- United States

- /

- Metals and Mining

- /

- NYSE:MP

MP Materials (MP) Completes US$650 Million Equity Offering

Reviewed by Simply Wall St

MP Materials (MP) has made significant announcements recently, including the completion of a follow-on equity offering of nearly $650 million and new high-profile partnerships with Apple and the Department of Defense. These developments coincide with a remarkable share price increase of 122% over the last quarter. The equity offering indicates strong market confidence, while the strategic partnerships bolster MP's long-term prospects in the rare earth sector. The broader market, with major indexes reaching record highs, provides a favorable backdrop, further enhancing MP's upward momentum. Such positive corporate maneuvers align well with the ongoing bullish trends in stock markets.

Every company has risks, and we've spotted 1 warning sign for MP Materials you should know about.

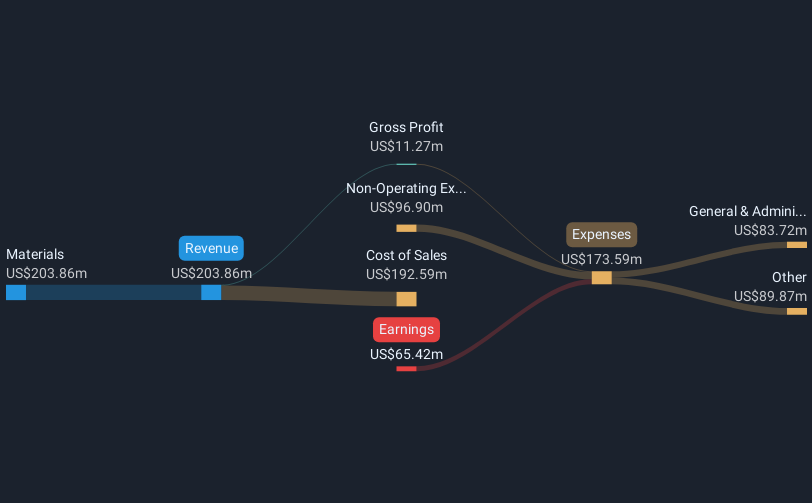

The recent announcements of MP Materials' successful equity offering and strategic partnerships with Apple and the Department of Defense could significantly impact its long-term narrative as it positions itself strongly within the rare earths sector. These developments are expected to enhance production capabilities and revenue opportunities, aligning with the company's strategy to expand into ex-China markets. Potential advancements in efficiency and sales volumes could positively influence future earnings and revenue forecasts, which analysts anticipate to grow robustly over the next three years.

Over a five-year period, MP Materials has achieved a total return of 293.48%, which underscores its substantial growth trajectory. Notably, over the past year, its performance surpassed the US Metals and Mining industry, which returned 6.1%. However, despite recent impressive share price gains, the current price of US$58.55 contrasts with the consensus price target of US$38. This discrepancy highlights a potential overvaluation according to analysts, suggesting investors might benefit from tempering expectations in light of market factors and the company's execution of future growth plans.

The strategic moves could help mitigate risks associated with heavy reliance on NdPr pricing and variable Chinese policies. However, executing its growth strategy without significant revenue or margin interruptions remains crucial. Although the company's long-term viability appears promising, as evidenced by planned expansions in the Upstream and Midstream segments, immediate financial forecasts also depend on external factors and successful integration of new processes. Thus, MP Materials' future prospects will largely depend on its ability to navigate these challenges effectively while aligning with analyst earnings forecasts and market expectations.

Explore historical data to track MP Materials' performance over time in our past results report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MP

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives