- United States

- /

- Metals and Mining

- /

- NYSE:HCC

Warrior Met Coal (HCC) Is Up 19.7% After Early Blue Creek Launch and Higher 2025 Outlook

Reviewed by Sasha Jovanovic

- In the past week, Warrior Met Coal announced the early startup of Blue Creek longwall operations, commencing eight months ahead of schedule and increasing its full-year 2025 production and sales guidance by 10%. The company also reported record quarterly sales volumes, improved operational efficiency, and secured a federal coal lease adding 58 million short tons of steelmaking coal reserves.

- This accelerated expansion means Warrior Met Coal is now positioned to realize operating benefits and extended resource life sooner, which may influence its outlook in an evolving steelmaking coal market.

- We'll explore how the early Blue Creek longwall startup shapes the company's investment narrative and outlook on production-driven growth.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

Warrior Met Coal Investment Narrative Recap

To invest in Warrior Met Coal today, you need confidence in the company’s ability to pivot quickly, execute large-scale projects efficiently, and capture growth from higher steelmaking coal demand, even as pricing remains under pressure from weak global steel markets and increased Asian sales exposure. The early Blue Creek longwall startup boosts Warrior's production outlook, strengthening the key short-term catalyst: achieving higher, lower-cost volumes. However, risks tied to soft coal pricing and concentration in volatile Asian markets remain present, with the news event not eliminating revenue volatility risk.

Among recent company announcements, the updated 2025 production and sales guidance is most relevant: management raised output expectations by 10% following the early Blue Creek ramp. This directly supports the main catalyst of accelerated volume growth, while revealing both operational strength and the inherent risk that increases in supply must still meet market demand in a challenging industry climate.

Yet, against these operational gains, investors should also know there is …

Read the full narrative on Warrior Met Coal (it's free!)

Warrior Met Coal's outlook foresees $2.0 billion in revenue and $636.5 million in earnings by 2028. This scenario assumes 18.8% annual revenue growth and a leap in earnings of $596.2 million from the current $40.3 million.

Uncover how Warrior Met Coal's forecasts yield a $74.00 fair value, a 9% downside to its current price.

Exploring Other Perspectives

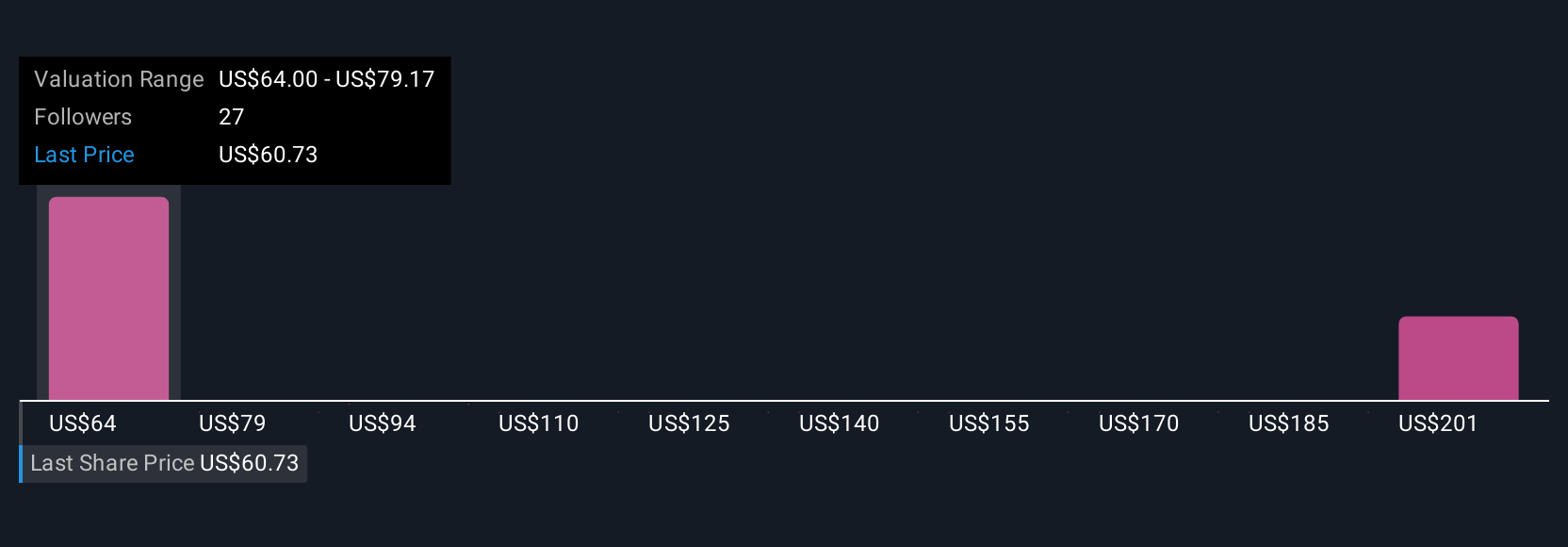

Four fair value estimates from the Simply Wall St Community range from US$74 to US$155.71, highlighting significant differences in expectations. With Asian demand shifts shaping Warrior Met Coal’s future earnings potential, you can see how different viewpoints play a part in market performance.

Explore 4 other fair value estimates on Warrior Met Coal - why the stock might be worth 9% less than the current price!

Build Your Own Warrior Met Coal Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Warrior Met Coal research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Warrior Met Coal research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Warrior Met Coal's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Warrior Met Coal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HCC

Warrior Met Coal

Engages in the production and export of non-thermal steelmaking coal for the steel production by metal manufacturers in Europe, South America, and Asia.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives