- United States

- /

- Packaging

- /

- NYSE:IP

International Paper (IP): Is There Hidden Value in the Current Valuation?

Reviewed by Kshitija Bhandaru

International Paper (IP) shares have been flat this week, with the stock hovering close to where it started. Investors tracking the company may be weighing recent performance data in light of broader industry trends, particularly in the packaging sector.

See our latest analysis for International Paper.

After a volatile start to the year, International Paper’s recent stretch of steady trading has come against a backdrop of modest gains and notable resilience in total returns. The 1-year total shareholder return of 3.67% may not turn heads, but looking further back, a three-year total return of 67.59% suggests that longer-term investors have seen significant gains even as short-term momentum has faded.

If you want to see what’s working in today’s market, this could be a great time to broaden your outlook and discover fast growing stocks with high insider ownership

With its recent track record and shares now trading well below analyst targets, the key question for investors is whether International Paper is currently undervalued, or if the market has already factored in all signs of future growth.

Most Popular Narrative: 12.6% Undervalued

With International Paper’s fair value estimated at $53.35 and shares last closing at $46.64, the narrative indicates the stock trades below what consensus deems reasonable. This valuation leans on clear sector trends and operational catalysts driving future expectations.

The company's substantial capital investments in automation, advanced manufacturing, and mill reliability, funded by targeted asset divestitures and plant closures, are expected to reduce operating costs and materially expand net margins over the next several years. Strategic focus on commercial excellence, including the 80/20 model and improved customer service, is resulting in market share gains in North America and Europe, which should help close the revenue gap with industry peers and lift future earnings.

Curious what projections power this double-digit discount? The key to the narrative’s optimistic view is a jump in profit margins and bold operational upgrades. What ambitious growth assumptions fuel the analysts’ premium target? Unlock the full story for the numbers behind the valuation.

Result: Fair Value of $53.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent mill reliability issues and ongoing macroeconomic uncertainty could easily undermine margin gains or stall the anticipated earnings recovery.

Find out about the key risks to this International Paper narrative.

Another View: Market Ratio Signals

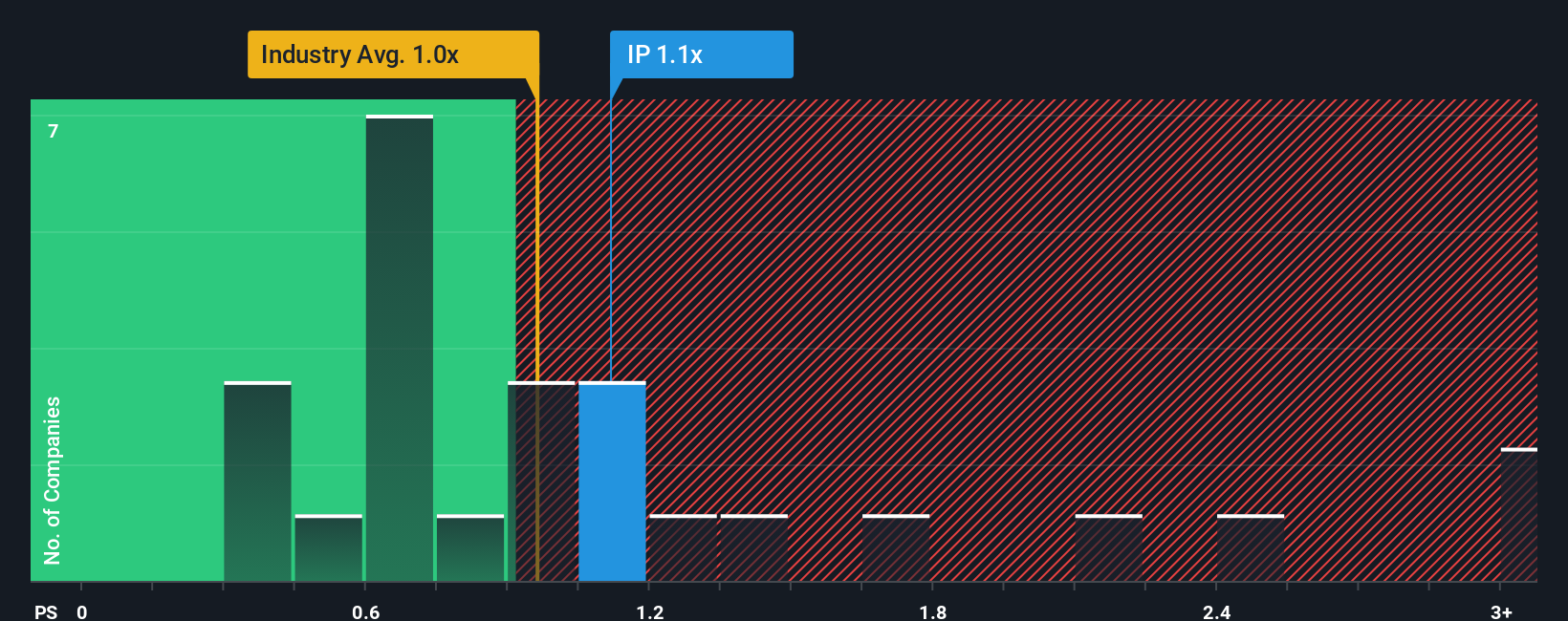

Looking from a different angle, International Paper’s price-to-sales ratio of 1.1x puts it above the US Packaging industry average of 1x, but still well below its fair ratio of 1.9x and its peer average of 1.4x. This gap suggests the stock is not especially cheap compared to the broad industry, yet it trades at a significant discount to where the market could eventually price it if fundamentals improve. Is this a sign of opportunity, or a reminder that risks remain?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own International Paper Narrative

If you want a different perspective or simply prefer to dig into the details yourself, it takes just a few minutes to build your own view. Do it your way

A great starting point for your International Paper research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors give themselves an edge by regularly checking for new opportunities. Give yourself the same advantage. There are standout stocks waiting just beyond your watchlist.

- Capture the potential for outsized returns by targeting innovation with these 24 AI penny stocks poised to transform industries through artificial intelligence breakthroughs.

- Boost your passive income with steady performers by tapping into these 20 dividend stocks with yields > 3% that offer reliable yields above 3%.

- Position your portfolio ahead of the curve with these 26 quantum computing stocks leading advances in quantum computing, unlocking vast growth opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IP

International Paper

Produces and sells renewable fiber-based packaging and pulp products in North America, Latin America, Europe, and North Africa.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives