- United States

- /

- Chemicals

- /

- NYSE:MOS

Mosaic (MOS): One-Off Gain Drives 284% Earnings Growth, Raising Profit Quality Concerns

Reviewed by Simply Wall St

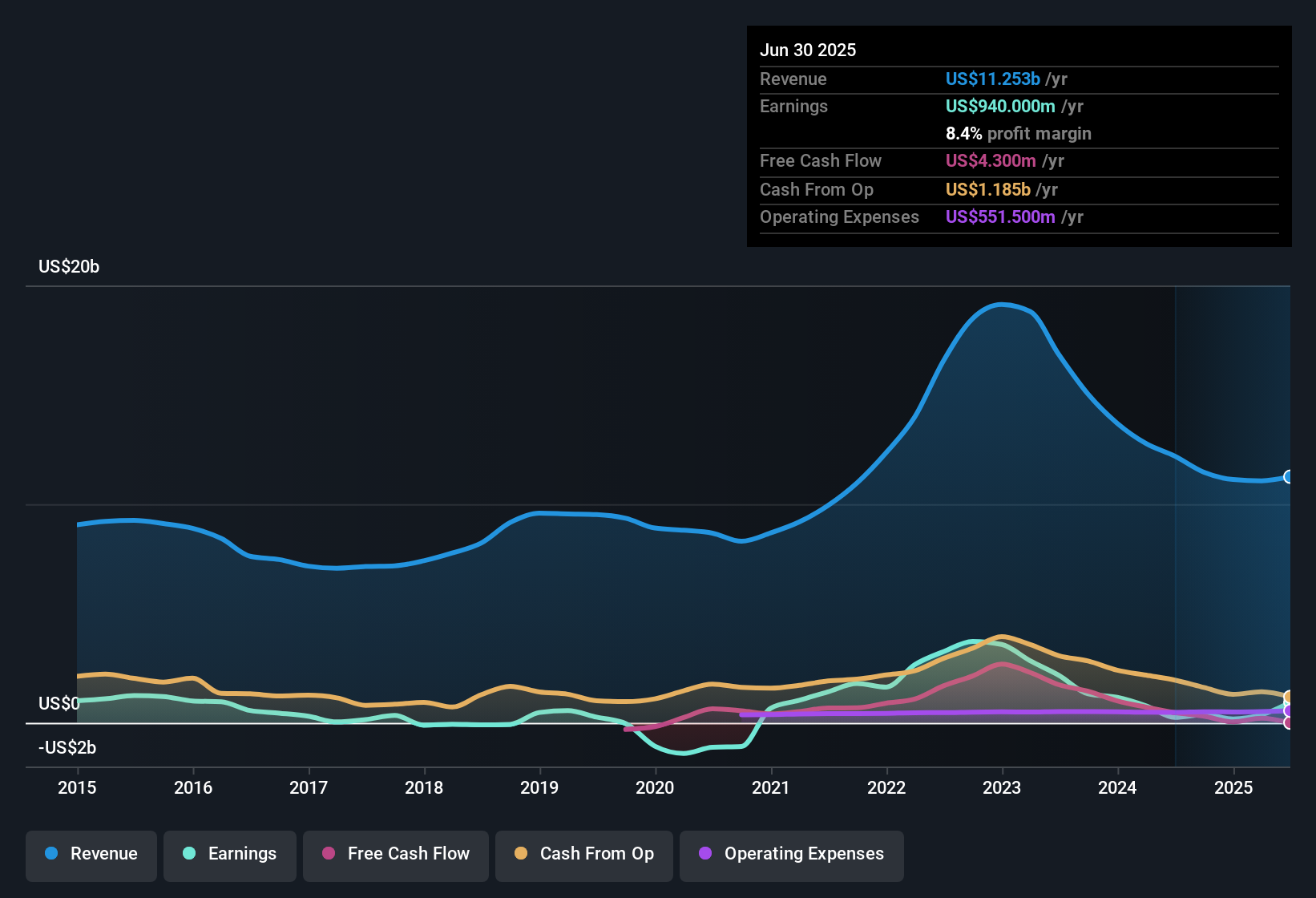

Mosaic (MOS) delivered remarkable earnings growth of 284% over the last year, a sharp turnaround from its five-year average decline of -8.4% per year. Net profit margins strengthened significantly, moving from 2% to 8.4%. However, this surge was driven in part by a one-off $652.2 million gain, making some of these earnings non-recurring. Looking ahead, sentiment will weigh Mosaic’s low Price-to-Earnings Ratio of 8.9x and pricing below analyst fair value estimates against the forecast for annual revenue to contract slightly at -0.09%, and for earnings to decrease by -13.2% per year over the next three years.

See our full analysis for Mosaic.The big question now is how these headline-making results compare to the most widely held narratives about Mosaic. Let’s see where the latest numbers confirm expectations and where they challenge the community’s prevailing views.

See what the community is saying about Mosaic

Margins Buoyed by One-Off Gain

- Net profit margins rose from 2% to 8.4%. This expansion includes a significant non-recurring gain of $652.2 million, raising questions about the sustainability of such high margins over the long term.

- The analysts' consensus view sees operational improvements and expansion into premium products driving more consistent profitability, but warns against relying solely on these trends:

- Ongoing reliance on traditional fertilizers makes Mosaic susceptible to commodity cycles, which could reverse recent margin gains.

- Investments in automation and cost reduction are expected to support higher margins and directly address concerns about longer-term margin durability.

- For investors weighing these factors, the current margin jump may not fully reflect future normalized earnings power.

Future Growth Under Pressure

- Analysts project annual revenue to decline slightly at -0.09%, and earnings to decrease by -13.2% per year over the next three years, with profit margins expected to shrink from 8.4% to 6.5% by 2028.

- The analysts' consensus view highlights several growth tensions:

- Favorable supply constraints and rising agricultural demand could offset some projected declines, supporting long-term revenue stability.

- At the same time, consolidation of revenues in key segments and increased regulatory pressures are expected to challenge both margins and top-line results going forward.

Discounted Valuation versus Industry

- Mosaic trades at a Price-to-Earnings Ratio of 8.9x, significantly below both the US Chemicals sector average of 25.9x and the analyst price target of 37.38, compared to its current share price of $26.22.

- The analysts' consensus view argues this discount looks compelling in light of recent profit strength, but also cautions:

- Recent earnings are flattered by the one-off gain, so a lower multiple may be warranted if normalized earnings are less robust.

- For the stock to close the gap toward analyst targets, profits must stabilize even as the company faces secular industry headwinds and needs to prove margin durability.

- For a deeper dive into how all sides of the debate are playing out, see the full consensus narrative.📊 Read the full Mosaic Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Mosaic on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have another take on the data? Share your viewpoint and shape your own narrative in minutes: Do it your way

A great starting point for your Mosaic research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Mosaic’s future growth is under pressure because earnings and revenue are forecast to decline, and margins may contract without further operational improvements.

If you want to focus on companies with reliable, steady performance, use stable growth stocks screener (2073 results) to find those consistently delivering growth year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MOS

Mosaic

Through its subsidiaries, produces and markets concentrated phosphate and potash crop nutrients.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives