- United States

- /

- Basic Materials

- /

- NYSE:KNF

Assessing Knife River (KNF) Valuation: What Recent Market Moves Mean for Investors

Reviewed by Kshitija Bhandaru

Knife River (KNF) shares have shown some fluctuations recently, with a slight uptick in the past day but losses over the past month and three months. Investors are watching to see how the company navigates changing market dynamics.

See our latest analysis for Knife River.

Knife River’s stock has lost ground lately, reflecting its 1-year total shareholder return of -0.18%. As the market reassesses the company’s long-term upside and recalibrates expectations after mixed short-term price movements, momentum looks a bit softer compared to earlier in the year. However, with Knife River’s fundamentals, investors may find opportunity as sentiment shifts.

If you’re curious what other interesting companies are gaining traction, this is a great moment to see what’s next and discover fast growing stocks with high insider ownership

Given recent underperformance and a notable discount to analyst price targets, is Knife River’s current valuation a window for value-driven investors, or are today’s prices already accounting for all expected growth ahead?

Most Popular Narrative: 31.9% Undervalued

Knife River’s most popular narrative sets a fair value of $106.78 per share, which is significantly higher than the last close price of $72.69. This sharp difference suggests analysts see considerable upside embedded in the company's future trajectory, even as recent price action remains weak.

Knife River's record $1.3 billion backlog and exposure to public infrastructure projects, supported by robust, multiyear federal and state Department of Transportation funding (including 60% of IIJA funds still to be spent), positions the company for strong, sustained revenue growth well into 2026 and beyond.

Want to decode the secret behind this optimistic price target? The pivotal narrative combines bold growth assumptions, a margin leap, and a future profit multiple more commonly seen in market-leading sectors. Curious which aggressive financial forecasts make this figure plausible? Dive in to discover the drivers analysts are betting on.

Result: Fair Value of $106.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent funding delays in Oregon and extreme weather disruptions across key regions could quickly undermine Knife River’s bullish growth outlook.

Find out about the key risks to this Knife River narrative.

Another View: Pricing by Industry Standards

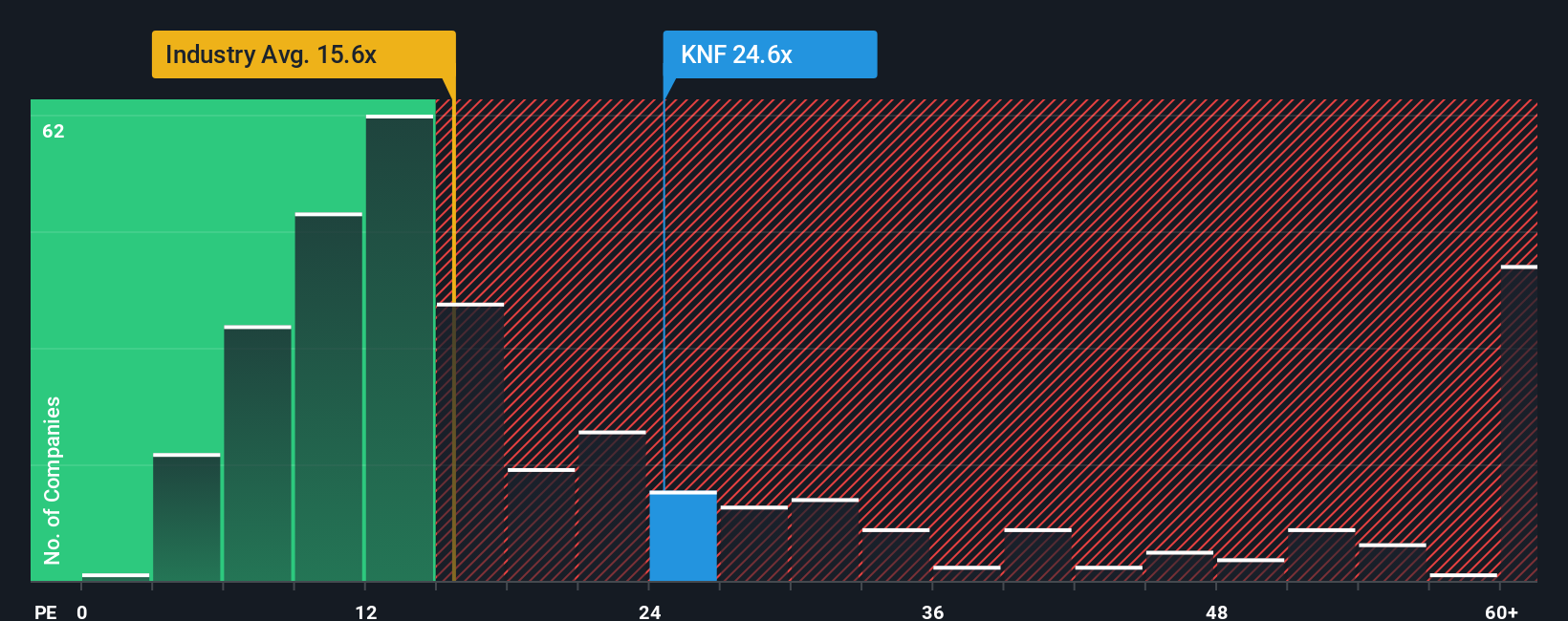

While analysts see Knife River as undervalued based on future earnings potential, a look at its price-to-earnings ratio tells a different story. At 26.9x, the company is priced higher than both its industry average of 15.6x and peer average of 19.8x. It is also above its own fair ratio of 23.2x. This higher valuation means investors are already paying up for expected growth, which increases the risk if results disappoint. Does this premium suggest hidden strengths or inflated hopes?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Knife River Narrative

If you see the story unfolding differently or want to follow your own approach, you can shape a custom narrative in just a few minutes. Go ahead and Do it your way

A great starting point for your Knife River research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Waiting on one stock could mean missing out. Use this moment to uncover unique opportunities that match your goals. Don’t let the next big trend pass you by. Here are three handpicked ways to power up your investment search:

- Boost your income potential by targeting steady payouts from these 19 dividend stocks with yields > 3% offering attractive yields above 3%.

- Jump into the innovation wave with these 24 AI penny stocks, putting you at the forefront of artificial intelligence breakthroughs.

- Capitalize on untapped growth by scanning these 896 undervalued stocks based on cash flows that may be trading below their true worth based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Knife River might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KNF

Knife River

Provides aggregates-led construction materials and contracting services in the United States.

Limited growth with questionable track record.

Similar Companies

Market Insights

Community Narratives