- United States

- /

- Paper and Forestry Products

- /

- NYSE:LPX

A Fresh Look at Louisiana-Pacific (LPX) Valuation Following Recent Share Price Gains

Reviewed by Simply Wall St

Louisiana-Pacific (LPX) has seen some recent movement in its stock price, giving investors a chance to reconsider its current valuation. Over the past month, LPX shares have climbed about 5%, although the year-to-date performance has been slower.

See our latest analysis for Louisiana-Pacific.

Despite some recent volatility, Louisiana-Pacific's 1-month share price return of 4.6% suggests renewed interest after subdued performance earlier this year. While momentum has improved in the short run, its 1-year total shareholder return of -8.7% shows a tougher backdrop, even as long-term holders still sit on exceptional gains.

If you're on the lookout for what's working elsewhere, now may be a good time to broaden your search and discover fast growing stocks with high insider ownership

With solid recent gains and a price still well below analyst targets, is Louisiana-Pacific a hidden value waiting to be unlocked, or has the market already priced in its growth prospects, leaving little room for upside?

Most Popular Narrative: 18% Undervalued

With shares last closing at $89.09 and the narrative consensus fair value set at $109.08, this widely followed perspective sees considerable upside left for Louisiana-Pacific. The following catalyst is key to understanding why this valuation stands out:

Continued product innovation (for example, new textures, prefinished offerings, three-dimensional corners) and penetration into under-served segments like manufactured housing and offsite/modular construction expands the company’s total addressable market and should enable further market share gains, providing a long runway for top-line and earnings growth.

Curious how ambitious market share grabs and game-changing products add up to this target? Discover the pivotal financial forecasts and bold growth assumptions underpinning this undervaluation in the full narrative.

Result: Fair Value of $109.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in housing starts or unexpectedly low OSB pricing could limit the upside and put the optimistic narrative to the test.

Find out about the key risks to this Louisiana-Pacific narrative.

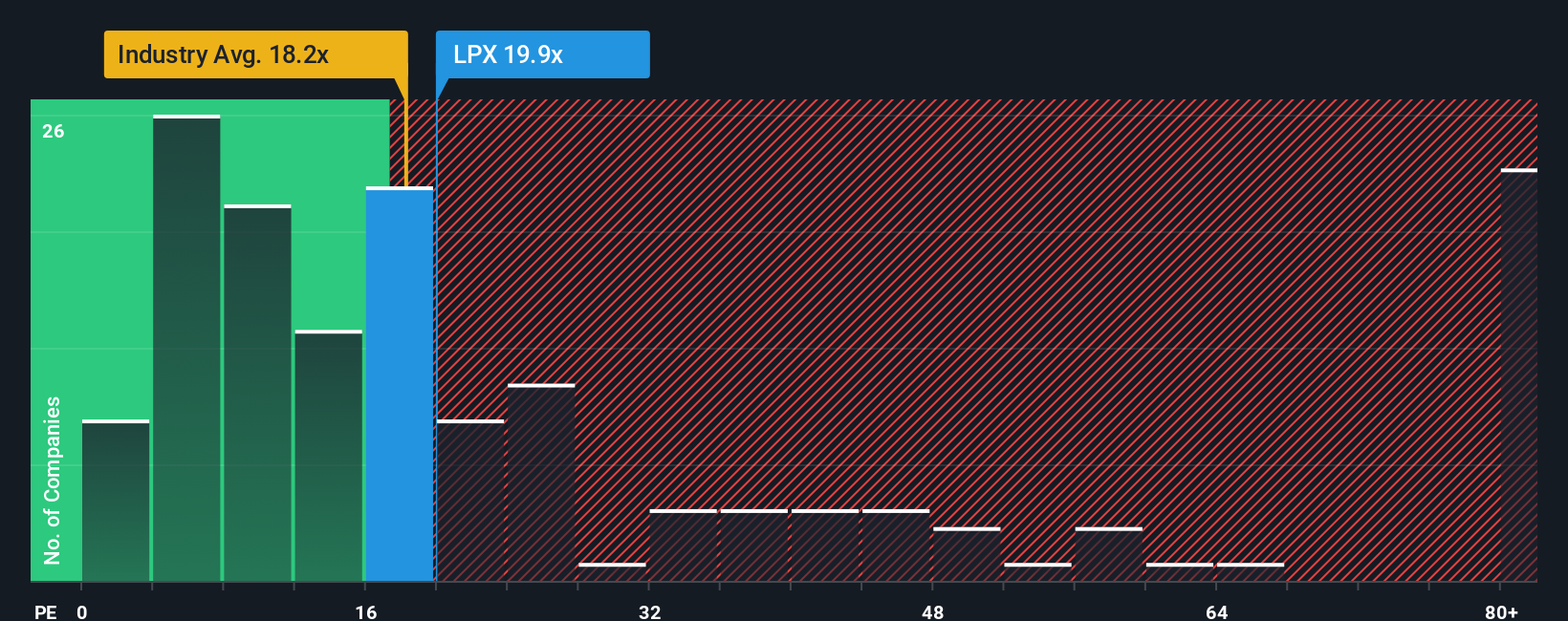

Another View: Looking Through a Different Lens

While analyst targets paint a bullish picture, looking at valuation through the lens of earnings multiples tells a more cautious story. Louisiana-Pacific trades at a price-to-earnings ratio of 20.8x, which is higher than the global industry average of 18.2x. It remains below the peer average of 34.6x. The fair ratio sits at 21.2x, so the current pricing is close but leans toward being a bit expensive. Does this narrow margin leave buyers exposed, or could the market still shift in Louisiana-Pacific's favor?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Louisiana-Pacific Narrative

If you have a different perspective or want to investigate the numbers firsthand, you can quickly craft your own Louisiana-Pacific narrative and see where your analysis leads you. This process can be completed in just a few minutes. Do it your way.

A great starting point for your Louisiana-Pacific research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Compelling Opportunities?

Be the friend in your group who spots the next big winner. Right now, you can uncover stocks with standout traits and strong financial potential by acting on these handpicked ideas:

- Catch the wave of generous payouts and secure your cash flow with these 21 dividend stocks with yields > 3%, which offers solid yields above 3%.

- Unlock tomorrow’s leaders in medicine and data by checking out these 34 healthcare AI stocks, where AI is changing the face of healthcare innovation.

- Position yourself for potential technology growth when you power up your strategy with these 26 AI penny stocks, featuring cutting-edge artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LPX

Louisiana-Pacific

Provides building solutions for applications in new home construction, repair and remodeling, and outdoor structure markets.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives