- United States

- /

- Metals and Mining

- /

- NYSE:FCX

Freeport-McMoRan (NYSE:FCX) Shareholders Have Enjoyed An Impressive 245% Share Price Gain

Freeport-McMoRan Inc. (NYSE:FCX) shareholders might be concerned after seeing the share price drop 12% in the last month. Despite this, the stock is a strong performer over the last year, no doubt about that. We're very pleased to report the share price shot up 245% in that time. So we think most shareholders won't be too upset about the recent fall. Only time will tell if there is still too much optimism currently reflected in the share price.

See our latest analysis for Freeport-McMoRan

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year Freeport-McMoRan grew its earnings per share, moving from a loss to a profit.

When a company has just transitioned to profitability, earnings per share growth is not always the best way to look at the share price action.

We doubt the modest 0.8% dividend yield is doing much to support the share price. We think that the revenue growth of 21% could have some investors interested. We do see some companies suppress earnings in order to accelerate revenue growth.

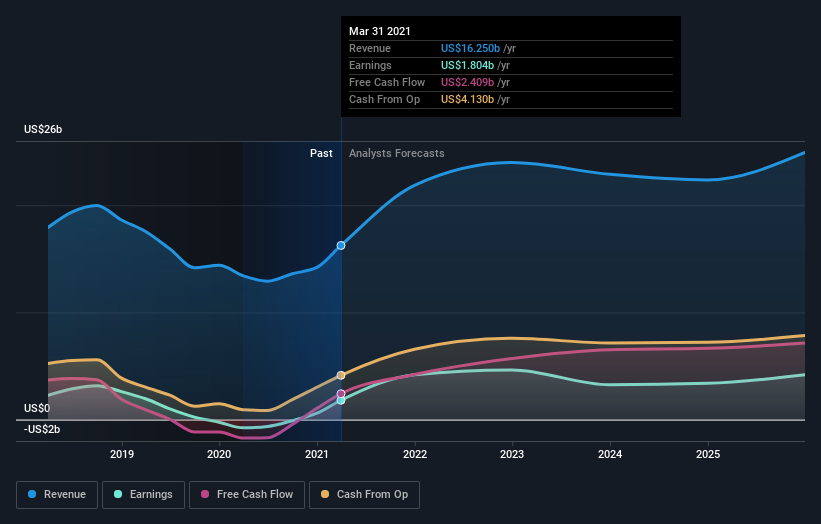

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Freeport-McMoRan is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. You can see what analysts are predicting for Freeport-McMoRan in this interactive graph of future profit estimates.

A Different Perspective

We're pleased to report that Freeport-McMoRan shareholders have received a total shareholder return of 246% over one year. Of course, that includes the dividend. That gain is better than the annual TSR over five years, which is 29%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Freeport-McMoRan better, we need to consider many other factors. Even so, be aware that Freeport-McMoRan is showing 4 warning signs in our investment analysis , and 1 of those shouldn't be ignored...

We will like Freeport-McMoRan better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

When trading Freeport-McMoRan or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:FCX

Freeport-McMoRan

Engages in the mining of mineral properties in North America, South America, and Indonesia.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives