St

- In recent days, the U.S. government announced major support for domestic rare earth supply, guaranteeing minimum prices and providing over US$500 million in funding and purchase commitments to MP Materials, while Apple also agreed to invest US$500 million for rare-earth magnet supply from the company.

- This effort underscores MP Materials' pivotal role as a geostrategic partner in the U.S. push to reduce reliance on China for critical minerals, despite ongoing challenges such as rising production costs and near-term losses.

- We'll now assess how these new government investments and long-term contracts could influence MP Materials' investment outlook and risk profile.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

MP Materials Investment Narrative Recap

To be a shareholder in MP Materials, you need to believe in the company’s long-term importance to the U.S. rare earth supply chain, which is now reinforced by sweeping government price guarantees and funding commitments. While this support may ease worries about short-term revenue and price volatility, the most pressing risk continues to be elevated production costs from ramping up separated product output, which is already impacting margins and near-term profitability.

Among recent announcements, the US$500 million contract with Apple stands out, given its direct connection to growing downstream magnet demand and added commercial visibility for MP Materials’ planned output. This long-term partnership, along with the latest government support, provides increased confidence in the company’s ability to scale U.S. magnet production, a key catalyst for future earnings growth.

However, despite the optimism around government and commercial contracts, investors should also be aware that as production of separated rare earth products increases, costs could remain elevated and...

Read the full narrative on MP Materials (it's free!)

MP Materials' narrative projects $655.9 million revenue and $101.4 million earnings by 2028. This requires 47.6% yearly revenue growth and a $166.8 million earnings increase from the current earnings of -$65.4 million.

Uncover how MP Materials' forecasts yield a $50.67 fair value, a 20% downside to its current price.

Exploring Other Perspectives

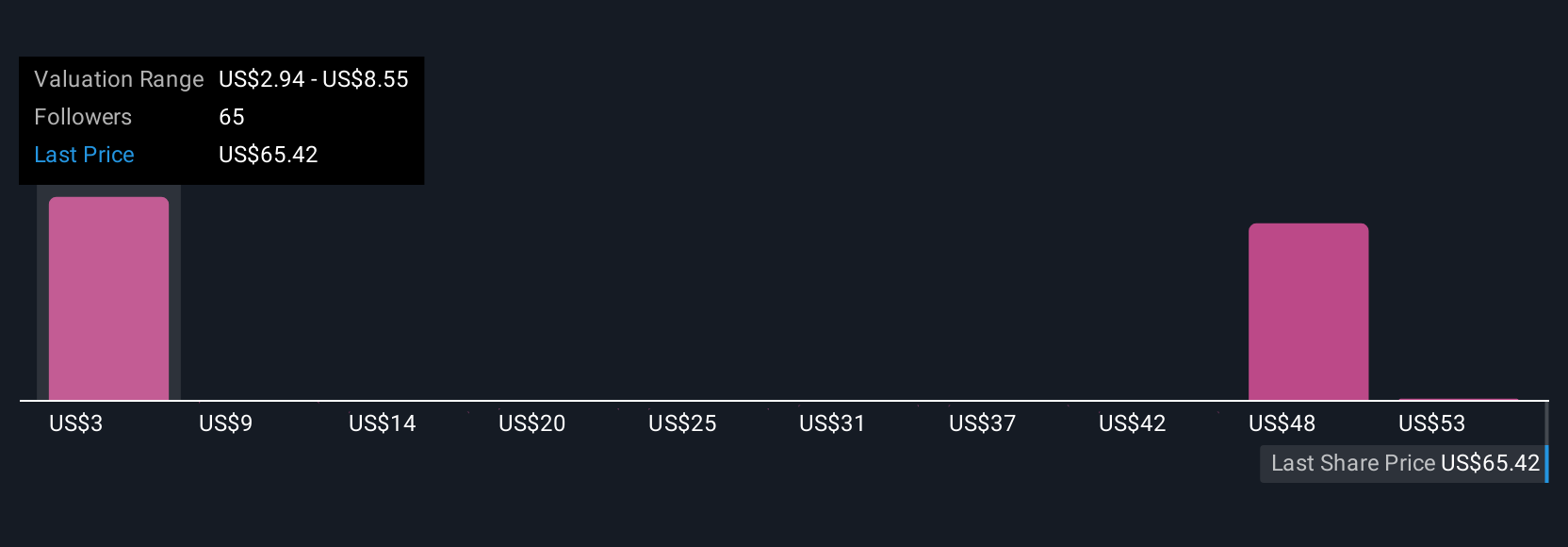

Seventeen private investors in the Simply Wall St Community value MP Materials between US$2.84 and US$59 per share. With persistently rising production costs continuing to pressure margins, opinions on future performance vary widely, explore what these different viewpoints could mean for your own outlook.

Explore 17 other fair value estimates on MP Materials - why the stock might be worth as much as $59.00!

Build Your Own MP Materials Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MP Materials research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free MP Materials research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MP Materials' overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 19 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MP

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives