- United States

- /

- Chemicals

- /

- NYSE:LYB

LyondellBasell (LYB): Unprofitable Status and Widening Losses Challenge Turnaround Narrative

Reviewed by Simply Wall St

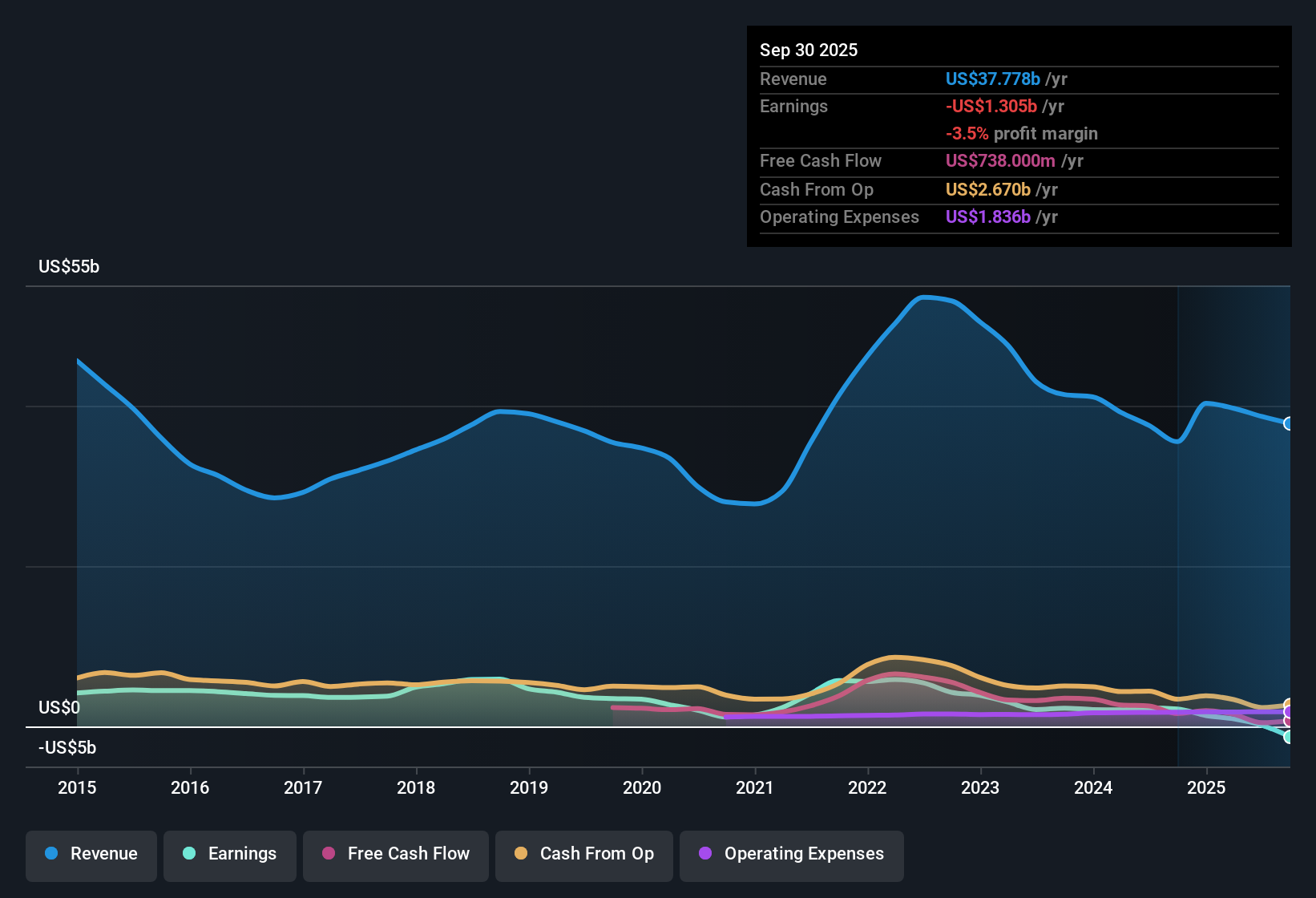

LyondellBasell Industries (LYB) reported widening losses, with net profit margins and earnings quality reflecting its unprofitable status. Over the past five years, annual losses have grown by 24.8% per year and year-over-year profit growth is unavailable due to continued unprofitability. Looking ahead, the company forecasts earnings growth of 52.66% per year and expects to return to profitability within three years, despite revenue projections showing a 7.1% annual decline.

See our full analysis for LyondellBasell Industries.The next section sets LyondellBasell’s latest numbers against the broader market narrative to see how expectations match the reality. This analysis can help identify where investor stories may be challenged.

See what the community is saying about LyondellBasell Industries

DCF Fair Value Sits Far Above Market Price

- The DCF fair value for LyondellBasell is $90.28, nearly double its actual share price of $46.42, signaling a valuation gap that stands out in the chemicals sector.

- Analysts' consensus view highlights that, even with anticipated annual revenue declines of 7.1% over the next three years, the company’s expected turnaround to $2.2 billion in earnings by 2028 could justify a higher multiple if longer-term margin expansion materializes.

- Consensus points to a future P/E ratio of 11x on those earnings, which would still be well below the current US Chemicals industry average of 25.9x. This suggests possible upside if the company executes against expectations.

- With the analyst price target at 56.61, current pricing offers a built-in discount for investors who trust the turnaround narrative tied directly to these figures.

To see what the broader market expects and how narrative meets numbers, check the balanced take for LyondellBasell Industries in the full consensus narrative. 📊 Read the full LyondellBasell Industries Consensus Narrative.

Price-to-Sales Multiple Supports Value Play

- LyondellBasell trades on a price-to-sales ratio of 0.4x, notably lower than both its direct peer group (0.6x) and the US Chemicals industry average (1.2x), reinforcing the deep value thesis even before profitability returns.

- The analysts' consensus view contends that this discounted multiple could position LyondellBasell to outperform, should the anticipated margin recovery and cost discipline lead to stronger free cash flow by 2026.

- Consensus notes the company’s focus on cost-advantaged regions and targeted cost reduction projects that are projected to generate $1.1 billion in incremental cash flow by 2026, a key offset to declining revenues.

- Ongoing portfolio shifts away from underperforming European assets and into more resilient areas underpin the resilience cited by consensus analysts, giving weight to the value argument embedded in the current ratio.

Margin Turnaround Hinges on Portfolio Shift

- Although current profit margins are negative, analysts agree that a turnaround is likely, with margins forecast to climb from 0.4% today to 7.7% within three years as the company pivots to more sustainable and high-growth product lines.

- The analysts' consensus view draws a line between portfolio shifts toward circular/recycling technologies and cost-advantaged regions and the prospect of resilient, higher-margin earnings amidst continued sector headwinds.

- Consensus highlights LyondellBasell’s strategic investments in recycling and sustainable plastics, along with cost reductions and capex discipline, as crucial drivers for achieving margin expansion and supporting future dividends, even if top-line growth remains under pressure.

- Bearish risks, such as delayed project rollouts or regulatory shifts, could constrain this margin recovery, but for now consensus expects the investment in proprietary technology and new markets to improve earnings quality and mix.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for LyondellBasell Industries on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a unique take on the figures above? Put your perspective into action and craft your own narrative in just a few minutes. Do it your way

A great starting point for your LyondellBasell Industries research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

LyondellBasell’s ongoing losses, negative margins, and declining revenues highlight business instability and a lack of consistent earnings growth.

If you’re seeking more reliable opportunities, use stable growth stocks screener (2087 results) to quickly spot companies with steady earnings and revenue trends that can weather market swings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LYB

LyondellBasell Industries

Operates as a chemical company in the United States, Germany, Mexico, Italy, Poland, France, Japan, China, the Netherlands, and internationally.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives