- United States

- /

- Metals and Mining

- /

- NYSE:MP

How Investors May Respond To MP Materials (MP) Securing Apple Supply Deal and Major DoD Partnership

Reviewed by Simply Wall St

- In July 2025, MP Materials secured a US$400 million public-private partnership with the U.S. Department of Defense and a US$500 million supply agreement with Apple to provide American-made rare earth magnets and expand domestic rare earth processing.

- This positions MP Materials as a key supplier in the U.S. rare earth supply chain, supporting efforts to reduce reliance on Chinese imports and develop advanced magnet recycling technologies.

- We'll explore how the Apple supply contract supports MP Materials' goal of scaling its U.S.-based magnet manufacturing business.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

MP Materials Investment Narrative Recap

To be a shareholder in MP Materials, you need to believe in the company’s vision to establish a secure, U.S.-centric rare earth supply chain, seizing on government support and rising demand for magnets in technology and defense. The recent Apple and Department of Defense deals appear to reinforce the company’s most important short-term catalyst, scaling domestic magnet manufacturing, while the largest risk remains production instability and potential process setbacks, which these deals do not fully mitigate.

Among recent announcements, the long-term supply agreement with Apple stands out. This US$500 million contract to provide American-made, recycled rare earth magnets is closely tied to MP Materials' ambitions for building out its U.S. manufacturing capacity and boosting revenue resilience in a shifting regulatory and pricing environment for NdPr.

Yet, against this backdrop, investors should remain mindful that, even as headline deals make headlines, persistent operational risks like...

Read the full narrative on MP Materials (it's free!)

MP Materials' narrative projects $655.9 million in revenue and $101.4 million in earnings by 2028. This requires 47.6% annual revenue growth and a $166.8 million increase in earnings from -$65.4 million today.

Uncover how MP Materials' forecasts yield a $50.67 fair value, a 18% downside to its current price.

Exploring Other Perspectives

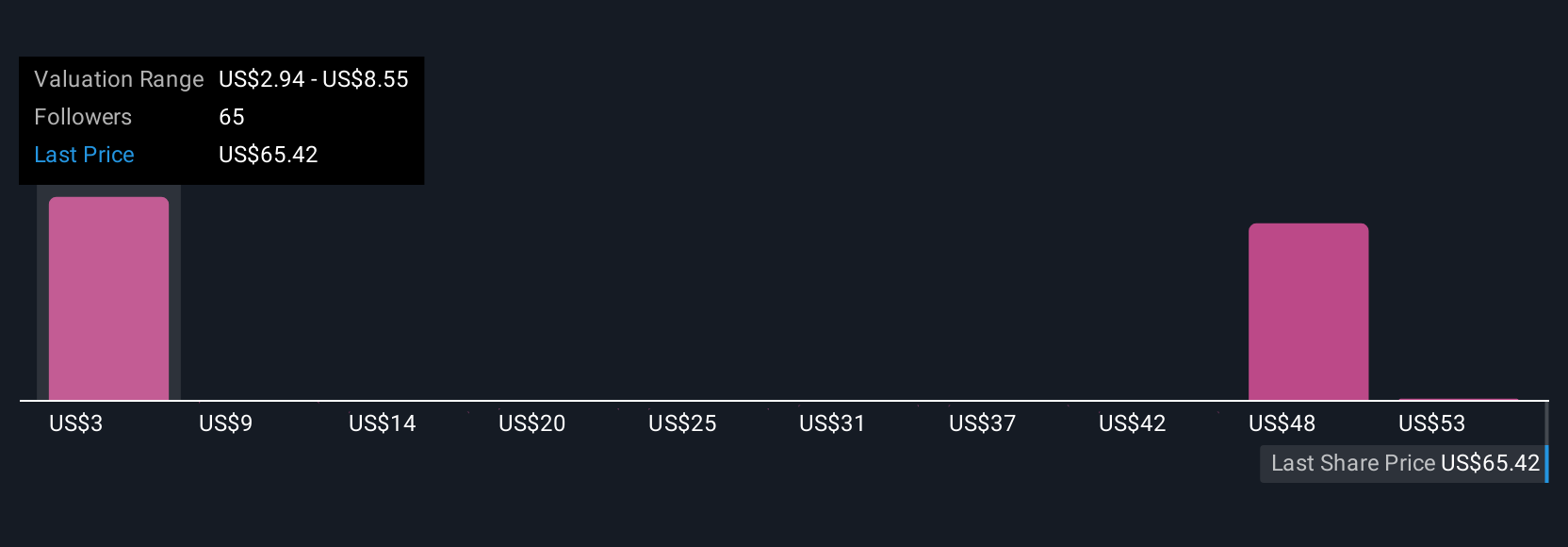

Seventeen Simply Wall St Community members have estimated MP Materials’ fair value between US$2.84 and US$59 per share. With such variety in outlook, remember that recent setbacks in production progress and process optimization could have widespread impacts across these views, see how investor opinions compare as you form your own perspective.

Explore 17 other fair value estimates on MP Materials - why the stock might be worth less than half the current price!

Build Your Own MP Materials Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MP Materials research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free MP Materials research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MP Materials' overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MP

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives