- United States

- /

- Basic Materials

- /

- NYSE:MLM

Martin Marietta Materials (MLM): Assessing Valuation as AI Projects and Asset Exchange Drive Positive Sentiment

Reviewed by Kshitija Bhandaru

Martin Marietta Materials (MLM) is drawing investor attention as the company broadens its exposure to AI and data center projects, while advancing an asset exchange with Quikrete Holdings. This move deepens its core business footprint.

See our latest analysis for Martin Marietta Materials.

Martin Marietta Materials recently made headlines by hitting a record share price and announcing a 5 percent dividend boost, all while advancing its asset exchange with Quikrete and continuing to seize opportunities in AI and data infrastructure. The momentum is clear, with the stock showing a 22.3% year-to-date share price return and posting an impressive 109% total shareholder return over three years. This is a sign that investors increasingly view MLM as positioned for both growth and resilience.

If the company’s recent run and strategic moves have you thinking about other possibilities, now’s the perfect time to discover fast growing stocks with high insider ownership.

Yet with shares touching all-time highs and expectations running high around AI and infrastructure growth, the big question for investors is whether Martin Marietta Materials is undervalued, or if the market has already priced in the company’s future potential.

Most Popular Narrative: 5.1% Undervalued

Martin Marietta Materials' narrative fair value lands at $658 a share, about 5.1% above its last close at $624.14. With only a modest upside, the most popular perspective hinges on the company’s ability to convert infrastructure tailwinds and margin gains into lasting value.

The exchange of cement and ready-mix assets for high-quality aggregate operations in Virginia, Missouri, Kansas, and Vancouver, BC, strategically increases Martin Marietta's exposure to advantaged geographies with strong barriers to entry and pricing power, expected to enhance margins and support stable earnings growth over time.

Want to see what’s fueling this premium? Key drivers are bold expectations for margin expansion and powerful demographic shifts, as well as a future PE ratio that is aggressive for the sector. Which numbers actually underpin this conviction? The full narrative spills all the details.

Result: Fair Value of $658 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, demand could slow further if housing affordability remains strained or if government infrastructure spending faces unexpected delays. This could potentially challenge this optimism.

Find out about the key risks to this Martin Marietta Materials narrative.

Another View: What Do Market Ratios Reveal?

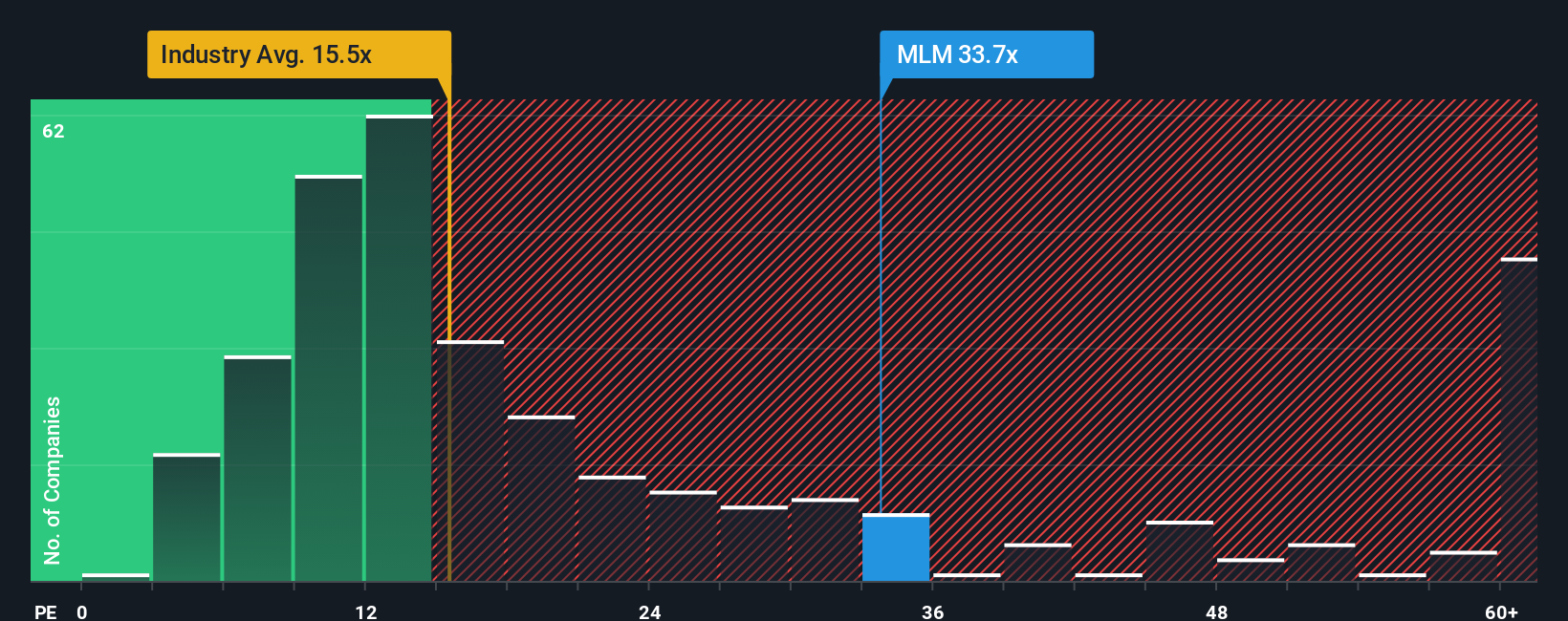

Looking beyond fair value estimates, Martin Marietta trades at a price-to-earnings ratio of 34.2 times. This places the stock well above both its industry peers (26.5x) and the global sector average (15.6x). Notably, this is also far higher than the fair ratio of 23.1x, suggesting investors are paying a considerable premium right now. Is that extra optimism justified, or could the shares be vulnerable if expectations cool?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Martin Marietta Materials Narrative

If you want to analyze the numbers firsthand and shape your own perspective on Martin Marietta Materials, you can easily craft your own narrative in just a few minutes. Do it your way.

A great starting point for your Martin Marietta Materials research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you’re eager to spot tomorrow’s winners before everyone else, don’t stop at just one stock. The Simply Wall Street Screener reveals fresh opportunities you could be missing.

- Uncover high-yield opportunities in the market by checking out these 20 dividend stocks with yields > 3%, which consistently deliver strong income with yields above 3%.

- Stay ahead of the digital transformation and spot potential leaders by reviewing these 24 AI penny stocks, positioned to capitalize on breakthroughs in artificial intelligence.

- Get proactive in finding untapped value among these 3577 penny stocks with strong financials, which boast impressive financial strength and underlying fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MLM

Martin Marietta Materials

A natural resource-based building materials company, supplies aggregates and heavy-side building materials to the construction industry in the United States and internationally.

Mediocre balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives