- United States

- /

- Basic Materials

- /

- NYSE:KNF

Knife River (KNF): Assessing Valuation After JPMorgan Coverage and a New $112 Million Texas Highway Contract

Reviewed by Simply Wall St

Knife River (KNF) just picked up a $112 million materials and paving contract on Texas State Highway 6, a long duration project that neatly reinforces the company’s public infrastructure growth story.

See our latest analysis for Knife River.

The new Texas contract lands as Knife River’s share price, now at $74.64, shows a 1 month share price return of 5.1 percent but a weaker year to date share price return of negative 25.7 percent. Meanwhile, the 1 year total shareholder return of negative 27.1 percent suggests that despite solid earnings and fresh coverage from major banks, investors are still recalibrating growth expectations even as infrastructure driven momentum quietly builds.

If this kind of long dated infrastructure story interests you, it could be worth scanning aerospace and defense stocks for other companies tied to government and public sector spending themes.

With shares still well below Wall Street’s targets even after the Texas win, investors face a key question: Is Knife River quietly undervalued here, or already reflecting the next leg of infrastructure fueled growth?

Most Popular Narrative Narrative: 24% Undervalued

Compared with Knife River’s last close at $74.64, the most followed narrative pegs fair value materially higher, framing today’s price as a potential discount.

Analysts are assuming Knife River's revenue will grow by 7.4% annually over the next 3 years.

Analysts assume that profit margins will increase from 5.2% today to 7.2% in 3 years time.

Want to see what turns steady infrastructure work into a premium valuation story? The secret mix blends accelerating earnings, expanding margins, and a punchy future multiple. Curious which assumptions really move that fair value line higher, and how long they need to hold for the math to work? Read on and unpack the full narrative behind this gap.

Result: Fair Value of $98.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent Oregon funding delays and extreme weather disruptions could easily derail margin expansion targets and push out the expected infrastructure-driven earnings ramp.

Find out about the key risks to this Knife River narrative.

Another Way to Look at Value

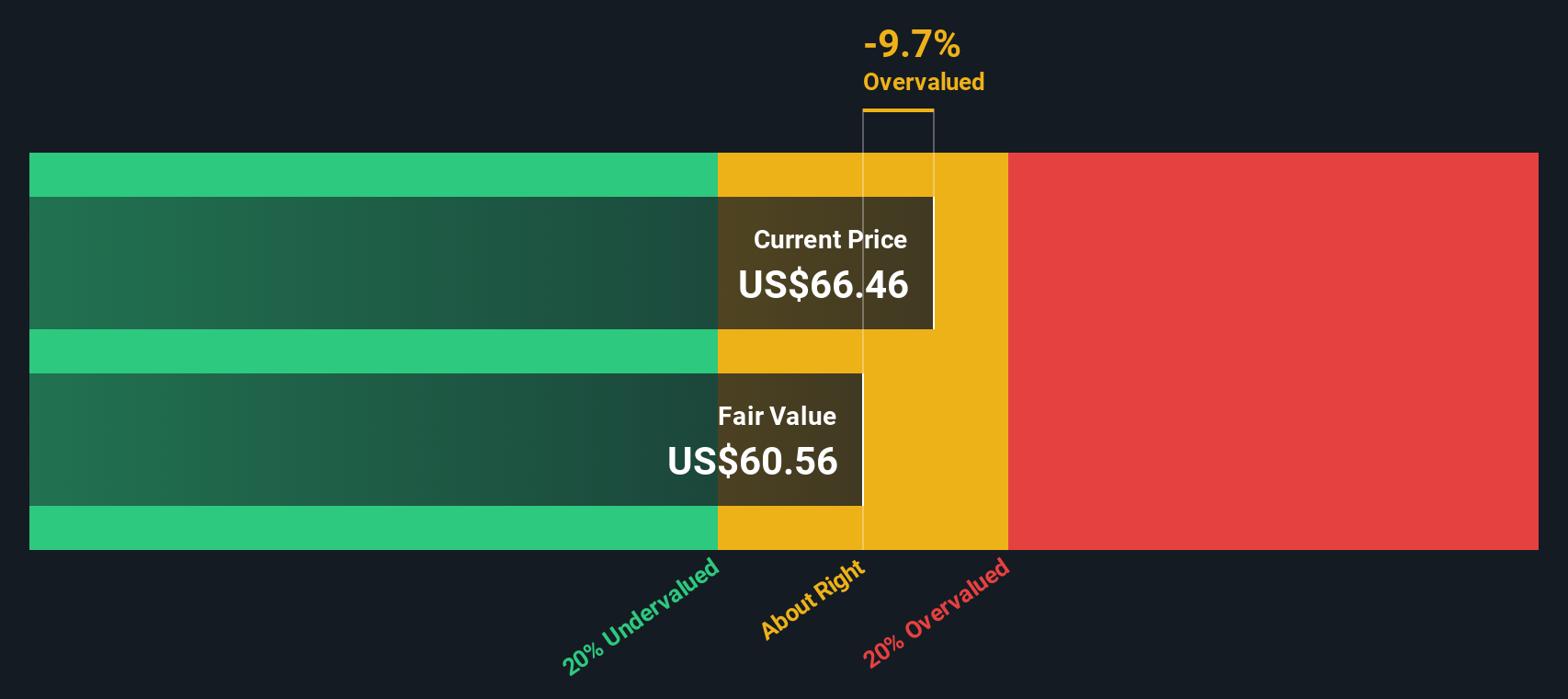

While the narrative suggests upside, our SWS DCF model is far more cautious. In that framework, Knife River screens as overvalued at around $74.64 versus an estimated fair value near $27.53. This raises the question of whether growth assumptions are still too optimistic.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Knife River Narrative

If these conclusions do not quite fit your view, or you prefer to dive into the numbers yourself, you can craft a custom take in just a few minutes: Do it your way.

A great starting point for your Knife River research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop at Knife River when the market is full of mispriced opportunities. Let Simply Wall Street’s powerful Screener guide your next smart move today.

- Target income potential by reviewing these 15 dividend stocks with yields > 3% that can help strengthen your portfolio with reliable cash returns.

- Capitalize on market inefficiencies by scanning these 899 undervalued stocks based on cash flows that may be trading below their intrinsic worth.

- Position yourself at the frontier of innovation by tracking these 28 quantum computing stocks shaping tomorrow’s computing breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Knife River might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KNF

Knife River

Provides aggregates-led construction materials and contracting services in the United States.

Mediocre balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026