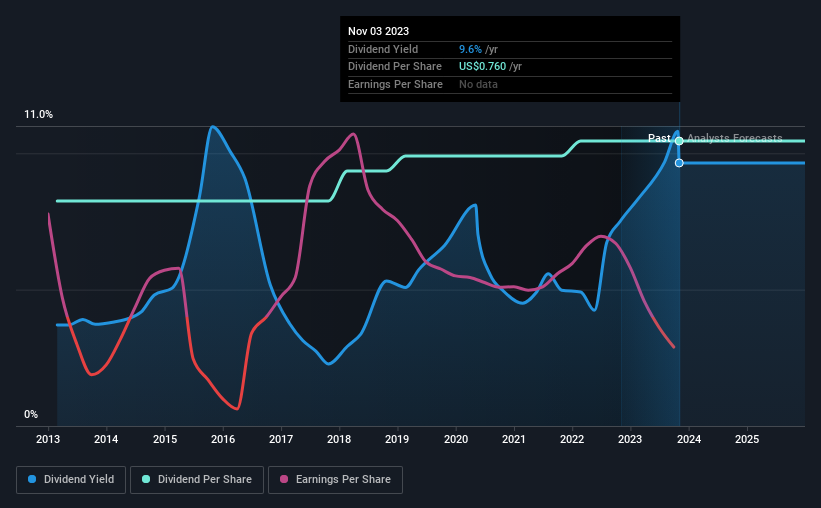

The board of Kronos Worldwide, Inc. (NYSE:KRO) has announced that it will pay a dividend of $0.19 per share on the 14th of December. This makes the dividend yield 9.6%, which will augment investor returns quite nicely.

Check out our latest analysis for Kronos Worldwide

Kronos Worldwide Might Find It Hard To Continue The Dividend

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Even though Kronos Worldwide is not generating a profit, it is still paying a dividend. The company is also yet to generate cash flow, so the dividend sustainability is definitely questionable.

Over the next year, EPS might fall by 24.2% based on recent performance. This means the company won't be turning a profit, which could place managers in the tough spot of having to choose between suspending the dividend or putting more pressure on the balance sheet.

Kronos Worldwide Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. The annual payment during the last 10 years was $0.60 in 2013, and the most recent fiscal year payment was $0.76. This works out to be a compound annual growth rate (CAGR) of approximately 2.4% a year over that time. Although we can't deny that the dividend has been remarkably stable in the past, the growth has been pretty muted.

Dividend Growth Potential Is Shaky

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Let's not jump to conclusions as things might not be as good as they appear on the surface. Over the past five years, it looks as though Kronos Worldwide's EPS has declined at around 24% a year. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future.

Kronos Worldwide's Dividend Doesn't Look Sustainable

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. Although they have been consistent in the past, we think the payments are a little high to be sustained. We don't think Kronos Worldwide is a great stock to add to your portfolio if income is your focus.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've picked out 2 warning signs for Kronos Worldwide that investors should know about before committing capital to this stock. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Kronos Worldwide might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:KRO

Kronos Worldwide

Produces and markets titanium dioxide pigments (TiO2) in Europe, North America, the Asia Pacific, and internationally.

Slight risk with acceptable track record.

Similar Companies

Market Insights

Community Narratives