- United States

- /

- Chemicals

- /

- NYSE:FTK

Flotek Industries' (NYSE:FTK) 59% YoY earnings expansion surpassed the shareholder returns over the past year

The simplest way to invest in stocks is to buy exchange traded funds. But you can significantly boost your returns by picking above-average stocks. For example, the Flotek Industries, Inc. (NYSE:FTK) share price is up 51% in the last 1 year, clearly besting the market return of around 31% (not including dividends). If it can keep that out-performance up over the long term, investors will do very well! Unfortunately the longer term returns are not so good, with the stock falling 10% in the last three years.

The past week has proven to be lucrative for Flotek Industries investors, so let's see if fundamentals drove the company's one-year performance.

Check out our latest analysis for Flotek Industries

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

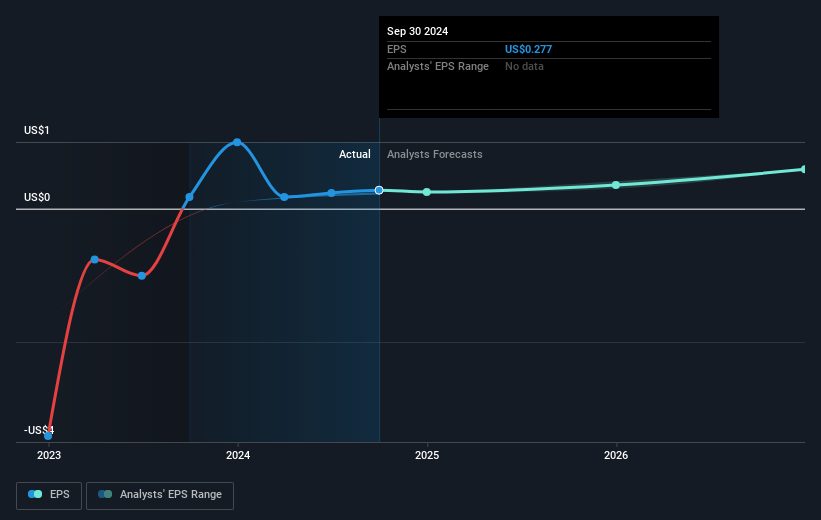

Flotek Industries was able to grow EPS by 59% in the last twelve months. This EPS growth is reasonably close to the 51% increase in the share price. That suggests that the market sentiment around the company hasn't changed much over that time. It looks like the share price is responding to the EPS.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Flotek Industries has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on Flotek Industries' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that Flotek Industries has rewarded shareholders with a total shareholder return of 51% in the last twelve months. That certainly beats the loss of about 8% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Flotek Industries has 1 warning sign we think you should be aware of.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:FTK

Flotek Industries

Operates as a technology-driven green chemistry and data company that serves customers across industrial and commercial markets in the United States, the United Arab Emirates, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives