- United States

- /

- Chemicals

- /

- NYSE:MOS

Is Mosaic's Recent 21% Drop an Opportunity or Warning for 2025 Investors?

Reviewed by Bailey Pemberton

- Ever wonder if Mosaic stock is an undervalued gem or just another rock among the minerals? You’re in the right place if you want a no-nonsense look at Mosaic’s true worth.

- The share price is up 11.8% year-to-date, but that ride came with some sharp turns, including a 7.8% drop in the last week and 21.1% in the past month.

- Recent headlines point to shifting market dynamics in agriculture and fertilizer, with Mosaic playing a key role in global supply chains. Ongoing discussions about commodity pricing and environmental policies have added some volatility as investors monitor Mosaic’s position in this evolving landscape.

- Mosaic currently boasts a valuation score of 6/6, which puts it in rare company for being undervalued across all the major checks we track. Let’s break down what goes into these numbers and why there may be an even smarter way to judge value by the article’s end.

Approach 1: Mosaic Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by forecasting its future cash flows and discounting them back to today's dollars. This method helps investors understand whether a stock price truly reflects its underlying cash-generating potential.

Mosaic’s current free cash flow stands at $68.7 Million. Analysts have projected cash flows over the next five years, with forecasts reaching $899.2 Million in 2026 and $675.5 Million by 2029. Beyond these years, further projections are extrapolated based on available patterns and estimates. All valuations here are expressed in $ Millions. These projections provide a detailed roadmap of Mosaic’s expected profitability into the next decade.

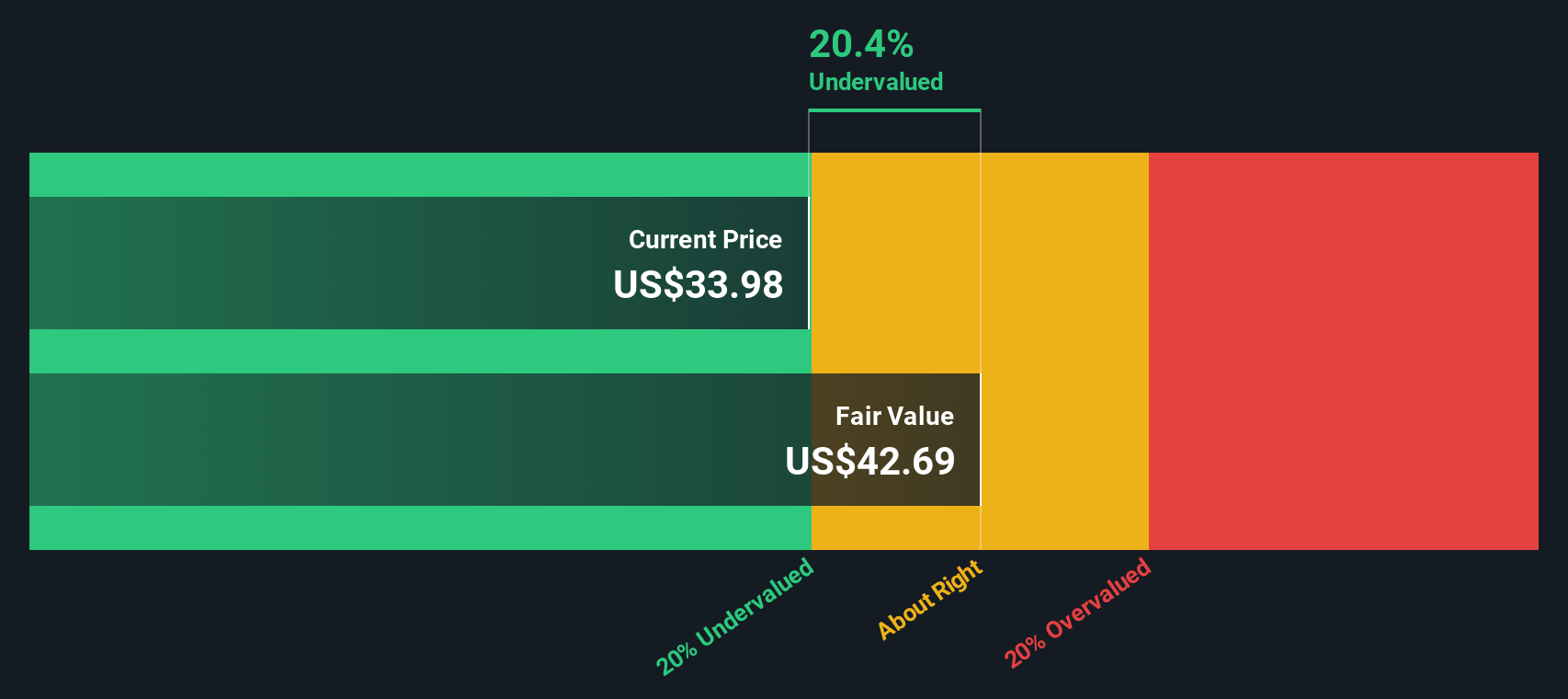

According to this two-stage DCF calculation, Mosaic’s fair value comes to $34.43 per share. Compared to current trading levels, this suggests the stock is 20.8% undervalued by the market.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Mosaic is undervalued by 20.8%. Track this in your watchlist or portfolio, or discover 843 more undervalued stocks based on cash flows.

Approach 2: Mosaic Price vs Earnings (P/E)

The price-to-earnings (P/E) ratio is commonly used to assess valuation for profitable companies, like Mosaic, because it directly relates what investors are paying for each dollar of annual earnings. For established firms with consistent profits, the P/E is a reliable starting point to judge whether a stock is cheap or expensive relative to its income-generating power.

"Normal" or "fair" P/E levels depend on expectations for future growth and the risks the business faces. Companies with higher expected growth or lower perceived risk typically sell at a higher P/E, while those with slower growth or greater risk deserve a lower one.

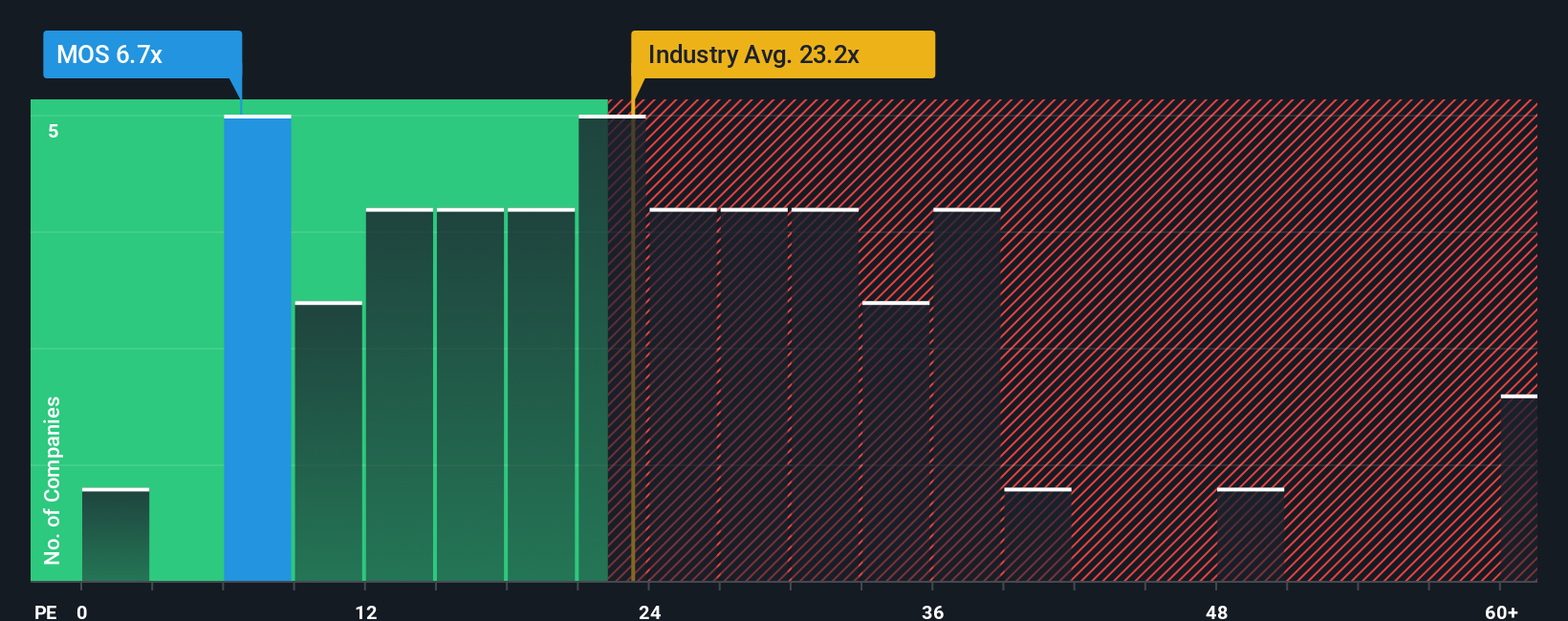

Mosaic currently trades at a P/E of 9.2x, which is well below both the industry average of 24.7x and the average among close peers at 30.3x. Despite looking cheap compared to these benchmarks, we also have access to Simply Wall St’s “Fair Ratio,” a proprietary metric that tailors the expected P/E for Mosaic, factoring in its earnings growth outlook, risks, profit margins, industry dynamics, and market capitalization. For Mosaic, the Fair Ratio works out to 15.2x.

Unlike a simple peer or industry comparison, the Fair Ratio offers a more nuanced and company-specific perspective, suggesting what Mosaic’s multiple truly deserves based on its unique profile, not just broader market sentiment.

Mosaic’s actual P/E (9.2x) is well below its Fair Ratio (15.2x), pointing to the stock being meaningfully undervalued according to this approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Mosaic Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your own investment story for a company. It’s how you connect Mosaic’s future prospects, revenue and earnings forecasts, and margin expectations into a logical, numbers-backed view of what the company is truly worth.

In simple terms, your Narrative is the bridge between a company’s story and its financial outcome. You define how Mosaic’s business realities and future trends translate into a fair value, all based on your assumptions. Narratives make this process easy and accessible for everyone, and you can build, share, and compare them directly in the Simply Wall St Community page, where millions of investors exchange real-world perspectives.

By putting your story into a Narrative, you see how your fair value compares to Mosaic’s actual share price, making it straightforward to decide whether to buy, hold, or sell. Because Narratives dynamically update when new earnings, regulatory news, or industry data comes in, they always reflect your latest view on the business.

For example, one investor might believe Mosaic’s premium products and global demand will fuel growth, leading to a bullish Narrative and a fair value of $49 per share. Another might see regulatory risk and market headwinds, resulting in a more cautious Narrative with a fair value of $33 per share.

Do you think there's more to the story for Mosaic? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MOS

Mosaic

Through its subsidiaries, produces and markets concentrated phosphate and potash crop nutrients.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives