The board of FMC Corporation (NYSE:FMC) has announced that it will pay a dividend of $0.58 per share on the 17th of October. This means the annual payment is 3.6% of the current stock price, which is above the average for the industry.

See our latest analysis for FMC

FMC's Projected Earnings Seem Likely To Cover Future Distributions

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. However, FMC's earnings easily cover the dividend. As a result, a large proportion of what it earned was being reinvested back into the business.

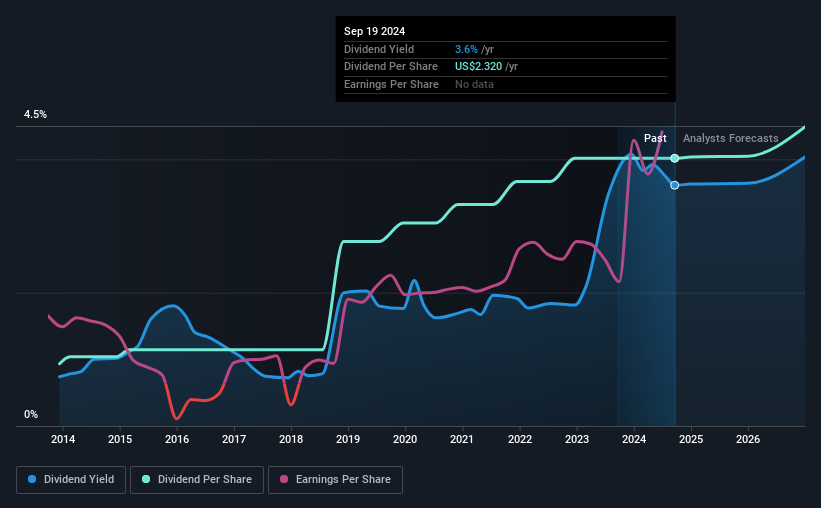

Looking forward, earnings per share is forecast to fall by 52.2% over the next year. Assuming the dividend continues along recent trends, we believe the payout ratio could be 48%, which we are pretty comfortable with and we think is feasible on an earnings basis.

FMC Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. The annual payment during the last 10 years was $0.54 in 2014, and the most recent fiscal year payment was $2.32. This works out to be a compound annual growth rate (CAGR) of approximately 16% a year over that time. So, dividends have been growing pretty quickly, and even more impressively, they haven't experienced any notable falls during this period.

The Dividend Looks Likely To Grow

The company's investors will be pleased to have been receiving dividend income for some time. We are encouraged to see that FMC has grown earnings per share at 21% per year over the past five years. Earnings per share is growing at a solid clip, and the payout ratio is low which we think is an ideal combination in a dividend stock as the company can quite easily raise the dividend in the future.

We Really Like FMC's Dividend

Overall, we think that this is a great income investment, and we think that maintaining the dividend this year may have been a conservative choice. The company is generating plenty of cash, and the earnings also quite easily cover the distributions. If earnings do fall over the next 12 months, the dividend could be buffeted a little bit, but we don't think it should cause too much of a problem in the long term. All of these factors considered, we think this has solid potential as a dividend stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. Just as an example, we've come across 3 warning signs for FMC you should be aware of, and 2 of them shouldn't be ignored. Is FMC not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:FMC

FMC

An agricultural sciences company, provides crop protection solutions to farmers in Latin America, North America, Europe, the Middle East, Africa, and Asia.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success