- United States

- /

- Metals and Mining

- /

- NYSE:MP

Is MP Materials’ Valuation Justified After a 220.8% Surge and Apple Partnership News?

Reviewed by Bailey Pemberton

- If you have ever wondered whether MP Materials is fairly valued or possibly misunderstood by the market, you are not alone. Let's dig into whether the recent buzz is justified.

- In the last year, shares have soared by 220.8%, even after a wild 34.7% drop this past month, leaving investors both excited about the future and cautious about changing risk.

- Recent headlines have spotlighted MP Materials as a pivotal player in the rare earths supply chain, drawing investor interest amid global shifts in technology and trade policy. This ongoing attention has contributed to a surge in trading activity, reinforcing both the company’s growth narrative and the volatility around its stock.

- On the numbers side, MP Materials earns a valuation score of 1 out of 6 on our checks. This hints there may be more to the story than the headline metrics. We will look at different ways to value MP Materials in detail, but stick around to the end for a broader perspective on what really drives a company's value.

MP Materials scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: MP Materials Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting those amounts back to their present value, reflecting today's dollars. This approach helps investors gauge if a company's current share price fairly represents its underlying business prospects.

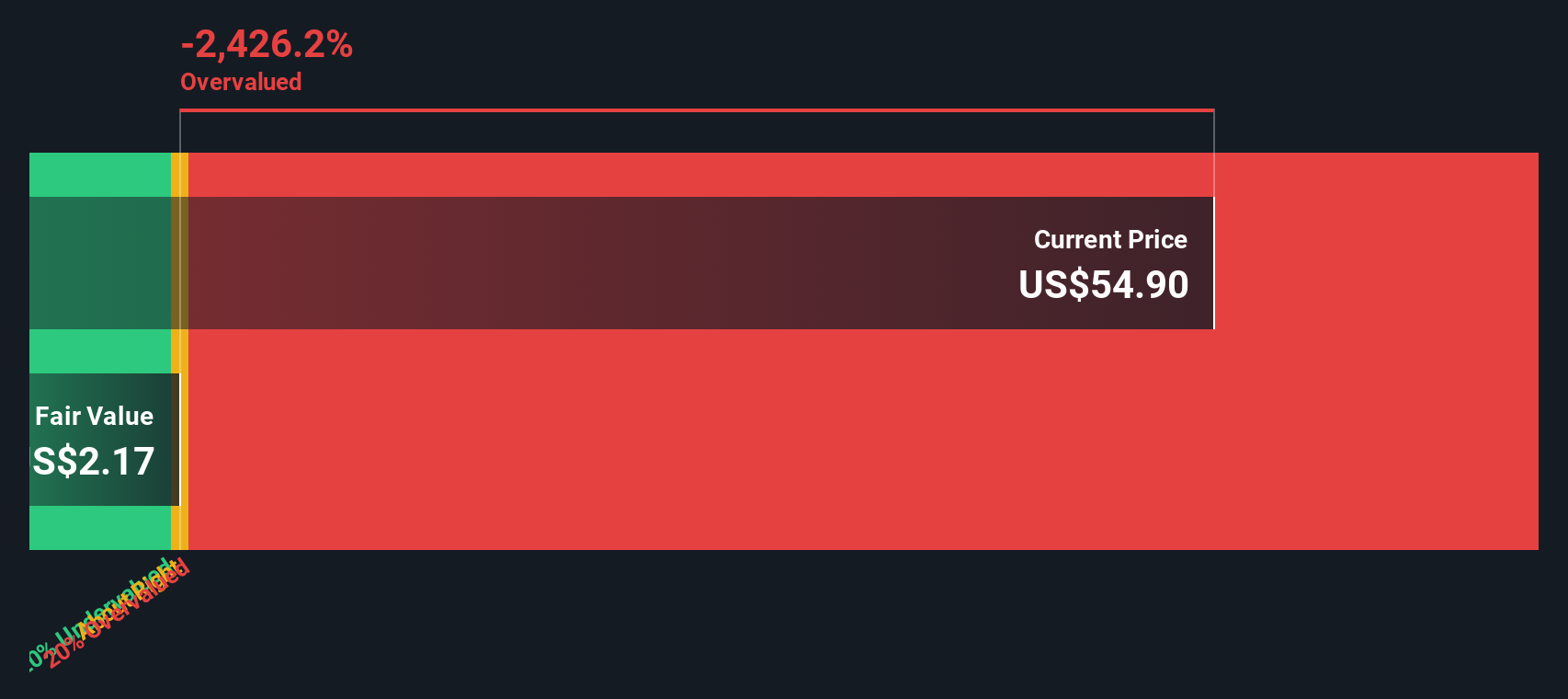

For MP Materials, current Free Cash Flow is negative at -$294.5 Million, meaning the company has spent more than it has generated over the last twelve months. Analysts expect this to improve significantly over the next decade, with forecasts projecting Free Cash Flow to reach $599 Million by 2035. The model uses both analyst estimates for the next several years, as well as longer-term projections based on historical and industry growth patterns, to map out this improvement.

Based on this two-stage DCF model, the estimated intrinsic value of MP Materials is $41.30 per share. However, this result comes with a notable caveat: the DCF calculation suggests MP Materials is currently about 42% overvalued by the market.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests MP Materials may be overvalued by 42.0%. Discover 874 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: MP Materials Price vs Sales

The Price-to-Sales (P/S) ratio is a commonly used valuation tool, especially for growth companies where near-term profits might be limited or unpredictable. By comparing a company's market value to its revenues, the P/S ratio helps investors assess whether a stock is trading at a reasonable price relative to how much money the company brings in annually.

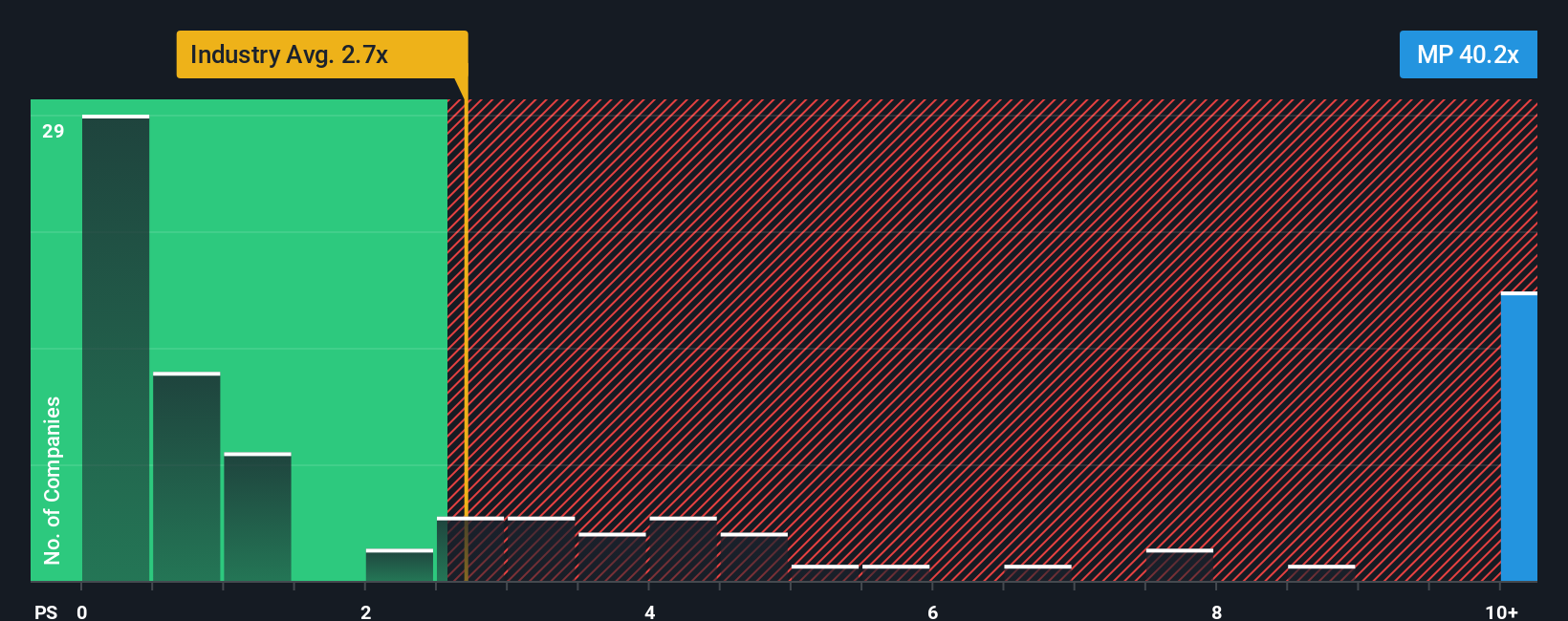

MP Materials currently trades at a P/S ratio of 44.65x. For context, the Metals and Mining industry average is just 2.52x, while its key peers average around 0.70x. This headline number suggests that MP Materials is valued much more richly than most of its direct competitors and the broader sector. This likely reflects significant growth expectations and perceived strategic importance.

To get a fairer sense of value, Simply Wall St's proprietary "Fair Ratio" is used. This metric blends factors such as the company’s expected growth rates, profit margins, size, risk profile, and industry dynamics. It generates a more tailored valuation reference point than a basic peer group or industry comparison. For MP Materials, the Fair Ratio is calculated as 2.53x, which means the current P/S multiple is far above what the business's characteristics would ordinarily justify.

With the actual P/S ratio dramatically exceeding the Fair Ratio, the stock appears significantly overvalued by this method.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1401 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your MP Materials Narrative

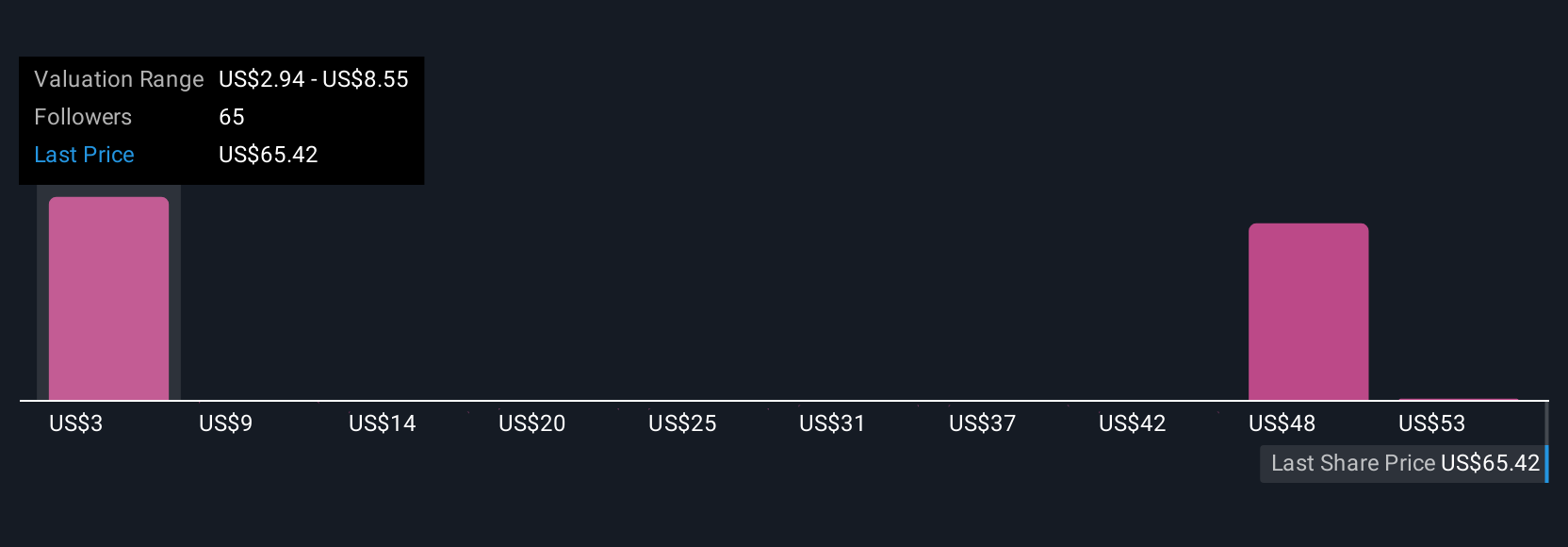

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is essentially your unique story about a company. It links your personal perspective on future revenue, margins, and fair value with a meaningful financial forecast and a fair value estimate, making the numbers come alive.

Unlike traditional valuation models that can feel abstract or impersonal, Narratives help you translate your beliefs about MP Materials’ future into actionable insights. On Simply Wall St’s Community page, millions of investors use Narratives as an intuitive tool to define when a stock looks attractive to buy or when it may be time to sell, by directly comparing Fair Value to the current share price.

Narratives are dynamic. As new information comes in, such as major news, earnings, or regulatory changes, your Narrative updates to reflect this, helping you maintain a current view. For example, some investors think the recent government contracts and Apple partnership will drive MP Materials’ value as high as $85 per share, while others focus on operational risks and set the fair value closer to $65. Narratives let you compare these perspectives, make your own, and react quickly as the story unfolds.

Do you think there's more to the story for MP Materials? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MP

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives