- United States

- /

- Chemicals

- /

- NYSE:KWR

Quaker Chemical (KWR): Examining Current Valuation After Recent Modest Share Price Rebound

Reviewed by Simply Wall St

Quaker Chemical (KWR) shares have moved slightly this week, rising around 1% over the past seven days after a steady month. Investors continue to assess recent performance trends, with an eye on longer-term value and earnings momentum.

See our latest analysis for Quaker Chemical.

Quaker Chemical’s recent uptick continues a modest rebound, but the stock’s longer-term performance tells a different story. Despite short bursts of momentum, its 1-year total shareholder return is down 13.8%, with longer-term returns lagging as well. Investors seem to be reassessing the company’s pace of growth and overall value as fundamentals shift.

If you’re curious about where else value or momentum might be building, this is a perfect opportunity to discover fast growing stocks with high insider ownership.

The recent performance raises a critical question: Is Quaker Chemical truly trading at a discount with nearly 18% upside to analyst targets, or has the market already factored in all realistic growth expectations?

Most Popular Narrative: 14.2% Undervalued

Quaker Chemical’s current share price of $133.41 sits well below the most popular narrative’s fair value estimate of $155.40. The narrative builds its case on transformational changes and bold growth strategies.

The ongoing roll-out of FLUID INTELLIGENCE (breakthrough sensor technology, digitalization, and automation of services) creates stickier customer relationships and recurring revenue streams. This also differentiates Quaker in an environment increasingly focused on sustainability and efficiency, supporting more predictable cash flows and potentially higher net margins.

Want to dig into why this valuation is catching Wall Street’s attention? There is a bold earnings leap locked into the numbers, and a future profit margin that could reshape how the market values Quaker. Discover which forecast is shifting analyst consensus in the narrative.

Result: Fair Value of $155.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressure or unexpected financial headwinds in key regions could quickly challenge these optimistic forecasts and reshape analyst sentiment.

Find out about the key risks to this Quaker Chemical narrative.

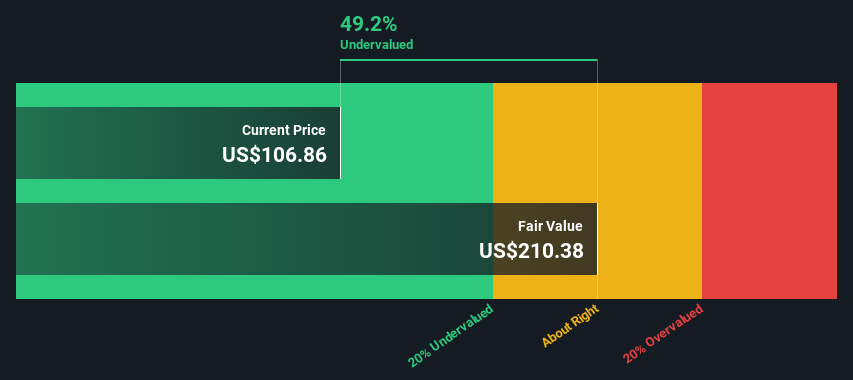

Another View: SWS DCF Model Suggests Deeper Value

While most analysts focus on earnings forecasts and market multiples, our DCF model presents a markedly different picture. According to SWS calculations, Quaker Chemical shares trade at a steep 47.7% discount to intrinsic fair value, which is far deeper than the consensus price targets. Is the market overlooking a bigger opportunity here, or are there risks not yet reflected in the numbers?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Quaker Chemical Narrative

If you see the numbers differently or want to take a hands-on approach, you can build your own perspective on Quaker Chemical in just a few minutes. Do it your way.

A great starting point for your Quaker Chemical research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Seize this moment to expand your portfolio beyond Quaker Chemical. The best opportunities go to investors who actively uncover fresh possibilities on Simply Wall Street.

- Tap into tomorrow’s health breakthroughs by targeting innovation-driven companies in AI-powered medicine using these 33 healthcare AI stocks.

- Kickstart your hunt for undervalued market gems and identify stocks trading below their real worth with these 879 undervalued stocks based on cash flows.

- Unlock potential double-digit yields and consistent cash flow by seeking out high-performing companies through these 17 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quaker Chemical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KWR

Quaker Chemical

Quaker Chemical Corporation, doing business as Quaker Houghton, provides industrial process fluids worldwide.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives