- United States

- /

- Metals and Mining

- /

- NYSE:HL

Hecla Shares Surge 145.8% in 2025 After Silver Discoveries but Is the Price Justified?

Reviewed by Bailey Pemberton

Deciding what to do with Hecla Mining stock is not just a matter of checking tickers. If you have kept an eye on mining stocks lately, you may have noticed the rollercoaster ride Hecla has experienced. Just last week, the stock finished down 15.2%, a sharp correction after a recent 15.8% surge over the past month. Looking a bit further back, the story becomes even more dramatic: year-to-date, Hecla shares are up an impressive 145.8%, and over the past five years, they have climbed nearly 188%.

This volatility is not simply a short-term phenomenon. Some of the price swings can be attributed to broader optimism around precious metals and supply chain constraints in the mining sector. Recent headlines about new silver discoveries and renewed investor focus on U.S.-based mines have generated increased attention on Hecla specifically. While none of these updates directly determine day-to-day price movement, they help explain why investors are watching Hecla as both a growth story and a potential safe haven.

But does this momentum mean Hecla Mining is undervalued at current prices? It is important to move past the hype and consider how the company measures up against key valuation checks. On a simple value score, where a point is added for each area in which the company is considered undervalued out of six total checks, Hecla scores a 0. This provides a clear initial impression, but traditional valuation approaches do not tell the whole story. Here is a breakdown of those methods, followed by a look at a different way to analyze the stock’s value by the end of this article.

Hecla Mining scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Hecla Mining Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future free cash flows and discounting them back to their present value. For Hecla Mining, this method uses a two-stage Free Cash Flow to Equity model. Initial estimates are based on analyst forecasts, with further years extrapolated by Simply Wall St.

Currently, Hecla’s last twelve months of free cash flow stand at $52.95 million. Analyst projections foresee this figure rising significantly over the next several years, hitting $453 million by 2027. Long-term estimates continue to climb, with 2035 projections reaching approximately $381 million. While these forecasts suggest growth, it is important to note that only the first five years are covered directly by analysts. Numbers beyond that rely on extrapolation.

After discounting these future cash flows, the DCF analysis arrives at a fair value estimate of $10.36 per share. However, when combining this with the current market price, Hecla Mining appears to be 24.8% overvalued on this basis. This indicates the stock trades at a notable premium to its underlying cash-generating potential.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Hecla Mining may be overvalued by 24.8%. Find undervalued stocks or create your own screener to find better value opportunities.

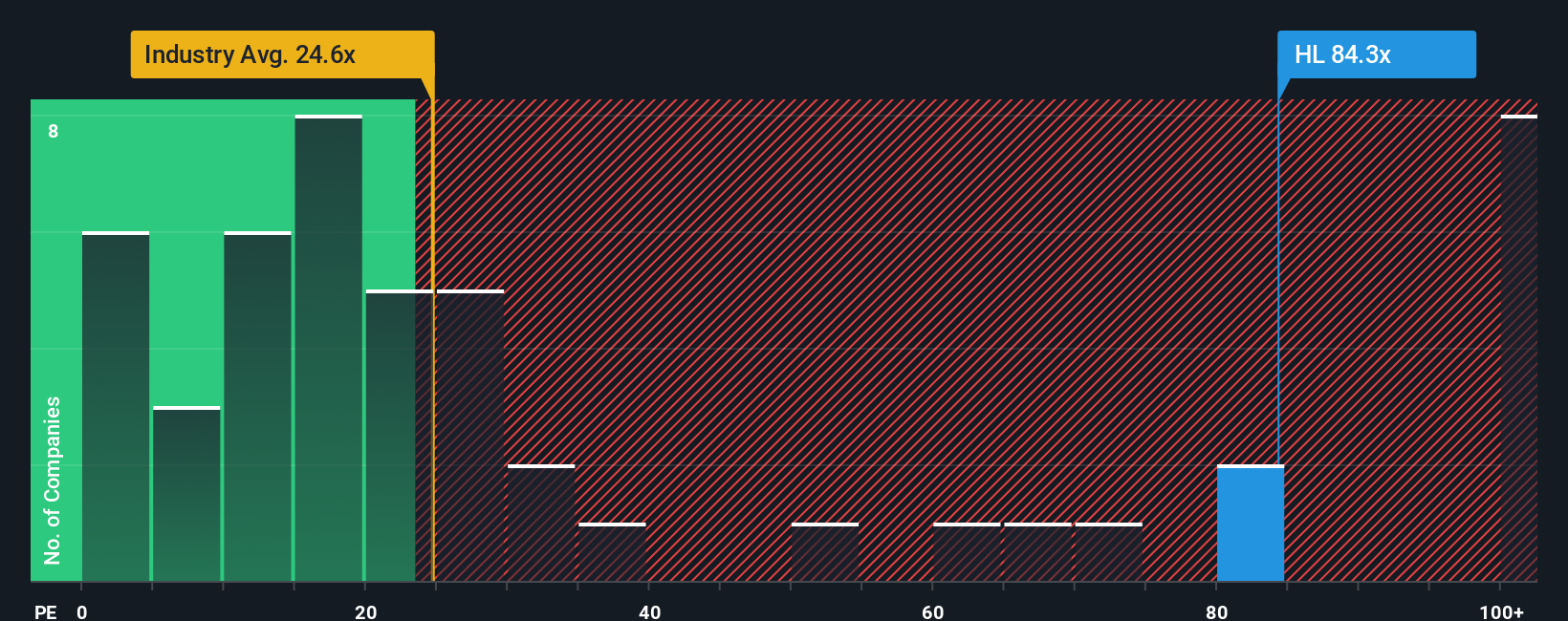

Approach 2: Hecla Mining Price vs Earnings (PE)

The price-to-earnings (PE) ratio is a widely recognized tool for valuing profitable companies because it directly connects a company’s share price to its underlying earnings power. For investors, it provides a straightforward way to compare how much you’re paying for each dollar of earnings relative to similar firms.

Interpreting what qualifies as a "normal" or "fair" PE ratio isn’t just about the number itself. Higher PE ratios can reflect stronger expected growth or lower perceived risk, while lower ratios might indicate uncertainties or slower prospects. Therefore, context is crucial. Benchmarks like the industry average or peer companies help, but they don’t account for a company’s unique characteristics.

Hecla Mining currently trades at a PE ratio of 86.9x. By comparison, the average for its direct peers sits at 16.8x, and the broader metals and mining industry averages 24.3x. At first glance, this makes Hecla look expensive. However, Simply Wall St’s proprietary Fair Ratio for Hecla is 47.6x, which is calculated from an in-depth model that weighs factors including earnings growth outlook, industry context, profit margins, market capitalization, and company-specific risks. This approach is typically more accurate than relying solely on broad sector benchmarks or peer groups.

Since Hecla’s current PE (86.9x) is well above its Fair Ratio (47.6x), the stock appears to be overvalued based on this method.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

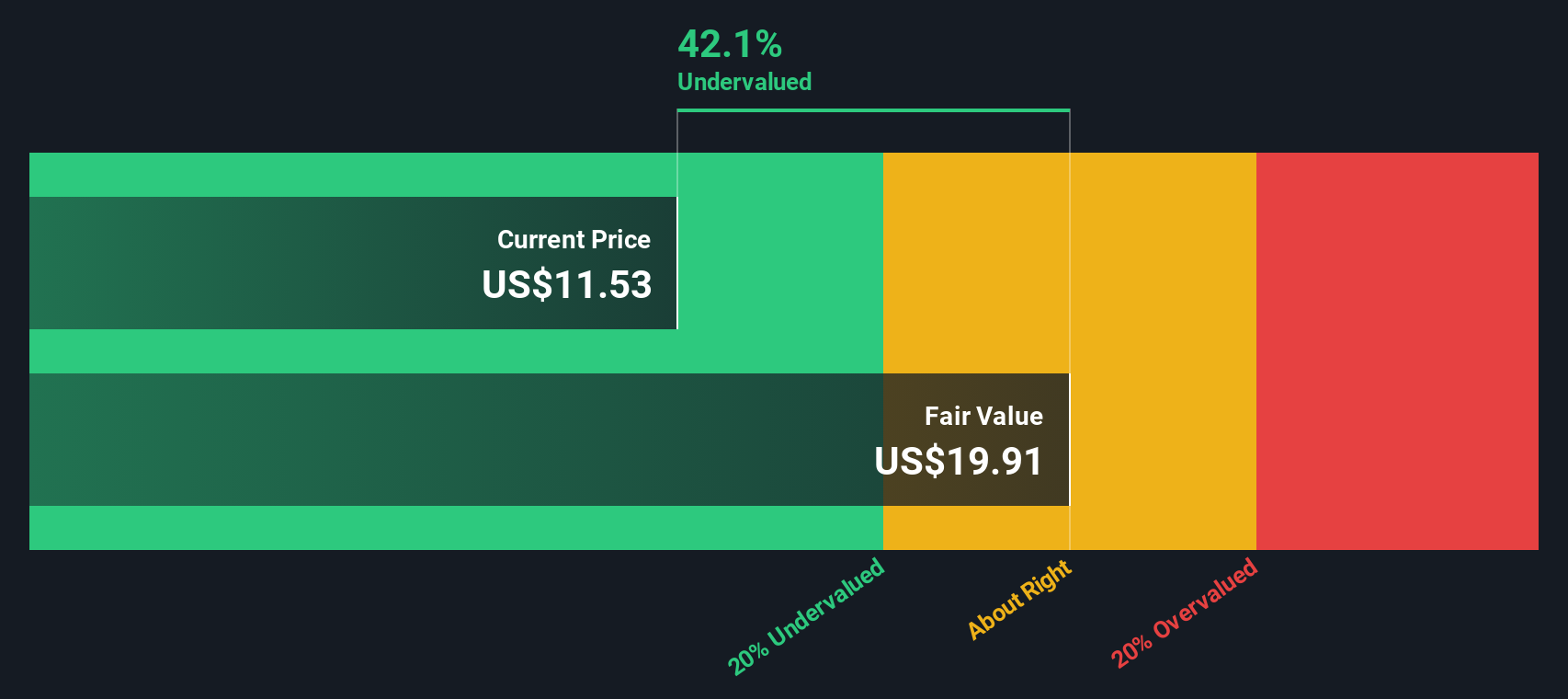

Upgrade Your Decision Making: Choose your Hecla Mining Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply the story behind your investment perspective, a way to connect your view of Hecla Mining’s future, such as assumed fair value, future revenues, or margins, to an actionable forecast and price target. Narratives bridge the gap between raw numbers and real-world outlook by inviting anyone to back up their expectations with specific forecasts, and then see how those translate to fair value estimates.

On Simply Wall St’s Community page, you will find a wide range of Narratives for Hecla Mining, built and updated by millions of investors, making it easy to compare different views, adjust assumptions, and follow how new information dynamically updates your thesis. By comparing these fair values to the current share price, Narratives help you easily decide whether it is time to buy, hold, or sell. For example, some investors might forecast strong demand growth and set a price target as high as $12.50, while others see more risk and set theirs at $6.50. These choices reflect each person’s viewpoint on Hecla’s prospects and its place in a changing global economy.

Do you think there's more to the story for Hecla Mining? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hecla Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HL

Hecla Mining

Provides precious and base metal properties in the United States, Canada, Japan, Korea, and China.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives